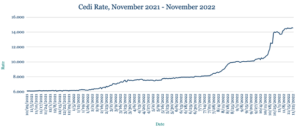

The Cedi weakened against the dollar, hitting a fresh low 14.59 before recovering to 14.53, compared to 14.50 at last week’s close. FX demand to pay for commodity imports such as rice and cooking oil has constrained liquidity and worsened the supply and demand mismatch. This week’s sale of T-Bills was oversubscribed for the first time in six weeks, with the government selling GHS1.656bn of 91-day and 182-day bills against a target of GHS1.168bn. The 91-day bills yielded 35.19%, up from 34.3% at the previous week’s auction, while the 182-day bills yielded 35.98%. While that is still lower than inflation—currently running at an annual rate of 40.4%—the pick-up in demand indicates improved investor confidence as the government seeks to secure a $3bn loan with the IMF. We expect the Cedi to remain around the 14.5 level in the next seven days, with a bias for marginal weakening.

‘Food shock window’ to help Malawi, South Sudan

The International Monetary Fund agreed this week to provide emergency financing for Malawi and South Sudan under its “food shock window,” a new channel to help countries that have urgent balance of payment needs due to acute food insecurity, a sharp increase in their food import bill, or a shock to their cereal exports. The Fund has allocated US$88.3m to Malawi, where tropical storms, poor crop production and rising prices for food and agricultural inputs such as fertilizer and seeds will leave one in every five people “acutely food insecure” in the next six months, according to the IMF. Malawi’s central bank devalued the Kwacha by 25% earlier this year amid severe FX shortages; the currency is 25.7% lower against the dollar year-to-date. The IMF said it will release US$112.7m to South Sudan, where continued conflict and four consecutive years of severe flooding will mean 8.3 million, or over two-thirds of the population, suffering severe food insecurity. The Sudanese Pound has depreciated 30% this year amid unification of the official and parallel exchange rates as part of an IMF program. The IMF agreements come in the same week that rich nations at COP27 agreed to provide “loss and damage” funding for developing countries most impacted by climate change, though details about how the fund will be run, the amount of funds to be raised and the eligible countries are still to be hashed out. The Bill and Melinda Gates Foundation has pledged $7bn to improve healthcare, gender equality and food production in targeted countries across Africa.

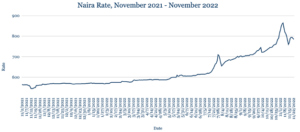

Rate hike gives Naira temporary boost

The Naira appreciated against the dollar, trading at 785 from 795 at last week’s close after Nigeria’s central bank lifted interest rates 1 percentage point to 16.5% in a bid to cut inflation, which hit a 17-year high of 21.1% last month. The central bank said it will continue raising rates until inflation starts coming down. It has now hiked rates by 5 percentage points since May. Nigeria this week began drilling for oil in the northeast of the country for the first time after decades of exploration in the south. The new project has already attracted $3bn of investment, with the government planning to build an oil refinery, a gas processing unit, a power plant and a fertiliser factory. Despite the Naira’s rate-induced bump, we expect weakness to resume in the coming days as FX demand picks up on the parallel market.

Rand weaker amid power cuts and worker strikes

The Rand weakened slightly against the dollar, trading at 17.28 from 17.25 at last week’s close. Ongoing power cuts are weighing on the economy, with the South African government this week saying it is urgently seeking funds for state-power company Eskom to buy diesel to keep its auxiliary power plants running. The company has spent more than ZAR11bn on diesel so far this year. The BankservAfrica Economic Transactions Index, which monitors interbank payments, dropped to its lowest level this year for October as port and rail worker strikes limited export activity. The Rand outlook in the week ahead correlates with the South Africa Reserve Bank’s rate decision on Thursday.

Record-low Egypt Pound depreciation is starting to slow

The Pound traded at a record dollar low, hitting 24.54 from 24.52 at last week’s close, though the weakening has slowed compared to earlier in November as the central bank allows the currency to float more freely. Among announcements at the UN’s COP27 climate summit was an $11bn project by a consortium of investors including Infinity Power to build one of the world’s largest onshore windfarms in Egypt, which could provide surplus electricity to Saudi Arabia and Europe. The is expected to start in 2024, with a slated finish in 2030. Egypt’s trade with African Union members increased last year by 38%, with exports up by roughly the same amount, the bulk of which went to North African neighbours including Libya, Sudan, Morocco and Algeria. We expect the slowing of the Pound’s depreciation to continue as it moves towards a free float floor.

Rate hike bounces Kenyan Shilling off record low

The Shilling weakened against the dollar, briefly touching a new record low 122.64 before settling at 122.20/122.40 from 121.90/122.10 at last week’s close. The respite came after Kenya’s central bank raised interest rates by 50 basis points to 8.75% against a backdrop of continued global uncertainties, volatile financial markets, weaker growth and persistent inflationary pressures. The Shilling may stabilise around current levels, with central bank reserves adequate for 3.94 months of import cover at $7bn providing a buffer against short-term FX shocks.

Ebola to keep pressure on Ugandan Shilling

The Shilling weakened marginally against the dollar, slipping to 3740 from 3732 at last week’s close. Uganda’s government overspent its budget by UGX684bn in October, due to higher than anticipated expenditure on development projects as the country seeks to sustain its post-Covid economic recovery. Higher prices drove a 35% jump in coffee export revenue in the past 12 months, despite a decline in export volumes, according to the Uganda Coffee Development Authority data. We expect the Shilling to remain under pressure in the week ahead amid the ongoing Ebola outbreak.

Tanzanian Shilling stable amid manufacturing boost

The Shilling was steady against the dollar, trading at 2332, in line with last week’s close. Tanzania received a EUR87m grant from Germany to support development projects in areas including health, water and biodiversity. Tanzania’s program to become a semi-industrialised nation by 2025 was given a boost this week after statistics from the Tanzania Revenue Authority and the Bank of Tanzania showed the value of manufactured goods hit $1.5bn in the 12 months to September, almost double the value in 2020. Vice President Philip Mpango has been urging the Tanzanian diaspora to invest in their homeland, while also appealing to locals to invest in the industrial sector. We expect the Shilling to remain stable against the dollar over the coming seven days.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

For more information, high-resolution charts or interviews, please contact:

Gavin Serkin

[email protected]

+44 20 3478 9710