One of Africa’s key challenges in confronting climate change is figuring out how to finance the necessary transformation of the continent’s economies. Since climate finance from the Global North remains more of a promise than a reality, part of the solution must be to unlock the vast potential of voluntary carbon credits.

A carbon credit is a certificate representing one tonne of carbon dioxide that has been removed from the atmosphere (by planting new trees, for example). In voluntary carbon markets (VCMs), buyers – usually corporations – purchase such credits to compensate for (or ‘offset’) their own emissions, thereby financing carbon-abatement projects.

Across Africa, policy-makers are recognising that VCMs represent a major opportunity to accelerate sustainable economic development, both by attracting more climate finance to the continent and by curbing greenhouse-gas emissions. But making the most of the opportunity will require thoughtful, deliberate action, including by African governments.

That is why we are excited to be part of a new initiative that is being launched this month at the United Nations Climate Change Conference (COP27). The Africa Carbon Markets Initiative (ACMI) will support a dramatic increase in the production of African carbon credits, while also ensuring that carbon-credit revenues are transparent, equitable, and go toward creating good jobs. Crucially, African governments must rely only on high-integrity credits that are directly tied to decarbonisation.

Globally, the demand in VCMs (as measured by retirements of carbon credits) has nearly quadrupled in the last five years, a trend that is driven mainly by companies’ purchases of credits to help meet their climate pledges. The demand for African credits is also increasing, but it is starting from a low base, and the continent currently produces only a small proportion of its potential. Boosting the supply of credits would enable much-needed sustainable investment in sectors ranging from renewable energy and clean cook stoves to agriculture and forestry.

From our experiences in government, we have seen the potential that carbon markets hold. But we also know that Africa will have to work hard to capitalise on this potential to the fullest. In 2016, the Colombian Government launched the Colombian Voluntary Carbon Market Platform as part of its efforts to meet the country’s climate targets. Between 2016 and 2019, Colombian carbon credits grew more than fourfold to become a US$20 million market, leading to the planting of more than 180 million new trees.

But this market didn’t simply develop on its own. It was a top presidential priority and required extensive coordination across society, including collaboration with the Colombia Stock Exchange. As part of the process, Colombia launched Latin America’s first green taxonomy for financial assets.

In Africa, Nigeria has demonstrated its ambitions to be a regional climate leader with its 2021 Climate Change Act and its commitment to achieve net-zero emissions by 2060. In September, President Muhammadu Buhari inaugurated a National Council on Climate Change, and his government is committed to using carbon credits as a tool for achieving Nigeria’s climate and sustainable development goals. We estimate that Nigeria could produce more than 30 million tonnes worth of carbon credits annually by 2030, generating more than US$500 million per year.

Still, Africa’s nascent carbon-credit market faces numerous obstacles to growth in many parts of the continent, owing to a lack of project developers capable of operating at scale, a complex regulatory landscape, inadequate methodologies for valuing and certifying credits, and concerns about integrity. To help overcome these hurdles, the ACMI (where we sit on the steering committee alongside 11 other African leaders and carbon-markets experts) will use COP27 to launch an initial roadmap that touches every part of the VCM ecosystem.

One key priority will be to support African governments in establishing VCM country plans, with Colombia’s recent effort serving as a model. These plans will aim to support carbon-credit production by clarifying government responsibilities, setting out market incentives, and establishing transparent regulation of the sector within the context of each government’s commitments under the Paris Climate Agreement. Nigeria will be one of the first countries to launch such a plan, with the goal of rapidly increasing the development and sale of carbon credits.

The point about the Paris Agreement is crucial because there has been some confusion around its carbon-credit rules. To avoid double counting, when two countries trade carbon credits, only one of them can put the credit toward its nationally determined contributions (NDCs), the Paris Agreement’s term for emissions reductions. But with sales to foreign corporations, there is no confusion or tension: buyers can use African carbon credits without worrying about double counting.

We believe this approach is fully in line with both the letter and the spirit of international cooperation on climate change because the funding from foreign buyers in the VCM will provide the resources that African countries need to meet their own NDCs. Without international financing, these climate targets will remain out of reach.

To be sure, some buyers may require a commitment that host countries will not count sold credits toward their NDCs (either to demonstrate greater impact to their shareholders or to comply with regulations in their home countries). In these cases, African countries can apply a premium to the price. Ultimately, though, we do not believe that such demands will play a major role in voluntary corporate carbon-credit use.

The ACMI steering committee wants 300 megatons of African credits to be retired annually by 2030 – 19 times the 2020 level. That may sound daunting, but it merely requires demand and supply to continue growing at roughly the rate they have grown in recent years. By 2050, the committee wants to retire an even more impressive 1.5 gigatons of credits annually, which would mobilise capital totalling US$120 billion per year. At this level, carbon markets would be a major industry for the continent, and could support more than 100 million jobs.

The ACMI seeks to eliminate the barriers to continuing carbon-market growth. We invite governments across the continent to get behind its important mission.

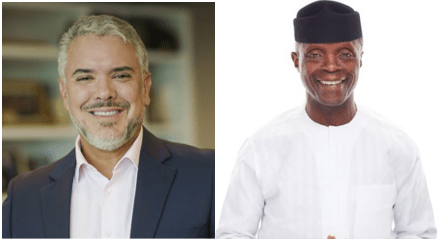

Yemi Osinbajo is Vice President of Nigeria. Iván Duque Márquez is a former President of Colombia.

Copyright: Project Syndicate, 2022.

www.project-syndicate.org