…records growth in all indicators

Amansie Rural Bank PLC at Antoakrom in the Amansie West district of Ashanti Region has made some incredible gains in its 2021 year under review, recording growth in all indicators.

The bank posted a pre-tax profit of approximately GH¢5.8million in the 2021 period under review as against a little over GH¢5million in the previous year, representing a growth of 16.17%. The rise in profit is attributed to improved revenues generated from operations and prudent management of recurrent expenditures by the board, management and entire staff.

In view of these impressive results, the Directors have recommended the payment of GH¢926,314 total dividend; representing GH¢0.026 dividend per share with total qualifying shares of 35,627,455 as at December 31, 2021.

The bank’s directors obtained approval from the Bank of Ghana to pay dividend to shareholders for the financial year 2021. Amansie Rural Bank PLC is among the few banks approved to pay dividend by the BoG.

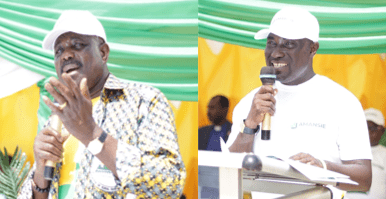

The Chairman of the Board of Directors, Ben Kwaakye Adeefe Esq., announced these and more at the bank’s 37th Annual General Meeting of shareholders held last Friday in Antoakrom.

Operating Environment

According to him, the global economy, including that of Ghana, experienced a slow start to the year 2021 due to the resurgence in COVID-19 infections in last quarter of the year 2020. However, economic activities picked up in the second and third quarters of year 2021 as a result of successful mass COVID-19 vaccination programmes.

On the Ghanaian economy, data released by Ghana Statistical Services (GSS) indicated a provisional Real GDP growth outturn of 5.4 % in 2021 as against 0.5% in 2020. The improvement in growth was reflected in all components with the exception of industry, which decreased by 0.8%

Headline inflation increased to 12.6% in December 2021 as against 10.4% at the end of December 2020, due to rising crude oil prices, exchange rate depreciation of the local currency and upward adjustments in ex-pump prices.

In respect of these difficulties that had to be surmounted, the bank redefined its operational strategies considering its strength, weaknesses and the external threats and opportunities to mitigate the far-reaching effect, and managed to pull yet another remarkable operational performance in all the financial indicators for 2021 as indicated in the table below.

Performance

| Indicators | 2021 | 2020 | % Change |

| Deposit | 176,209,347 | 159,635,850.00 | 10.38 |

| Investment | 83,200,399.00 | 76,226,479.00 | 9.15

|

| Loans/Advances | 81,478,490.00 | 71,645,893.00 | 13.72 |

| Total Assets | 210,053,940.22 | 193,366,545.00 | 8.63

|

| Stated Capital | 4,171,723.00 | 4,161,893.00 | 0.24 |

| Shareholders’ Funds | 20,070,756.89 | 15,833,082.00 | 26.76 |

| Profit Before Tax | 5,845,980.80 | 5,032,443.00 | 16.17 |

Share Capital

The bank’s stated capital increased marginally from GH¢4,161,893 at the end of December, 2020 to GH¢4,171,723 as at the end of December, 2021. The increase of 0.24% resulted from the sale of ordinary shares numbering 39,420 at GH¢0.25 per share, amounting to GH¢9,855.

Shareholders have therefore been urged to invest more in shares of the bank, so as to generate more profits and guarantee improved returns on their shares (investments) in terms of dividend and capital gains.

Corporate Social Responsibility

The bank continues to offer assistance to communities and institutions within its catchment areas in terms of community development projects. In the year under review, the bank spent an amount of GH¢92,367 on corporate social responsibility activities toward its stakeholders, with special focus on Education, Health and Security among others.

Cocoa Purchases

The bank paid a total cocoa transfer amounting to GH¢36,688,643 in the year under review. There was a sharp decrease of 57% when compared with the amount paid in 2020 to the tune of GH¢86,778,040 for cocoa transfers. The decline was attributed to reduced cocoa beans production in the bank’s catchment areas.

Electronic Banking

The bank continued to deepen its electronic banking operations with the issuance of GH Linked ATM cards to some customers in the year 2021. Again, the Ghana Inter-Bank Payment Settlement Systems (GhIPSS) has rolled out the Ghana Pay (Electronic platform) for customers to link their mobile money wallets to their accounts.

The Board Chairman entreated all shareholders who are also customers to register with the bank to be linked with the Ghana Pay platform, and their deposits on Ghana Pay will be kept with the bank – which will also deepen the financial intermediation and cash-lite agenda of the Government of Ghana.

Future Outlook

The ban’s CEO, Frederick Kwakye Kyei, in an interview with Business & Financial Times said management will continue seeking ways of strengthening and developing operations to maintain the confidence customers and shareholders have in the bank.

The bank’s business model, according to the CEO, is still tailored for the Micro, Small and Medium Enterprises, and will push for more market penetration as they develop new, innovative products and trusted relationships with clients.

According to him, the bank will continue to see its strength increase in the area of managing credit needs of small and medium enterprises, as well as continuing to improve on the support it offers to this sector of the economy.