For Ghanaian technology startups to gain a larger share of the rapidly increasing funding pouring into the continent, there is a need to show that their offerings are scalable and can work in a variety of markets; particularly in other parts of the continent.

This is according to the Country Manager of AZA Finance, Nana Yaw Owusu Banahene, who argues that while there is no shortage of bankable ideas and products, a factor such as size of the domestic market – as measured by population – leaves tech firms originating from the country at a disadvantage compared to their more populated peers.

To remedy this, he said, managers of these service providers must adopt a change in strategy: from solely selling the upside of their solutions to demonstrating their workability across different markets.

“There is definitely a huge opportunity to attract investment into Ghana… The challenges we have are things we do not have control over, like numbers, and population. We are 30 million people and the active population is even a little lower. We cannot compete with others on this front.

“But there is potential to go into other markets. There are fintechs from Ghana which are now operating in other markets and they have demonstrated that their business model – which is a key thing – works successfully in those other markets,” he said subsequent to the 2022 edition of the Ghana Economic Forum (GEF), where he was part of a panel that discussed the future of digital finance.

“If you are able to demonstrate you have a business model that has the potential to grow in terms of customers, volume, revenue within other markets, investors will like to listen to you,” Mr. Banahene added.

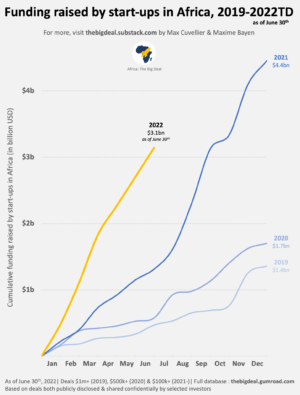

Funding into Africa – mostly from venture capital sources – has been on a steady rise, especially in the pandemic’s wake and the rapid shift toward digital solutions. While some regions appear to have reached a plateau and others saw a sharp drop in funding, African startups have seen a consistent period-on-period growth in capital.

At the end of 2019, African startups raised a total of US$1.4billion – a figure that grew by 21.4 percent to reach US$1.7billion by the comparable period of 2020 according to market-watcher, The Big Deal.

Despite the broad economic downturn in 2021, the figure shot up by a massive 158 percent to close the period at US$4.4billion and had crossed the US$3billion mark by the middle of 2022; albeit with third-quarter figures showing a marginal slowdown.

However, the national destinations for these funds have been skewed – with Nigeria in West Africa, South Africa down south, Kenya to the east and Egypt up north accounting for more than 90 percent of all inflows, at least since 2019, with Ghana at a distant fifth.

For additional context, start-ups in Nigeria alone raised funds similar to all that which came into the entirety of Northern and Eastern Africa combined – US$3.6billion compared to US$3.8billion.

Indeed, Nigeria represents the vast majority of funding raised in Western Africa – 86 percent since 2019; that’s 6 out of every 7 dollars raised, The Big Deal notes.

The AZA Finance Country Manager believes the goodwill Ghana continues to enjoy, with a broader scope and smarter decisions, could see Ghana break into the so-called Big Four and become the premier tech investment destination on the continent.

“In our ecosystem, we oftentimes focus on saying: ‘I have the best technology, I serve this product or I have this idea. But beyond the idea, how do you scale? How do you grow? Because at the end of the day, you are a business.

“We need to demonstrate to investors we have a business model that can drive growth and one which is also a bit unique and there is a strategy in place to attract customers… I am excited that the Bank of Ghana continues to provide the enabling environment; for instance, through its sandbox as well as a streamlining of its guidelines. This gives stability and will do us well.”