Ghana is currently facing what may arguably be her worst economic crisis in the 4th Republic against the construct of a challenging global environment of a strong US dollar, inflation, supply chain disruptions, interest rate hikes to fight global inflation, and the ongoing Russia-Ukraine war.

Using the official Bank of Ghana (BoG) rates, the local currency Cedi has depreciated year-to-date by 52% to 12.5370. Even though inflation skyrocketed to 37.2% as at September 2022, year-end inflation is likely to rise to between 45% to 50% largely driven by recent utility price increases and currency depreciation following the 23% Cedi depreciation between 30th September 2022 and 21st October 2022. It is worth noting that, Cedi depreciation on the interbank market is 57% with quotes at GHS15.00.

Ghana is facing significant stress in borrowing to finance the 2022 budget with both domestic and external bond markets effectively shut, and T-Bill yields now above 32%. BoG has had to step in with financing options to anchor financial stability. It is worth noting that, the International Capital Markets (ICM) is currently closed to most Emerging Market (EM) countries with very few sovereigns able to issue debt amid expectations of further USD rate hikes. EM countries are likely to regain ICM access in 18 to 24 months and this may create stress in countries that have Eurobonds maturing over the next 24 months. Ghana’s access to the ICM will likely be in 2025 at the earliest, post the 2024 election, thus it is important for the government to regain access to the domestic bond markets to finance the budget for the next 3 years.

Key focus for government

Fiscal Sustainability, Debt Sustainability and a stable Macro Environment are three objectives government needs to achieve to ensure confidence in the domestic economy is restored.

The “silence” from the government on fiscal consolidation is deafening and rather disappointing as this is the most important step to anchor discussions around debt sustainability and the proposed restructuring. Ghana missed the window for gradual fiscal consolidation in the 2021 and 2022 budgets and thus must deliver deep fiscal consolidation in the 2023 budget. Fiscal consolidation must be expenditure-led to be deemed credible as government has historically failed in achieving its initial budget revenue targets in the past 5 years. Holders of government debt will not support any restructuring proposal if government is not undertaking sufficient expenditure rationalization. Government should also review revenue measures including tax waivers and exemptions granted on imports.

Reviewing the Electronic Levy (E-Levy) from a percentage of notional to a flat fee on all electronic transactions may improve revenue collection. Assuming GHS 1.00 flat fee on all electronic transactions including Mobile Money (MoMo), cheque cleared, bank transfers, E-zwich, and Internet Banking irrespective of the amount, the annual revenue generated will be in excess of GHS 4.2bn based on the average transaction volume in the BoG Summary of Economic and Financial Data for October 2022. The flat fee could be charged to either the remitter only or split between the remitter and beneficiary.

Ghana’s debt sustainability has been significantly impacted by the recent Cedi depreciation. External debt stock was USD28.3bn in December 2021 and reduced slightly to USD28bn in July 2022. Average weighted interest cost on external debt was 5.3% in 2020 and assumptions are that current interest cost averages between 5.5% and 6.5%. The interest cost is not large; however, the recent depreciation of the Cedi means government needs to collect more taxes to purchase USD to service external debt, and this will invariably raise the Interest Cost/Tax Revenue ratio. Also, the impact of translating external debt into Cedi will significantly inflate the Debt/GDP ratio. External debt which was USD 28.3m translated to GHS 170bn as of December 2021 has increased to GHS 351bn as of July 2022 using the current BoG rate even though the stock is USD 28m. Domestic debt stock increased to GHS 190.3bn in July 2022 from GHS 181.3bn as of December 2021. The interest cost of domestic debt which was averaging between 17% to 19% in 2020 has accelerated above 22% and is rising, driven by recent T- Bill issuances at higher rates. Clearly, the rising cost of domestic debt is a concern however it’s worth noting the value of domestic debt has been inflated away by the high inflation. Domestic debt in USD value has declined from USD30.3bn in December 2021 to USD15.2bn using the current BoG rate. Total debt in USD value has declined from USD58.6bn in December 2021 to USD43.2bn, however, GHS value has increased from GHS 351.8bn to GHS 541bn using the current BoG rate. This currency depreciation elevates Ghana’s Debt/GDP ratio to 91% assuming nominal GDP of GHS 591.9bn. The high Debt/GDP ratio combined with high domestic interest costs means some form of debt restructuring is required. External debt holders will likely push back on any proposal that restricts debt restructuring to only external debts considering concerns about high interest cost on domestic debt. Reducing domestic debt service costs is essential in any successful debt restructuring plan.

It is unlikely the Debt Sustainability Analysis currently being conducted will be released to the public until the International Monetary Fund (IMF) programme is approved by the IMF Board. However, conversations on Domestic Debt Restructuring (DDR) have weighed heavily in the local media in recent weeks. The lack of clarity from government on its decision with regards to any DDR has created an information vacuum and led to panic rediscount of government bills and bonds by retail investors.

Based on the monthly bulletin published by the Central Securities Depository for September 2022, the total bills and bonds issued by government were GHS 160.1bn. Banks were the largest holders with 31.6%, Firms & Institutions with 25.3%, Others (including retail) with 13.9%, Foreign Investors with 10.8%, Bank of Ghana with 10%, Pensions with 5.6%, Rural Banks with 1.4%, Insurance Companies with 0.9% and SSNIT with 0.4%. T-Bills represented 16.4% of total securities, medium tenor bonds (2yrs to 5yrs) are 49.5% and long tenor bonds (6yrs and above) are 34.2%.

Domestic debt investors have already lost 52% of the USD value of their holdings this year and the government needs to weigh the fact that it needs access to the domestic bond market to finance the budget over the next three years in any decision on DDR. Debt restructuring can be done either via tenor extension, coupon reduction, principal haircut, or a combination of two or all options. With the USD value of domestic debt having been depreciated away, government’s focus should be on coupon reduction, combined with tenor extension if required, to reduce the interest cost of domestic debt.

Any proposal involving principal haircut will result in further loss of confidence in the domestic economy, accelerate further depreciation of the Cedi, and may lead to social unrest.

For instance: Principal haircut on holdings by SSNIT, Pensions and others have a direct impact on retail savings and pensions. Labour unions have already requested pensions be excluded from any DDR.

Holdings by firms and institutions include collective investment funds used by individuals for saving hence any haircut on this category will directly impact individual savings that have already lost value due to depreciation.

Foreign investors’ holdings have significantly dropped from above 30% to 10.8%. Since they must deliver USD returns to underlying clients, they are unlikely to increase holding in Ghana until economic stability is restored.

Principal haircuts on BoG’s holding will significantly impair the regulator’s balance sheet, extending maturities is a better solution.

Capital Adequacy Ratio (CAR) of banks has dropped from 21.3% in March 2022 to 18.1% in August 2022. CAR is expected to drop further as banks increase credit reserves due to rising non-performing loans, and mark-to-market losses from government bills and bonds. The irony is that currency depreciation has eroded USD value of capital, negatively impacted corresponding banking trade facilities, and reduced the ability to lend to the private sector. Principal haircut may potentially result in CAR falling below the minimum regulatory level of 13.5%. This may eventually trigger the need for banks to recapitalize in a challenging environment from local shareholders who are already impacted by the economic crisis and may have to take haircuts on personal investments held in firms & institutions or other categories as well. External shareholders may not be able to borrow internationally to recapitalize local banks considering the high USD interest rates. Fear of failure of some banks to recapitalize, combined with government’s inability to guarantee deposits as compared to the last financial crisis will lead to a run on some banks and disrupt the financial sector.

Way Forward

Government must urgently consider significant fiscal consolidation and debt restructuring to achieve macroeconomic stability in the medium term. Government needs to publish a credible fiscal consolidation plan that takes into consideration the current challenges in raising financing from both domestic and external markets. If the plan is not deemed credible, discussion on debt restructuring will delay, further exacerbating the current economic crisis. Discussions on DDR should focus on coupon reduction and tenor extension since principal haircuts will lead to chaos within the financial sector and ultimately social unrest. Government must act to address the information vacuum relating to DDR and implement any agreed DDR within a short period to enable the domestic bond market to recover from the current crisis. Macro stability will be restored once fiscal and debt sustainability are achieved.

Appendix

Appendix 1: Survey response

Under the leadership of the Advocacy Committee of the CFA Society Ghana, a survey was conducted which largely forms the bases of this Op-ed. We summarise below the questions asked and the responses from the Society members who responded to the questionnaire.

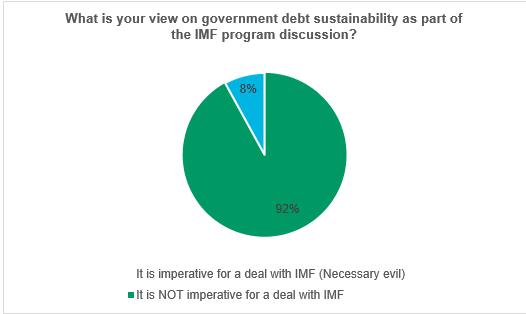

What is your view on government debt sustainability as part of the IMF program discussion?

In your opinion can government reach an IMF deal without Domestic Debt Restructuring (DDR)? State reasons for your opinion.

What form of DDR (coupon reduction, principal haircut, tenor extension or combination of all) will be optimum?

What will be the impact of principal haircut as part of DDR on banks, non-bank finance institutions, pensions, asset management, insurance companies and individuals? Should any group be excluded and why?

Loss of confidence in government issuances.

Loss of confidence in the financial market impacting already low savings culture.

Severe impact on banks’ capital and capital adequacy.

Run on financial institutions (banks, Asset managers and pension funds) and liquidity challenge.

Exacerbation of inflation as central back begins to print money to fill government fund gaps as investors shun government treasury.

What will be the worst outcome from negotiation around DDR?

What institutional controls can be implemented to ensure that as a country we do not get to the point of DDR?

What concession should the market/investors demand from the government to justify/support DDR?

Any other comments?

Market confidence will be impacted severely by any restructuring, whatever the form especially coming on the back of the recent financial sector cleanup.

Changes are required at the Finance Ministry.

This crisis presents an opportunity to begin looking at other asset classes.

Appendix 2: About CFA Society Ghana

The CFA Society Ghana is a member of the CFA Institute Global Network of Societies and advances professional excellence while promoting ethical behaviour. CFA Institute is a global, not-for-profit member organisation of financial analysts, portfolio managers, and other investment professionals.

The objectives of the CFA Society Ghana are to: provide a professional society for investment professionals in Ghana, enhance awareness of the investment profession and the CFA charter in Ghana, foster the interchange of information and opinions among its members, regulators and investment community, promote meetings designed to add to the knowledge of its members and the general public, foster a high standard of ethics and promote sound professional standards of investment research among its members, and promote a proper public understanding of the functions of security analysis.