Egypt intends to call on rich nations to fulfil pledges to support poorer countries in their transition to cleaner energy and build resilience to future climate shocks. Egypt intends to “leverage African leaders’ voices to mobilise greater support for a green and resilient recovery in Africa,” the UN Economic Commission for Africa said this week as African ministers of finance, economy and the environment met in Egypt ahead of the Nov. 6 opening of the summit in Sharm El-Sheikh.

“Egypt should play this role to represent the African continent and its needs clearly and explicitly: we were not the cause of these emissions, but it is us – our people and our natural resources – that are affected,” Egypt’s Environment Minister Yasmine Fouad said, according to Africanews. “At this point, a stance must be taken on the international community to say that everyone must fulfil their obligations, as set out in the Paris Agreement.

“Developed countries that are responsible for most of the world’s historical emissions are obligated under the Paris climate agreement to provide $100 billion a year to support vulnerable countries that have contributed the least to climate change. Africa accounts for less than 4% of global greenhouse gas emissions, with around 600 million people having no access to electricity. Progress in realising climate funding commitments would play a critical role in supporting project financing for energy transition and climate-resilient infrastructure.

Naira recovery from record low may be short lived

The Naira recovered from last week’s record low, trading at 722 from 745 at Friday’s close amid the Nigerian Independence Day holiday period. The Nigerian National Petroleum Company this week announced only its second profitable year in 45 years, with earnings hitting NGN671bn in 2021. Group CEO Mele Kyari said the profits were a result of policies and initiatives introduced two years ago to reduce costs and eliminate waste across the former state-owned business. We expect the Naira to resume losses against the dollar in the coming days as post-holiday FX demand picks up again.

Rand risk-on gains tempered by power cuts

The Rand appreciated against the dollar this week, crossing back over the 18 threshold to trade at 17.80 from 18.09 at last week’s close. Those gains came amid broader global risk-on sentiment, driven by expectations that the US Federal Reserve will start to slow the pace of its rate hikes following three 75-basis-point increases in a row. Gains have been tempered by domestic economic concerns as rolling power cuts continue, with the amount of loadshedding hours on course double the amount of planned power cuts in 2021, when there was 1,153 hours of loadshedding. We expect the Rand to follow global sentiment and continue trading with a 17 handle in the near term, though with a risk of breaching the 18 level once again if negative sentiment returns.

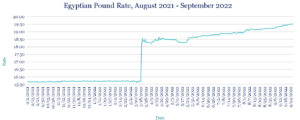

Record low Egyptian Pound has further to fall

The Pound hit a record low against the dollar this week, sliding to 19.67 before recovering marginally to 19.66, compared to 19.56 at last week’s close. Despite its slide, many of the world’s biggest banks believe the Pound remains overvalued, according to Bloomberg. Allowing the Pound to float more freely is a key requirement for a potential IMF loan package to help support Egypt’s economy, which has been hit by large capital outflows this year. We expect the Pound will continue depreciating in the coming weeks.

Record low Kenyan Shilling to lose further ground

The Shilling once again hit a fresh record low against the dollar this week, trading at 120.70/120.90 from 120.35/120.65 at last week’s close as FX demand from key importers such as the oil sector remained elevated. New President William Ruto said he intends to reform the country’s tax system by making it more progressive so that tax burdens increase with income. Meantime, FX reserves dropped to $7.42bn from $7.45bn a week earlier, sufficient for 4.19 months of import cover. We expect the Shilling to continue weakening in the next seven days amid strong dollar demand from the oil, energy and manufacturing sectors.

Inflation to pare Ugandan Shilling recovery

The Shilling strengthened against the dollar this week, trading at 3817 from 3853 at last week’s close. That came despite annual inflation jumping to a more than 10-year high in September, with prices rising 10% compared to 9% the previous month. Those higher prices were mainly due to food and alcoholic beverages, which jumped 18.4% from 15.7% in August. Meantime, the World Health Organization this week said two vaccines that are being developed to treat a rare strain of Ebola that has claimed the lives of at least 29 people in Uganda could start clinical trials in the coming weeks. We expect inflationary pressures to cause the Shilling to weaken in the near term.

Tanzanian Shilling steady as Zanzibar draws investment

The Shilling strengthened marginally against the dollar this week, trading at 2330 from 2332 at last week’s close. Tanzanian President Samia Suluhu Hassan reshuffled her cabinet, with Defence Minister Stergomena Tax moving to the Ministry of Foreign Affairs, and East African Cooperation and Local Government Minister Innocent Bashwunga moving to the defence ministry. Meantime, Zanzibar President Hussein Mwinyi said the semi-autonomous state had brought in more than TZS3.2tr of investments since 2020, creating more than 9,000 jobs. We expect the Shilling to continue trading around current levels in the coming days.

Note to journalists: please feel free to quote from this briefing for news reports and let us know any requests for further comment or interviews via the contact details at the end, or by reply to this email. AZA is Africa’s largest non-bank currency broker by trading volume at over $1 billion annually. See https://www.azafinance.com

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

For more information, high-resolution charts or interviews, please contact:

Gavin Serkin

[email protected]

+44 20 3478 9710