With inflation reaching decades-high levels and eroding investors’ real gains and purchasing power, talk of introducing inflation-indexed securities to the domestic market has begun to gather steam.

Inflation-linked bonds (ILBs) refer to securities that link their capital appreciation, or coupon payments, to inflation rates; allowing the variables to be adjusted in the same direction as changes in prices.

They are often issued by central governments, with the United Kingdom, Canada, and India being among some countries which issue ILBs – the most popular being the Treasury Inflation-Protected Securities (TIPS) issued in the United States.

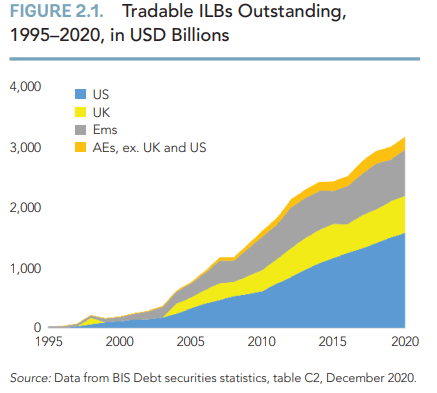

Over the past decade, the asset class has grown in emerging markets with Israel, Brazil, Mexico, South Africa and Turkey all issuing various ILBs, with the total tradable ILBs outstanding amounting to approximately US$3trillion at the end of 2020.

Describing the introduction of such securities as paramount, a Senior Research and Compliance Analyst at Tesah Capital, Joshua Adagbe, has argued that it is time to issue Ghana’s maiden inflation-linked bonds as they will provide a range of benefits to different classes of stakeholders.

“Aside from the benefits of offering protection against inflation, ILBs can be used as good security for diversification in a multi-asset portfolio because of their low correlation to other asset classes. ILBs have a low tendency to move in the same direction as equities and nominal bonds, and therefore lower the overall volatility of a portfolio.” He noted this as crucial to driving investor confidence and deepening the capital markets.

He added that with current inflation above the central bank’s inflation target band of 8±2 percent, the Bank of Ghana would benefit from the inflation risk protection by ILBs and also make savings on its interest expense.

“The central bank, which is the largest issuer of nominal bonds, bears a high degree of inflation risk when servicing its debt,” he added.

Providing contrary thoughts, president of the local arm of the Chartered Financial Analysts (CFA) Society, Nana Wiafe Boamah, said while he understands the appeal, a number of factors including historically high and volatile inflation … would make its introduction improbable.

“In this economy where inflation is almost always high, even when compared to some of our peers, who would be willing to offer inflation plus a premium?” he quizzed – adding that such an instrument would saddle government with too much debt and effectively rule out corporate issuances.

“When you have your inflation under control and the fiscals are looking good and we want to attract investors who need to see positive real returns, by all means then we can issue such bonds as an incentive. What we have had historically has been too volatile for it to be worth it; we should be working at getting the macroeconomy to a point of sustained stability,” he remarked.

The World Bank in a recently published study on the subject noted that from the cost perspective, ILBs can lower financing costs if the inflation premium of conventional bonds exceed the liquidity premium of the ILBs.

Additionally, medium- and long-term ILBs permit governments to lengthen the debt’s average maturity and allow for the substitution of riskier debt instruments, such as foreign currency (FX) linked securities or short-term local currency bonds – thus helping to reduce market and refinancing risks.

It however warned that emerging markets with underdeveloped savings industries and/or limited borrowing requirements may find that introducing ILBs further fragments the domestic debt market – driving up the liquidity premia for both ILBs and conventional securities, and increasing government funding cost.

“Economies prone to supply shocks may find that ILBs increase the debt service at times when the economy stagnates, worsening government’s financial position,” the World Bank added.

Inflation has climbed to 33.9 percent on an annualised basis in August from 31.7 in July; and despite the 91-day Treasury bill rate rising to 30.1 percent, the trend of negative real returns continues.