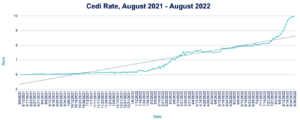

The Cedi recovered marginally against the dollar this week after the Bank of Ghana on Tuesday sold $60m of dollars into the market through its forward FX auction. Having revisited its record low 10.08 on Monday, the currency is currently trading at 10.05, in line with last week’s close. The Bank of Ghana is battling a surge in inflation, which jumped in August to a 21-year high of 33.9%, from 31.7% a month earlier, as import prices continue to soar. The Cedi is the world’s second worst performing currency this year, losing more than a third of its value against the dollar (only crisis-hit Sri Lanka’s Rupee had a more turbulent year). Given the inflationary backdrop, we expect further stress ahead, with the Cedi likely to weaken towards the 10.50 level in the near term.

Inflation surge continues to dampen FX outlook

Rising inflation continues to dampen the outlook for many currencies in Africa. The Bank of Ghana is battling 21-year high inflation at 33.9%, making the Cedi the world’s second worst performing currency this year (see Ghana report below). In Malawi, inflation has more than doubled since the start of the year to 24.6%. An FX shortage has led to a deepening fuel crisis in the country, with the central bank forced to devalue the Kwacha by 25% in May. Malawi is seeking IMF support to help with the fuel crisis, but the Fund reportedly postponed a planned visit this week to discuss a new loan. With the IMF delaying intervention, we see room for further FX depreciation as imports continue to dent already declining FX reserves. Meanwhile, in Rwanda, prices have been rising at the fastest pace in more than a decade, hitting 15.9% in August. Rwandan central bank Governor John Rwangombwa expects annual inflation to peak at 16% this year, given the combined measures of rate hikes and a continued government subsidy on fuel and agricultural inputs. The Rwandan Franc could still see further depreciation due to the country’s continued exposure to global commodity prices.

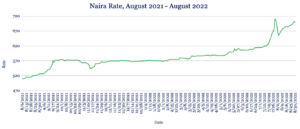

Naira slips closer to record 710 low

The Naira edged closer to a record low against the dollar on the unofficial market this week, trading at 706 from 701 at last week’s close. The Naira hit a record low 710 back in July. The Nigerian government is hoping to rake in an estimated $4bn a year from cashew exports as it seeks to grow annual production to 500,000 tons, up from 300,000 tons. It plans to invest in six new cashew processing facilities to increase production. Meantime, the Nigerian Senate has rejected the NGN12.43tr deficit that would be created by tax waivers and fuel subsidy payments that were proposed in the government’s 2023 budget. We anticipate slight Naira depreciation in coming days, but we don’t expect it to breach the 710 level.

Rand heads for 17.60 resistance after 100th day of power cuts

The Rand depreciated against the dollar this week, trading at 17.46 from roughly 17.30 at last week’s close, as Fed hike fears amid worse-than-expected US inflation data prompted a sell-off across emerging market currencies. At home, South Africa’s state-owned energy company Eskom announced further rounds of load shedding due to ongoing maintenance issues at power stations, having surpassed 100 days of power cuts since the start of the year. We expect the Rand to continue trading above 17 but short of the 17.60 resistance level in the week ahead bar any surprises from the US Federal Reserve when it announces its interest rate decision on Wednesday.

Egypt Pound nears all-time low on rising import costs

The Pound continued its slide against the dollar, trading at 19.36 from 19.32 at last week’s close, near to an all-time low of 19.61 in December 2016. The ongoing weakness comes as high import prices, rising living costs and a lack of positive economic data continue to weigh on the currency. The European Bank for Reconstruction and Development said it will finance the decommissioning of 5GW of inefficient gas-fired power plants from next year, pledging up to $1bn for renewable energy generation in Egypt. Over the long term, that could help divert local gas consumption to increased exports, which will be supportive for the Pound. For the near term we expect further weakness as the currency heads towards the 19.40 level.

Near record-low Shilling may stabilise under Kenya’s new president

The Shilling weakened against the dollar, trading at 120.30/120.50 from 120.10/120.30 at last week’s close, near its all-time low of 120.67 on Sept. 7, as dollar demand from importers remained elevated. William Ruto was sworn in this week as Kenya’s fifth president, pledging to improve the economy by addressing youth unemployment, support farmers who are struggling with severe drought conditions and strengthen the country’s finances. He also promised to release a $415m ‘hustler fund’ to support small businesses and drive growth. With the election period over and the focus on reviving the economy, we expect to see the Shilling start to stabilise in the near term.

Uganda Shilling gains may be short-lived amid cost pressures

The Shilling strengthened against the dollar, trading at 3809 from 3819 at last week’s close, as FX demand from importers and commercial banks tailed off and inflows from commodity exporters increased. Uganda this week said it expects to finalise lenders for its $4bn crude oil pipeline by November after the Islamic Development Bank committed $100m to the project, which is set to begin production in 2025. We expect the shilling to weaken in near to medium term due to an ongoing increase in transport, food and input costs.

Shilling stable amid Tanzanian maize export dispute

The Shilling appreciated marginally against the dollar this week, trading at 2330 from 2332 at last week’s close. Tanzanian Agriculture Minister Hussein Bashe dismissed claims that the country was freezing maize export permits, blaming traders from outside the country for not properly following export procedures. A group of 19 US companies are expected to explore business opportunities in Tanzania during a two-day fact-finding mission later this month as the country continues to court US investment. We expect the Shilling to remain stable in the week ahead, supported by investor inflows.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

Gavin Serkin

[email protected]

+44 20 3478 9710