…Over 1,000 beneficiaries targetted in first phase

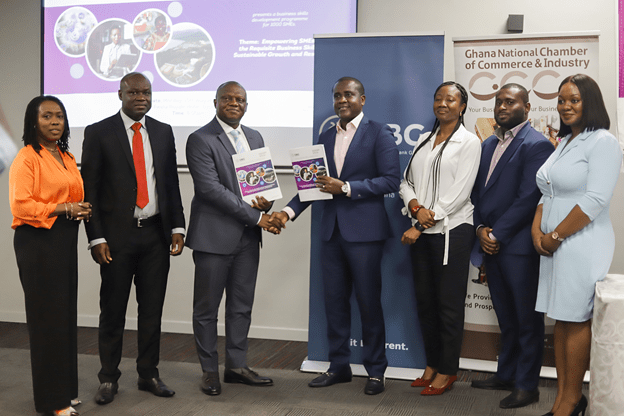

The Development Bank Ghana (DBG), in partnership with the Ghana National Chamber of Commerce and Industry (GNCCI), is undertaking the first phase of a capacity-building workshop targetted at 1,000 SMEs throughout the country. This initiative forms part of DBG’s commitment to foster strong partnerships to build capacity for SMEs.

The programme has been designed for SMEs to build knowledge on the various business areas that will enhance their ability to access funding from DBG’s partner financial institutions (PFIs), as well as build sustainable businesses.

The maiden edition, held in Accra a fortnight ago, hosted a total of 94 participating SMEs whose businesses are spread across DBG’s primary focus sectors – agribusiness, information technology, manufacturing, and high-value services. Within these sectors, women and youth-led businesses form an important part of DBG’s focus.

At the event, Deputy CEO, Michael Mensah-Baah, reiterated the bank’s commitment to being an integral part of the solution to foster SME growth in the economy. This he said, was pivotal to the success of Ghana’s economic growth. In another statement, Mr. Clement Osei-Amoako, President of the chamber said the skills development programme is to provide 1000 MSMEs with the requisite skills to scale up their business operations and de-risk them to better access long-term capital.

In Koforidua, where the second workshop in the series recently took place, a total of 100 SMEs within the locality participated. More than 40 percent of these were women-owned businesses. The participants who attended these workshops were taken through various business topics by experienced resource persons in risk management, environmental and social governance (ESG), financial management and entrepreneurship.

ESG practices require a holistic evaluation of a business to determine how it serves its internal and external stakeholders, and the environment where it has influence. Participants were exposed to the benefits of adopting ESG frameworks and sustainability practices in their businesses.

The joint business skills development programme is under the theme: ‘Empowering SMEs with the Requisite Business Skills for Sustainable Growth and Resilience’. The regional workshops look to develop and reinforce the business skills of Ghana’s private sector to improve commercial operations to become more competitive. The next set of workshops come off in Tarkwa, Takoradi and Cape Coast on the 13th, 15th, and 20th of September 2022, respectively.

DBG employs a wholesale banking model where it provides funding to eligible financial institutions to on-lend to Ghanaian businesses in targetted industry sectors. DBG does not lend directly to SMEs but leverages on the networks and existing infrastructure of its partner financial institutions to provide financing to the private sector. DBG also adopts a partnership approach to provide business advisory services and training to SMEs.

The Ghana National Chamber of Commerce and Industry (GNCCI) is an association of business operators, firms, and industries established under the Legislative Instrument (611 of 1968; Act 232), with the prime responsibility of promoting and protecting commercial and industrial interests in Ghana.

DBG’s partnership with GNCCI is to continuously engage with the PFIs to ensure collaboration to achieve financial de-risking of these SMEs and ensure a robust monitoring and evaluation framework.

SMEs are urged to take advantage of this unique opportunity and sign up with the Ghana National Chamber of Commerce and Industry (GNCCI), and more importantly, get on-boarded onto the digital platform (Ghana Integrated Financial Ecosystem – GIFE) along the five pillars: SME Financial Empowerment Platform; Market Place and Financial Trade Corridor; Connected Digital Financing; Reputational Building; and Equity Growth to benefit from the DBG’s loans via their participating financial institutions.