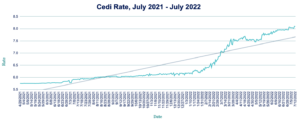

The Cedi slumped to a fresh record low against the dollar this week, trading at 9.38 from 9.03 at last week’s close, prompting Ghana’s central bank to call an emergency meeting on Wednesday where it raised rates by 300 basis points to 22%—its biggest hike in two decades. That was one percentage point more than most market participants had been expecting. The IMF is concerned that Ghana is not moving fast enough on its economic reform efforts to extend further support from the Fund. We expect the larger than expected hike to at least slow the Cedi’s recent slide against the dollar.

Kenya election stress for record low Shilling as yields soar

Kenya’s election descended into controversy as four of the country’s seven election commissioners disowned the result, and narrowly defeated candidate Raila Odinga rejected victory for William Ruto. Amidst a potentially drawn-out legal battle, yields on Kenya’s 2024 dollar bonds soared 336 basis points to 15.5% as the Shilling sank to a fresh low 119.57 against the dollar from 119.41 at last week’s close. Given the strains on Kenya’s economy, a lack of policy direction increases pressure across Kenya’s markets, particularly in the scenario of an election re-run, a process that could take up until November to fully complete. The only silver lining for the Shilling is that the long wait for a political outcome is stalling economic activity and demand for dollars for imported products. Expect the Shilling to remain subdued in the near and medium term.

Naira pushing towards 700 amid 17-year high inflation

The Naira continued its slide towards the 700 level this week, trading at 683 to the dollar from 680 at last week’s close amid sustained demand pressure in the parallel market. Nigeria’s annual inflation rose to a 17-year high 19.6% in July from 18.6% in June due to the rising cost of bread, cereal, gas and transportation. The Central Bank of Nigeria this week hiked the minimum interest rate banks need to pay on Naira deposits to 4.2% from 0.15%, equivalent to 30% of the central bank’s benchmark rate, reversing a move it made at the height of the Covid-19 pandemic to boost growth. We expect elevated dollar demand to continue pushing the Naira towards the 700 level in the near term.

Rand under pressure as emerging market FX sentiment sours

The Rand depreciated against the dollar this week, trading at 16.60 from 16.10 at last week’s close amid weaker-than-expected consumer and factory data out of China, fuelling a sell-off in emerging market currencies. External factors are likely to continue overshadowing local matters in South Africa for Rand traders in the short-term, with the US economy showing signs of resilience in July as lower gas prices saw retail sales—excluding autos and auto parts—increase by 0.4%. That could lead to a continued risk-off sentiment among investors in the week ahead, with the Rand expected to slide towards the 16.9 level.

Egyptian Pound outlook uncertain as central bank chief quits

The Pound remained relatively stable against the dollar this week, trading at 19.15, in line with last week’s close. That was despite annual inflation coming in higher than expected in July at 14.6%, well above the central bank’s current target of 7%. The bank’s Governor Tarek Amer quit unexpectedly on Wednesday, a day before Thursday’s interest rate decision, bringing to an end an almost seven-year tenure. With Egypt seeking a new loan from the IMF, market watchers are speculating that the Fund is demanding more exchange rate flexibility to unlock any fresh financing. We expect the Pound to continue trading around the 19.10-19.25 levels over the coming week, though the longer-term outlook is uncertain in the wake of Amer’s exit.

Ugandan Shilling gains to be short-lived as growth downgraded

The Shilling appreciated against the dollar this week, trading at 3782 from 3817, after Uganda’s central bank lifted interest rates by 50 basis points to 9% at the end of last week in a bid to counter rampant inflation and boost the Shilling. Annual inflation climbed to a six-and-a-half year high of 7.9% in July from 6.8% in June, above the central bank’s 5% target. With the bank cutting its economic growth forecast for this year to 2.5% from 3%, and with inflation remaining elevated due to higher fuel and transportation costs, we expect the Shilling to weaken over the near term.

Tanzanian Shilling to stabilise amid import tax exemption plans

The Shilling weakened marginally against the dollar this week, trading at 2334 from 2332 at last week’s close. The government intervened in the economy again this week by allowing a tax exemption on importing raw materials for soap and detergents as it seeks to cushion the effects of rising inflation. The government has been attempting to keep the economy stable through a combination of fuel subsidies, tax exemptions and maintaining FX reserves. With that in mind, we expect the Shilling to stabilise against the dollar in the week ahead.

Note to journalists: please feel free to quote from this briefing for news reports and let us know any requests for further comment or interviews via the contact details at the end, or by reply to this email. AZA is Africa’s largest non-bank currency broker by trading volume at over $1 billion annually. See https://www.azafinance.com

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

Gavin Serkin

[email protected]

+44 20 3478 9710