A Trade Practitioner and AfCFTA expert, Louis Yaw Afful, has called on start-ups in commodity trading and agribusiness to look into and take up the opportunity a recent 2-billion-dollar credit facility presents.

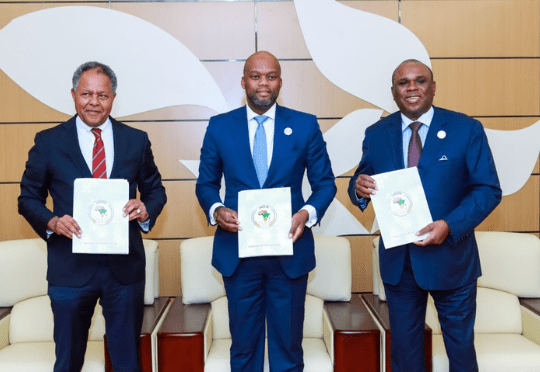

This comes on the back of reports that the African Continental Free Trade Area (AfCFTA) Secretariat, Afreximbank and World Food Programme (WFP) have signed a three-year Memorandum of Understanding (MoU) to disburse US$2billion in farming loans and credit lines for agro-processors and commodity traders by 2025 through Afreximbank lending instruments and blended finance facilities in support of AfCFTA and in contribution to addressing food security on the continent.

The MoU seeks to promote commercial development of smallholder agriculture and facilitate intra-regional agricultural trade initiatives, advance climate change mitigation, and adaptation of smallholder agriculture and related value chains.

As part of the financing component, Afreximbank will deploy adequate financing, lines of credit, supply chain financing, guarantees, among others, to support smallholder productive activities including development of post-harvest storage facilities, agro-processing and trade in commodities, and value-added products.

Further, Afreximbank will support the development of industrial projects, including export-oriented agricultural hubs and Special Economic Zones (SEZs) to support value addition in smallholder agricultural chains.

According to Louis Yaw Afful, the Director of the AfCFTA Policy Network (APN) Group, this is a good initiative by the AfCFTA Secretariat as “commodity trading is one of the best routes of becoming wealthy. Agribusiness is what will drive Africa at the moment because our value chains are all concentrated on Agribusiness”.

He said it is wise for the AfCFTA Secretariat to initiate this investment into agribusiness to serve as the linkage to manufacturing industries.

Speaking on the Eye on Port programme, the expert reiterated that commodity trading will be an enabler of AfCFTA’s success.

“Commodity traders are those who trade in volumes. One commodity alone can be shipped by three different ships. Without them they will be disruptions in the supply chain,” he expressed.

The Executive Director of the APN Group also revealed that the AfCFTA Secretariat is also trying to secure US$1billion to support Africa’s automotive industry.

He explained that this facility “will focus explicitly on African companies where the shareholder structure is African”.

Mr. Afful noted that this will not only favour vehicle manufacturing, but also producers who are part of that value chain.

The AfCFTA expert said the secretariat has lined up 5 priority areas to focus on; namely: agribusiness, pharmaceuticals, automotive industry, ICT, transport and logistics.

He expressed admiration for the work the secretariat is embarking on to develop structures that will support the Africa Continental Free Trade Agreement.