Global food supply disruption is stoking protests across Africa. In Nigeria, bread makers suspended production in anger at the soaring cost of flour, sugar and diesel. Kenyans took to the streets, demanding the frontrunners in August’s presidential election commit to workable solutions to ease the cost of living. In Cameroon, where wheat costs have caused a 50% jump in bread prices, President Paul Biya ordered an immediate disbursement of $150m to increase wheat production in the country. Despite such policy responses and international efforts – the US has committed $1bn in food aid to North Africa and the Middle East, for example – the most consistent response has been to increase interest rates as food and energy prices drive multi-year high inflation. We see no let up in the pace of monetary policy tightening, which will help to stem further weakening of some currencies.

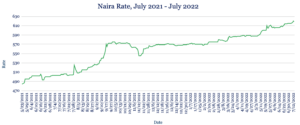

Record-low Naira has further to fall as inflation soars

The Naira plunged further against the dollar this week, hitting a fresh record low of 630 from 622 at last week’s close. Nigeria’s central bank this week raised interest rates by 100 basis points to 14%, a three-year high and its second consecutive hike this year. The latest move comes as annual inflation hit a more than five-year high of 18.6% in June. Prices of basic staples continue to rise. The government finally caved to demands from petroleum marketers to increase gasoline prices amid tighter supply, raising the cost of a litre of petrol to between NGN170 and NGN190 from NGN165 – a move that has eased queues at filling stations. Nigerian bread makers are protesting against their surging costs – flour, sugar, diesel – by suspending production. Against this backdrop and amid higher dollar demand and ongoing FX supply constraints, we expect the Naira to lose further ground in the coming days.

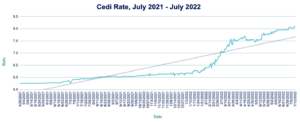

All-time low Cedi may see relief from Afreximbank flows

The Cedi slipped to a fresh low against the dollar this week, trading at 8.129 from 8.09 at last week’s close. The Ghanian parliament this week approved a $750m loan agreement with Afreximbank to finance infrastructure projects and to bolster the country’s FX reserves. In a bid to avert a planned strike by public sector workers, the government also agreed to increase the cost of living allowance by 15% to lessen the impact of soaring inflation and economic hardship. That higher inflation coupled with a heavy debt burden and declining reserves has crimped foreign investment inflows. However, proceeds from the Afreximbank deal should provide FX support and slow the Cedi’s depreciation in the coming days.

Rand tumble halts on SARB vs. Fed rate outlook

The Rand halted its recent slide against the dollar, trading marginally stronger at 17.05 from 17.09 at last week’s close, a 22-month low. Relief came amid expectations that US interest rate rises will be lower than initially feared and in anticipation of continued hikes by the South African Reserve Bank following June’s annual inflation rate hitting 7.4% (surpassing the central bank’s 6% upper limit). We expect to see further Rand strength in the coming days if the commodity outlook improves and if China’s central bank cuts interest rates again to stimulate economic growth.

Five-year low Egyptian Pound to touch 19 levels

The Pound depreciated to a five-year low against the dollar this week, trading at 18.93 from 18.88 at last week’s close. The ongoing weakness comes amid higher demand for the greenback to finance imports, combined with declining foreign investment inflows given the broader retreat in past weeks from riskier assets. Egypt’s President Abdel-Fattah El-Sisi this week said the country was ready to help ease Europe’s gas crisis by exporting all the natural gas it can produce from the Eastern Mediterranean. Overall, we expect the Pound to continue weakening towards the 19 level in the near term.

Record-low Shilling under Kenyan election pressure

The Shilling declined to a fresh record low against the dollar this week, trading at 118.20/118.65 from 118.10/118.30 at last week’s close as continued high demand for the greenback from the manufacturing and energy sectors weighs on the local currency. Kenya’s annual inflation accelerated in June to 7.9% on the back of higher fuel and food costs. The IMF agreed to disburse a $235.6m loan to Kenya after the country met the lender’s performance targets. The funds will be used to support the country’s debt repayments and to mitigate the effects of the Covid-19 pandemic and Russia’s war in Ukraine. We expect further weakness for the Shilling ahead of next month’s presidential election.

Shilling at 7-week low as Uganda plans spending cuts

The Shilling remained under pressure against the dollar, trading at a seven-week low of 3790/3810 from 3765/3775 last week. In response to rising goods and services prices triggering inflation, the government is planning a 6% cut to public spending in the first quarter of the 2022/23 fiscal year. We see continued downside on the Shilling in the coming week due to rising inflation and the stronger dollar.

Tanzanian Shilling steady amid IMF loan deal

The Shilling was unchanged against the dollar this week, trading at 2331. The IMF this week approved a $1.05bn extended credit facility for Tanzania, of which $151m is expected to be disbursed immediately. The IMF said the loan should stimulate private sector investment in the country. At the same time, the African Development Bank this week agreed a $73.5m loan to boost food supply as Tanzania seeks to become self-sufficient in wheat and edible oil production by 2030. We expect the Shilling to remain stable against the dollar in the week ahead.

Note to journalists: please feel free to quote from this briefing for news reports and let us know any requests for further comment or interviews via the contact details at the end, or by reply to this email. AZA is Africa’s largest non-bank currency broker by trading volume at over $1 billion annually. See https://www.azafinance.com

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

Gavin Serkin

[email protected]

+44 20 3478 9710