- The LMI Value for Ghana for the first quarter of 2022 is 64.7

The Logistics Managers Index (LMI) is a new tool developed by the Centre for Applied Research and Innovation in Supply Chain – Africa (CARISCA) based at Kwame Nkrumah University of Science and Technology for Ghanaian businesses and policymakers. The calculated LMI for Ghana along with the accompanying analysis of its components provide useful insights for the government of Ghana, business decision-makers, market analysts and investors as it offers a predictive indicator of overall economic activity in Ghana.

The LMI report will be available quarterly at https://carisca.knust.edu.gh/LMI. Senior executives and managers of Ghanaian organizations are invited to participate in the quarterly LMI surveys by visiting: https://www.surveymonkey.com/r/3RJ3FCX.

| The LMI measures the growth or decline of Ghana’s logistics industry based on eight key logistics components: |

|

|

|

An index score is calculated for each of these components, and an overall index score (LMI value) is then evaluated as a composite of these sub-indicators. This LMI value is expressed as a percentage with a mid-value/threshold of 50%. An LMI value above 50% indicates a growing logistics industry, while a value less than 50% indicates a contracting logistics industry. This is an effective and reliable approach to identifying prevailing trends in logistics activities in Ghana, and due to its predictive nature, the LMI is also an effective tool for forecasting future trends.

- This first study indicates that the overall Logistics Managers Index (LMI) for Ghana currently stands at 64.7 for the first quarter of 2022. This index reflects growth in Ghana’s logistics activities which is a positive outlook because the Ghanaian economy, like most other African economies, is beginning to recover from the effects of COVID-19. Hence, an LMI value of 64.7 (14.7 points above the threshold value of 50.0) is quite promising.

- Also, the values of all key indicators were above the threshold mark. However, logistics cost is generally high, with three of the cost-related indicators (warehouse prices, inventory cost and transport prices) recording the highest values in the first quarter of 2022. This suggests that the general cost of logistics operations in Ghanaian businesses is high. Constrained transport capacity, coupled with increasing demand for limited warehousing space, increasing fuel prices and increased cost of supply of goods contribute to this.

- Currently, the demand for warehousing outstrips supply and even though warehouse capacity was above the threshold it was the lowest among all the indicators. There is a great need for more warehousing and customer fulfillment facilities in proximity to major towns. The prospect of growth in online retail also indicates that increasing demand will be placed on available warehousing space. It is therefore not surprising that warehouse prices are high. Warehouse utilization is also observed to be high which implies an efficient use of limited warehousing space by Ghanaian organizations.

- Current inventory levels are high and this reflects a strong demand for goods and services in the country. Increasing local demand seems to be placing pressure on Ghanaian supply chains resulting in the inventory levels observed. This includes goods in retail storage, goods in distribution centers and supplies in raw materials warehouses across the country. It also seems post-covid, Ghanaian companies are increasing stock levels because of the general unreliability of global supply lines.

- Predictions by respondents indicate a continuous growth in logistics activities in Ghana within the year, which will positively influence several sectors of the Ghanaian economy. This projection from the LMI is supported by the World Bank’s projected growth rate of 5.5% for Ghana in 2022[1]. Even though the World Bank estimates this projected growth to be broad-based, it will be boosted by a relatively stronger industry sector that is undergirded by logistics activities. Hence, logistics activities will play a major role in the nation’s rebound post-covid.

- The LMI for Ghana is based on a quarterly survey of logistics, supply chain and procurement managers across multiple industries in Ghana. Subsequent surveys and reports will provide avenues for analyses of trends and comparisons.

A SNAPSHOT OF GHANAIAN LOGISTICS

As Ghana continues to position itself as the transportation hub of West Africa (Africawatch, 2014), there is a growing expectation that, given the right infrastructure development and fiscal policies, the country will become an important emerging economy. However, the achievement of this goal is very much dependent upon the extent of efficiency of Ghana’s logistics sector, which, if strengthened, can significantly facilitate trade and commerce in West Africa.

The World Bank has identified logistics activities as a major contributor to a nation’s economic development (Arvis et al., 2016). Logistics captures the extent of efficient movement of physical goods to customers within and across national borders. Improvement in a country’s logistics activities can determine the extent of its participation in international trade. Therefore, knowledge of Ghana’s logistics readiness and capacity can help explain the country’s competitive advantage in the international market arena.

Notwithstanding the importance of logistics activities as a driver of Ghana’s competitiveness in international markets, there is virtually no established index that systematically and periodically measures and tracks logistics activities in the country. An exception is the World Bank’s 2018 Logistics Performance Index (LPI), which compares 160 countries’ logistics and supply chain activities, including Ghana’s (Arvis et al., 2016).

While the LPI measures logistics infrastructure development and supply chain capacity, it does not track movement in logistics activities as this new Logistics Managers Index does. Additionally, although macro-economic indicators such as Gross Domestic Product (GDP) help track general economic activities and provide an extra line of information, it is considered to be a lagging indicator that is not predictive enough (Rogers et al., 2018).

The Logistics Managers Index (LMI), developed by supply chain researchers in the United States (Rogers et al., 2018; 2019), is a more reliable framework for tracking the movement of logistics activities in an economy. This document is the initial release of the African Logistics Managers Index.

Understanding Ghana’s logistics landscape in real-time from its managers

Respondents are asked to identify the monthly change across each of the eight metrics collected in this survey. In addition, they also forecast future trends for each metric ranging over the next 12 months. The raw data is then analyzed using a diffusion index. Diffusion Indexes measure how widely something is diffused or spread across a group.

These are argued to be more predictive and, therefore, provide a stronger indication of economic consumption before it happens. This is unlike GDP, which measures economic consumption at the final point of consumption and is a lagging indicator. In addition, the eight metrics used in this LMI report can track economic activity both upstream (close to supply base) and downstream (close to the point of consumption), thus helping capture the totality of movement of logistics activities in an economy.

As companies in Ghana continue to look for opportunities to improve customer service levels, transportation (and warehousing) activities provide distribution options to meet different customer needs in terms of delivery speed and reliability. For example, with growth in online retailing in Ghana, pioneered by companies such as Jumia, Tonaton, OLX, and JIJI, there is an increasing need for transportation services and warehousing spaces across the country.

In addition, the health sector in Ghana has warehouse capacity constraints due to an increased inflow of COVID-19 PPEs to the country. Several health facilities have no storage space for government-supplied PPEs and other health commodities. This is compounded by the fact that the country’s third-party logistics (3PL) industry is in the nascent stage, with a limited number of vendors capable of providing all-around transportation services. Major players in this sector are predominantly multinational companies such as DHL and UPS, with a very limited number of local companies providing such services. Consequently, several companies tend to invest in in-house transportation and warehousing facilities.

Expansion in transportation outsourcing

Despite these capacity constraints, recent developments are pointing to expansion in transportation outsourcing, with demand outstripping supply in many sectors of the Ghanaian economy. Cold chain solutions, for example, are in high demand stimulated by the need to distribute COVID vaccines across the country. The growing requirement to minimize supply chain disruptions has also generated increased investor interest in local manufacturing capacity development with strong implications for transportation and warehousing services.

In addition to this, the prospect of moving goods freely and at low cost due to reduced import taxes, as promised by the African Continental Free Trade Area (AfCFTA), also serves as a booster to manufacturing locally. The LMI for Ghana, modelled after the LMI in the United States, therefore, provides a timely measure of movement in logistics activities in Ghana. It is expected that this index will eventually be extended to sub-Saharan Africa, making it possible to provide comparisons across African countries over time.

OVERVIEW OF RESULTS

The LMI for Ghana study utilizes eight metrics to capture logistics activities in Ghana: inventory levels, inventory capacity, warehouse capacity, warehouse utilization, warehouse prices, transportation capacity, transportation utilization, and transportation prices. The index measures combinations of inventory, warehouse and transportation activities and tracks the relationship between these variables to make inferences about their effects on the broader Ghanaian economy. Therefore, this index provides predictive value as compared to other lagging economic indicators (e.g., GDP), helping address a deficiency in the measurement of logistics activities and movement in the economy (Rogers et al., 2018).

To calculate the current LMI for Ghana, the diffusion index was used. The diffusion index has been used in the past to calculate other widely accepted indexes, such as the Purchasing Managers Index (PMI). This index gives an indication of whether the metric being evaluated is contracting or growing. Values below 50.0 suggest a contraction, while values above 50.0 suggest growth in an activity (Getz and Ulmer, 1990). Thus, LMI values below 50.0 would be suggestive of contraction whereas values above 50.0 would suggest expansion in logistics activities.

The result of this first quarter of 2022 LMI for Ghana comes from a March 2022 survey of logistics and supply chain professionals in Ghana. As the March 2022 data are the first of their kind, trend analyses and comparative assessments are not undertaken in this report. It is expected that this survey will be repeated quarterly over the years to make it possible for analyses of trends and comparisons.

Observations: inventory and transportation

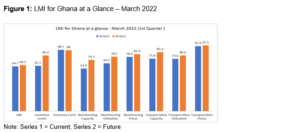

We make several observations from the March 2022 data. The data shows expansion in logistics activities in Ghana, with all eight metrics registering values above 50%. Transportation prices recorded the highest value (93.9), followed by inventory costs (88.7) and warehousing prices (78.4).

The high transportation prices may be linked to the relatively low transportation capacity and infrastructure in Ghana. It can be contended that the recent increases in fuel prices driven by the Russia-Ukraine war may have been responsible for the high transportation prices. A significant proportion of the managers surveyed expressed fear of further increases in fuel prices, which may result in a continued rise in the transportation metric.

The high inventory cost is also indicative of the high cost of operations in Ghana’s logistics sector. Although we cannot compare it with previous data, the high inventory cost reported is not surprising given recent supply chain disruptions caused by the COVID-19 pandemic and the Russian-Ukrainian war that have significantly increased the cost of supply of goods globally.

The high warehousing prices could also be attributed to the growing demands from Ghanaian businesses for greater warehouse spaces spurred on by increasing levels of consumerization. Even though Ghana’s online retail is relatively young, there is the prospect for growth with more online retailers entering this market. This has also contributed to the increased demand for warehousing services resulting in the high prices reported.

Inventory levels were high at 65.5%, which reflects a good demand for goods and services in the economy. Warehouse capacity recorded 61.6%, which is also above the threshold value, indicating growth in warehouse capacity. However, it was the lowest among all the eight indexes. Warehousing utilization registered 69.2%, which is indicative of growth. In general, a lack of warehousing capacity drives warehousing utilization and warehousing prices. The limited availability of warehousing options is encouraging respondents to improve the utilization of existing warehousing space.

Transport capacity index registered a 75.8% value, which is indicative of growth in this logistics activity. Respondents believe this index will continue to grow going forward because greater transport capacity will be required to accommodate expected increases in supplies as the global economy bounces back from the pandemic.

Transport utilization index registered a 75.6% value for the first quarter of 2022, indicating growth in this logistics activity. Transport utilization is noted to be inversely related to transport prices; hence it is expected that transport utilization will increase as transportation prices decrease.

Snapshot of Logistics in Ghana

Table 1.0 shows the summary results of the first quarter of 2022 LMI for Ghana (January – March 2022). The index scores for each of the eight components and the overall index score of the LMI for Ghana show signs of growth. Overall, we have observed significant growth in Ghana’s logistics industry, as indicated by the index values.

Table 1.0: LMI Values for Ghana for the First Quarter of 2022

| LOGISTICS AT A GLANCE | |||

| Index | March 2022 – Current | March 2022 – Future | Anticipated Direction |

| Overall LMI for Ghana | 64.7 | 66.5 | Growing |

| Inventory Levels | 65.5 | 80.4 | Growing |

| Inventory Costs | 88.7 | 88 | Contracting |

| Warehousing Capacity | 61.6 | 74.2 | Growing |

| Warehousing Utilization | 69.2 | 78.5 | Growing |

| Warehousing Prices | 78.4 | 82.4 | Growing |

| Transportation Capacity | 75.8 | 85.4 | Growing |

| Transportation Utilization | 75.6 | 80.6 | Growing |

| Transportation Prices | 93.9 | 95.1 | Growing |

PREDICTED FUTURE LMI VALUES FOR GHANA

Table 1.0 also shows the predicted future values for all eight metrics from the March 2022 data. To generate the predicted future LMI values for Ghana, we asked respondents to predict movement in the individual metrics for the next 12 months. Results show that the respondents are optimistic about the potential for increased logistics activities within the next 12 months. They predicted continued growth in all metrics except for inventory costs, which are predicted to contract (a difference of -0.7 between actual and projected).

With the threat of COVID-19 seemingly contained and the economy of many countries (including Ghana) opening up, the expectation is that transport routes will open up, leading to faster deliveries and shorter storage periods which will, in turn, lead to a reduction in inventory costs. On the other hand, all other seven indicators are predicted to grow in the future.

Respondents anticipate a continual growth of inventory levels as the economy picks up following a decline in disruptions from COVID-19 and other external shocks. This increased demand for goods will lead to an increase in demand for warehouse spaces, which currently outstrips supply and will likely result in increased warehouse prices. Warehouse capacity and utilization are also predicted to increase. Furthermore, respondents believe that transportation capacity and utilization will continue to grow in the future.

It is important to note that this prediction cannot be compared with past forecasts as there is no historical data. Future LMI values will enable a comparison of the growth or decline of logistics activities as indicated by these eight indexes and the overall LMI value. Figure 1 shows the current (actual) and future (predicted) values of the LMI indexes for the first quarter of 2022.

Overall, the LMI index for Ghana for the first quarter of 2022 is 64.7%, which is above the threshold value of 50.0%. This index is high and reveals a growing logistics sector. In comparison, the LMI value for the USA (an economy with a GDP of $25 trillion compared to Ghana’s $74 billion) in March 2022 was 76.20[2].

As a developing economy, a current LMI value of 64.7 indicates a positive outlook for the Ghanaian economy as this suggests a burgeoning logistics sector, which is expected to keep growing. Respondents were positive that this growth observed in Ghana’s logistics sector in the first quarter of 2022 will increase in the future and predicted a future LMI value of 66.5.

METHODOLOGY

Data for the Logistics Managers Index for Ghana are collected in quarterly surveys. Respondents for the study include senior logistics, supply chain and procurement executives and managers in the formal sector of the Ghanaian economy. Senior executives and managers are more likely to have macro-level information on inventory, warehousing and transportation trends in their organizations.

Data are also collected from professional members of the Chartered Institute of Logistics and Transport (CILT) and the Chartered Institute of Procurement and Supply (CIPS). Members of these professional bodies in Ghana tend to hold senior management positions in their organizations.

To ensure that the LMI value for Ghana is a true reflection of logistics activities in the Ghanaian economy, the respondents for this study were required to be working for organizations that operate in Ghana. Multiple industries were represented in the respondent pool: automobile and parts, telecommunications, shipping and transport, agriculture and agriculture business, manufacturing, mining, pharmaceuticals, industrial services, oil and gas/petroleum, and machinery and equipment. A total of 130 valid responses were used for the March 2021 report.

The diffusion index: Relying on a time-tested approach

Respondents were asked to identify monthly change across the eight metrics collected in this survey. In addition, respondents were asked to provide predicted future trends for each metric for the next 12 months. The data were then analyzed using a diffusion index as used in the USA LMI study (Rogers et al., 2018).

Diffusion indexes are widely used to measure how widely a variable is spread across a group. The Institute for Supply Management (ISM) has been using the diffusion index to compute the Purchasing Managers Index since 1948. In keeping with the approach by Rogers, et al. (2018) and ISM, we computed the diffusion index as follows:

| DI: 0.0 * PD + 0.5 * PU + 1.0 * PI |

Where PD = % of respondents saying a category is declining, PU = % of respondents saying a category is unchanged, and PI = % of respondents saying a category is increasing.

ABOUT THE LOGISTICS MANAGERS INDEX FOR GHANA

The Logistics Managers Index (LMI) for Ghana is a study by the Center for Applied Research and Innovation in Supply Chain – Africa (CARISCA) at the KNUST School of Business in Kumasi, Ghana. This project is a collaboration between Kwame Nkrumah University of Science and Technology (KNUST) in Ghana and Arizona State University (ASU) in the United States, with support from the United States Agency for International Development (USAID). This study was led by Nathaniel Boso (Ph.D.) and Emmanuel Quansah (Ph.D.) of KNUST.

The data used to prepare this report were obtained from a nationwide survey of senior logistics, supply chain and procurement executives and managers in major organizations in Ghana. The Logistics Managers Index (LMI) for Ghana makes no representation other than that stated in this release regarding the individual company data collection procedures. The data should be compared to all other economic data sources when used in decision-making.

LOGISTICS MANAGERS INDEX FOR GHANA – REQUEST FOR PERMISSIONS

Requests for permission to reproduce or distribute the contents of the Logistics Managers Index for Ghana should be sent (in writing) to Professor Nathaniel Boso, CARISCA-KNUST Secretariat, PMB, KNUST School of Business, Kumasi, Ghana. Alternatively, requests for permission can be made by sending an email to [email protected].

The authors of the Logistics Managers Index for Ghana report shall not have any liability, duty, or obligation for or relating to the content of the Logistics Managers Index for Ghana or other information contained herein, any errors, inaccuracies, omissions or delays in providing any Logistics Managers Index content, or for any actions taken in reliance thereon. Under no circumstances shall the authors of the Logistics Managers Index for Ghana be liable for any special, incidental, or consequential damages arising out of the use of the Logistics Managers Index for Ghana.

| To participate in the LMI survey, go to https://www.surveymonkey.com/r/3RJ3FCX. |

REFERENCES

Africawatch (2014). Transporting Ghana into the Future, Africawatch Special Report, October Edition

Arvis, et al. (2016). Connecting to Compete 2016: Trade Logistics in the Global Economy – The Logistics Performance Index and Its Indicators. The World Bank

Getz P.M., and Ulmer M.G. (1990). Diffusion indexes – A barometer of the economy Monthly Labour Review, April Edition, PP. 13-21

Martí, L., Puertas, R. and García, L., (2014). The importance of the Logistics Performance Index in international trade. Applied Economics, 46 (24), pp.2982-2992.

Rogers, Z., Rogers, D., Carnovale, S., Lembke, R., Leuschner, R. and Yeniyurt, S., (2019). The predictive value of the logistics managers’ index. Rutgers Business Review, 4 (2).

Rogers, Z., Rogers, D. and Leuschner, R., (2018). The logistics managers’ index. Rutgers Business Review, 3 (1).

This report is supported by the United States Agency for International Development and created by the Center for Applied Research and Innovation in Supply Chain – Africa (CARISCA), a joint project of Arizona State University and Kwame Nkrumah University of Science and Technology under award number 7200AA20CA00010.