All societies across time and place have faced the ‘basic’ economic problem – scarcity and how best to make use of limited resources. Some have prioritised improving production through enhanced technology with varying degrees of success. Others have relied on the exchange of their natural resources to succeed.

But some citizens from some regions have pursued the proverbial greener pastures with the intention of bettering their lot and that of persons they have strong ties with – family and friends – in their native regions.

With the makeup of these economic migrants becoming more skilled versus unskilled, development stakeholders continue to bemoan the high human capacity deficit – which the African Development Bank (AfDB) estimates is about 70,000 professionals across the continent annually: this group of persons is responsible for a crucial flow of foreign exchange or capital.

Conservative figures suggest that remittances accounted for more than half of all private capital flows to Africa in 2016; studies, including one by Ratha et al. (2022), indicate that since that time remittances have been the largest source of external finance flows to low- and middle-income countries (LMICs) other than China.

Locally, diaspora remittances continue to be a primary source of income for families and inflow into the country, with the US, UK and Nigeria topping the list of sending countries.

Official data show that the inflow of remittances has grown exponentially, rising from US$32.40million in 2000 to US$135.85million in 2005. This grew further to US$2.13billion and US$4.982billion in 2011 and 2015. Just prior to the pandemic, in 2019, approximately one million migrant Ghanaian workers in foreign countries and others in the diaspora remitted US$4.054billion – equivalent to about 6.1 percent of GDP.

Official data show that the inflow of remittances has grown exponentially, rising from US$32.40million in 2000 to US$135.85million in 2005. This grew further to US$2.13billion and US$4.982billion in 2011 and 2015. Just prior to the pandemic, in 2019, approximately one million migrant Ghanaian workers in foreign countries and others in the diaspora remitted US$4.054billion – equivalent to about 6.1 percent of GDP.

Despite these, it is estimated that unrecorded flows through informal channels are at least 50 percent larger than recorded flows. This is in no small part due to inefficiencies which drive cost and time of execution. While international money transfer operators (IMTOs) work around the clock to improve efficiency, the emergence of cryptocurrencies as a tool for fund transfer has been embraced by consumers – to the horror of central banks.

eCedi

To get in on the digital finance action and also rein-in the appeal of unregulated cryptocurrency, central banks across the globe have been sprinting – and in some instances got ahead of themselves – to introduce digital currencies which they regulate. Enter central bank digital currencies (CBDCs).

Simply put, CBDCs are the digital form of a country’s fiat currency; issued by and consequently a direct liability on the central bank. They are digital representations of physical cash legal tender, they are to be a medium of exchange – accepted for payment and settlement, store of value and unit of account.

According to the International Monetary Fund (IMF): “Around 100 countries are exploring CBDCs at one level or another. Some researching, some testing – and a few already distributing CBDC to the public”.

Locally, the Bank of Ghana (BoG) in June 2021 announced plans to introduce a CBDC, the eCedi. The tool was piloted in September and has progressed at a calculated pace relative to its peers. A month later, at the Ghana Economic Forum organised by the B&FT, the regulator indicated that plans were underway to make the eCedi available to offline users; without the need for power or connectivity. The pilot of this feature began in May 2022.

The case for…

Globally, sending remittances costs an average of 6.04 percent of the amount sent, according to the World Bank’s Remittance Prices Worldwide. Despite witnessing a decrease in average cost, from 8.27 percent to 7.83 percent for every US$200 sent – which is believed to be an accurate representation of a typical remittance transaction size – sub-Saharan Africa (SSA) remains the region with the highest cost of inward remittance. The cost, which can go as high as 20 percent in smaller migration corridors, is a multiple of the Sustainable Development Goal (SDG) target for remittance costs of three percent.

High costs in the region are driven by a number of structural inefficiencies, particularly low levels of financial inclusion and a lack of access to banking services.

The introduction of CBDCs is being heralded as a critical cool to overcome some of the systemic impediments regarding, especially, cross-border payments and settlements. It is said that the digital currency will support financial inclusion by providing a less costly, more efficient and safer means of payment by minimising the demand for a third currency and limiting the need for intermediaries.

Indeed, a report titled ‘Inthanon-LionRock to mBridge; Building a multi CBDC platform for international payments’ published by the Bank of International Settlements (BIS) in September 2021 suggests the impact of CBDCs on cross-border payments is substantial. A review of the prototype mCBDC Bridge project – a collaboration among central banks of China, Thailand, the United Arab Emirates and Hong Kong – suggests CBDCs could cut remittance costs by as much as 50 percent.

Additionally, it is said that CBDCs can reduce the transaction throughput of cross-border payments from three to five business days to only a few seconds. This prospect has stakeholders salivating. The argument, then, seems to be that the expected success of CBDCs with respect to cross-border payments will be replicated, especially for remittances – invariably boosting diaspora remittances through formal channels.

Not so fast

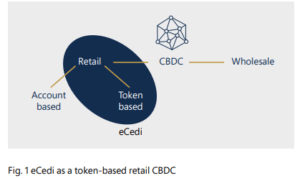

The discourse on CBDC has so far provided only an overview of what it is. To further investigate its potential impact on remittances, we must now familiarise ourselves with its categories. Broadly speaking, there are two categories of CBDCs being developed globally: Wholesale and Retail.

As implied in the names, Wholesale CBDCs (wCBDCs) will primarily be utilised on a ‘large scale’ by financial institutions such as banks. On the other hand, Retail CBDCs (rCBDCs) will primarily be utilised by individuals… essentially as digital cash. The wCBDCs will enable large institutions to make payments in an even faster and more automated manner. On this scale, it is expected that cross-border transactions may become faster and more reliable.

“Retail CBDC is digital cash that is designed to take on most traditional attributes of physical cash (in practice, though, it may have other additional functionalities depending on its final design).”

Additionally, CBDCs can be categorised as token-based (value-based) and account-based depending on the mode of implementation. The BoG’s Design Paper on the eCedi defines both: “Token-based CBDCs are cryptographic tokens which can be stored locally on a card, on a phone, or a smart device and can be passed on from one user to another. Account-based CBDCs envisage general-purpose accounts – and each mode has a corresponding balance”.

In the same document, the BoG confirms that at launch “the eCedi is a retail token-based CBDC. This is a value-based approach that implies an eCedi that represents a token, or a digital value note,” effectively limiting its usage for large, cross-border transactions. This is perhaps the more prudent approach as the ecosystem develops across sovereigns.

But, also, there are other issues relating to the inherent attributes of CBDCs and ensuing implications on the international regulatory and supervisory framework. As one author put it: “[CBDCs] inherit the negatives of fiat currency (depreciation, volatility) and cryptocurrencies (complexity, opacity). Yet, it lacks the positives of the former (familiar, universal) and latter (decentralised)”.

Simply stated, by virtue of its design the eCedi will carry along many of the pros and cons that are inherent with its physical, older sibling. For the eCedi to have a material impact on cross-border payments and subsequently the levels of inward diaspora remittances, issues around know your customer (KYC), Anti-money Laundering and Counter-terrorism Financing (AML/CTF) must be regularised across nations.

Finally, it must be stated that despite the broad shift toward more digital finance solutions, particularly in urban centres, the same cannot be said as convincingly for persons in rural settings. Introduction of the E-levy and the shockingly poor communication around it has raised suspicion about the value proposition of digital money and might set back the agenda by a few steps.

Jury still out

It is perhaps a bit too early to say if CBDCs will actualise the dream of reducing cost of cross-border payments and subsequently remittances, as many of the systemic problems persist. However, central banks on the continent can begin to take a cue from their counterparts in regions where digital finance has blossomed – especially in Scandanavia, where the cashless agenda is in full force.

Some have proposed that central banks, the BoG included, could partner with foreign and local players and come up with innovative arrangements. These could include persons seeking to remit funds into the country buying the eCedi in a foreign currency-denominated account, then they send the eCedi to family and friends in-country. A win-win situation for all, in an ideal world.

Thankfully, the BoG does not appear eager for a gold medal in the first-to-launch category but is adopting a measured approach prior to launch… learning from the missteps of others. Hopefully, it will work out as intended and we’ll see a growth in remittance inflows, coupled with reduced costs. For now, we will file this under the ‘we wait to see’ category.

Source: BoG

Governor Ernest Addison

References:

- IMF (2022). The Future of Money: Gearing up for Central Bank Digital Currency.

- IMF (2020). New Forms of Digital Money: Implications for Monetary and Financial Stability.

- IMF (2019). Stablecoins, Central Bank Digital Currencies, and Cross-Border Payments: A New Look at the International Monetary System.

- World Bank (2021). Central Bank Digital Currency: Background Technical Note.

- IOM (2021). Remittance inflow trends snapshot.

- BIS (2021). Inthanon-LionRock to mBridge: Building a multi CBDC platform for international payments.

- Migrationdataportal (2022). https://www.migrationdataportal.org/themes/remittances. Accessed June, 2022.

- BoG (2022). Design Paper on the eCedi.

- edu (2021). Keep remittances flowing to Africa. https://www.brookings.edu/blog/africa-in-focus/2021/03/15/keep-remittances-flowing-to-africa/. Accessed June 2022.

- CBN (2021). Design Paper for the eNaira.

- Stears Nigeria (2021). Why the eNaira is not yet useful to Nigerians