Every business in Ghana that buys in US$ and sells in GH¢ is most concerned and affected by the Ghana cedi depreciation. This is because the currency depreciation requires them to use more GH¢ to purchase the same US$ – hence causing forex-driven inflation in addition to demand and supply-driven inflation. However, businesses that buy in GH¢ and sell in US$ are heavily insulated against the Ghana cedi depreciation. Such companies benefit significantly as they need fewer US dollars to buy more Ghana cedis. Juxtaposing this onto the Ghana Cocoa Sector, Cocobod buys cocoa from Ghana Cocoa Farmers in Ghana cedis and sells it in United States dollars.

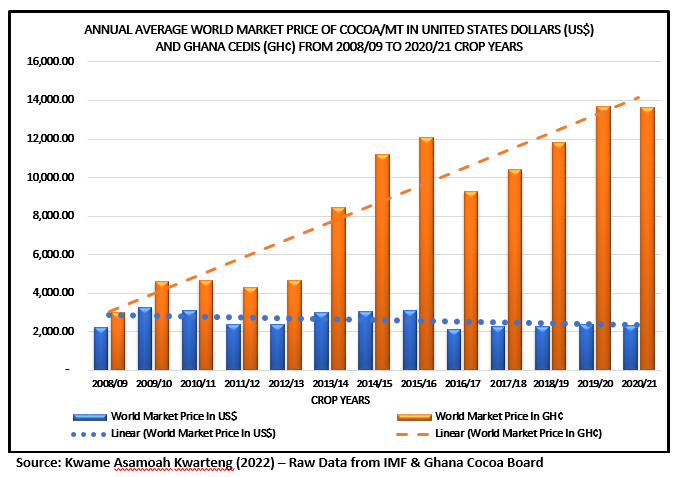

This has meant that with the consistent annual increase in depreciation of the Ghana cedi against the United States dollar (as shown in graph 1) since the 1990s, Cocobod has consistently benefitted economically from the exchange rate without transferring part of these benefits to cocoa farmers whose products they trade. In fact, from the blue-dotted trendline in graph two, you will see that the annual average world market price of Cocoa in US$ between 2008/09 to 2020/21 crop year declined slightly. However, from the red-dashed trendline in graph two, the annual average world market price of cocoa in ‘Ghana cedi’ terms between 2008/09 to 2020/21 is on a sharp increase. The difference is depreciation of the Ghana cedi in favour of Cocobod, with none being transferred to the cocoa farmer.

Graph 5: Annual Average World Market Price of Cocoa/mt in United States dollars (US$) and Ghana cedi (GH¢) from 2008/09 To 2020/21 Crop Years

This is a massive blow to cocoa farmers because Ghana Cocoa Board refuses to adjust its farm-gate price to reflect inflation. So, the farmers lose the foreign exchange benefits which could have reduced the inflation effects. This is why cocoa farming is heavily unprofitable and creates more poverty than it alleviates.

This is a massive blow to cocoa farmers because Ghana Cocoa Board refuses to adjust its farm-gate price to reflect inflation. So, the farmers lose the foreign exchange benefits which could have reduced the inflation effects. This is why cocoa farming is heavily unprofitable and creates more poverty than it alleviates.

Further to this, as explained in graphs 2 and 3, within a period when there was a consistent increase in the world market price of cocoa in US$ and a rise in its Ghana cedi equivalent, Ghana Cocoa farmers did not receive any increment in their farm-gate price year-on-year. This means the farmgate price wasn’t adjusted to inflation, reducing the cocoa farmers’ purchasing power and increasing poverty-driven challenges. What can be the excuse for the Ghana cocoa board not to increase the farm-gate price during periods when the Ghana cedi has depreciated and the US$ value of cocoa in the world market goes up?

This is happening because they know the Ghana cocoa farmer isn’t literate enough to see this detail and fight for a change. Stakeholders in the sector who claim to be ‘Experts’ do not know this, and hence are unable to champion the actual changes that can result in a trickling down of the cocoa value chain’s benefits to the pockets of cocoa farmers.

Ghanaian Cocoa Farmers Purchasing Power (Inflation on their incomes)

Inflation plays a crucial role in ending poverty within the cocoa sector. Inflation is a gradual increase in the prices of goods and services. The rise in these prices reduces the currency’s value; hence if US$100 could buy 2kg of rice in 2021, the same US$100 in a country that records inflation will purchase less than 2kg of rice. Most organisations, including cocoa processing and chocolate manufacturing firms, can adjust the salaries of their staff to inflation to ensure that they are protected against inflation.

For example, civil servants in Ghana received a 7% salary increment for 2022. Comparing this increase to the annual average inflation rate of 9.3% for the past three years, i.e., 2019 to 2021, One could say that Civil servants were somewhat protected against inflation; hence it not affecting their purchasing power substantially.

But how about the smallholder cocoa farmer? How are they or Ghana Cocoa Board able to adjust their incomes to protect them against the consequences of inflation? Graph 5 compares the nominal and real income smallholder cocoa farmers receive from the farm-gate price awarded them from the sale of a metric tonne of cocoa for each crop year.

First, you will notice that I did not include the LID as part of farmers’ 2020/21 nominal income. The reason has been explained here. When you study graph six closely, you will realise the continuous drop in real income for cocoa farmers year on year from 2008/09 till date. Whereas Ghana Cocoa Board cannot be blamed for the rising inflation in Ghana and its effects on farmers’ income, they can be legitimately held responsible for not adjusting their income to insulate cocoa farmers from the impact of inflation. As highlighted in graphs 2 and 3, the world market price for cocoa in both USD and Ghana Cedi terms increased yearly. Yet cocoa farmers did not receive an increase in the producer price to reflect this and insulate them against the staggering inflation rate. What better explanation can be given to this if not institutionalised corruption against smallholder cocoa farmers?

What makes the real income of cocoa farmers critical is that they are geographically located in areas with unmotorable roads and lack social amenities like water, electricity, good health care, schools, etc. So as compared to someone living in the city, the cocoa farmers’ real income is further made worse as their quest to access these social amenities comes at an extra cost.

What further worsens their plight is that teachers and healthcare workers find it challenging to accept postings to geographical areas like theirs. Secondly, the unmotorable roads, less demand due to poverty, and the continual increase in fuel prices have meant that the cocoa farmer pays an extra cost to access food like rice, oil, etc., than someone living in the city.

—— Subscribe to https://cocoadiaries.substack.com/subscribe to continue reading & view the graphs with detailed labels ——–

Kwame is a cocoa farmer’s son with expertise in international trade & policy, industrial policy, and project management, with a professional focus on the Cocoa-Chocolate Industry, the Smallholder Cocoa Farmer and the digital economy.

- Newsletter: https://cocoadiaries.substack.com/subscribe

- Twitter:@asamoahpeters

- Email:[email protected]

- LinkedIn:Kwame Asamoah Kwarteng

Copyright Note:

The content of this publication should not be republished in any shape or form without official consent from the author. You can reach out to me for publication discussions via [email protected]. If you want the complete 5,000 word report sent to you in PDF, kindly reach out to the author for a quote. Alternatively, you can subscribe to my newsletter cocoadiaries.substack.com/subscribe to read the full version of this article.