Mobile transactions have become ubiquitous across most economies in Africa over the past decade, which has been a pillar in bridging the financial inclusion gap as well as the financial inclusion gains witnessed in Ghana. The increased penetration of mobile money over the years has been correlated with increased access to digital financial services by the informal sector of the Ghanaian economy.

According to a BoG report, Ghana had 50.2 million registered mobile money accounts and 18.6 million active users while the total number of transactions performed stood at 403 million as at April 2022. This comes as no surprise, since Ghana has become one of the fastest-growing mobile money markets in Africa. Additionally, the issue of distance to traditional banks had long been a barrier until digital financial services, especially mobile money, helped overcome some of these challenges.

Despite the strides made by mobile money, in government’s quest to close the gap between taxes to GDP ratio and expand the tax base by giving an opportunity for everyone to contribute toward national development, E-levy appears to be the simplest way to go. The proceeds from this tax, according to the Finance Minister, will be used to finance the ‘YouStart’ initiative; road construction; develop the digital space of Ghana; and particularly the development of basic education among several others in the country. These initiatives will eventually improve the economy when properly implemented.

While the E-levy can be justified by the need for a stable source of revenues, there is a potential risk of going back with the digital agenda and discouraging users from using formal platforms, with a final negative outcome for revenue collection. It is clear that there is a trade-off between two of government’s key agendas – specifically, effective domestic revenue mobilisation and financial inclusion.

The early wave has already been felt. According to the May-2022 Summary of Economic and Financial data, the mobile money industry lost 4,000 active agents as their number declined to 454,000 in April from the previous months 458,000. Additionally, active mobile money subscribers saw a decrease in April to 18.6 million from the 18.9 million recorded in the previous month.

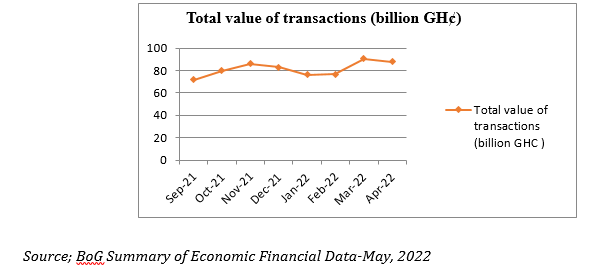

The graph illustrates Mobile Money’s total value of transactions from September 2021 to April 2022. According to the graph, the value of transactions on the country’s payment platform decreased to GH¢82.9billion in December from GH¢86.1billion recorded in November 2021 just after the E-levy’s introduction was announced. It further declined to GH¢76.8million in February 2022.

The Way Forward

Lack of transparency and accountability on the part of government on certain critical projects has made Ghanaians sensitive to the slightest price increments, leading to more exclusion. The more expensive electronic transactions become, the easier it can be to revert to cash. Moving forward, government must ensure value for money, give a consistent and clear feedback on projects undertaken by revenues from this E-levy – as it was in the era of HIPC, when one could see projects put up under the initiative.

Furthermore, taxpayer’s willingness to pay taxes is connected to their trust in institutions and perceptions of corruption. The integrity of our public finances is essential for sustainability of the e-levy. This holds the potential to increase revenues. Additionally, best practices suggest that vulnerable groups should be put at the centre of this policy – leaving no one behind in this digital era. There should be a cap on the range of transaction amount – say GH¢2,000-GH¢5,000 attracts an E-levy charge of GH¢40. These measures will help government realise its estimated revenue from the E-levy.

The author is a researcher/consultant. Contact: [email protected].

Cell: +233 54 347 5499