The excessive exposure of asset allocation by pension funds to government securities presents a real challenge for short-term market viability and long-term economic growth, Chief Executive Officer (CEO) of Axis Pensions Trust, Afriyie Oware, has warned.

With approximately 75 percent, on average, of pension funds channeled toward this asset class, there is a real risk of ballooning public debt and the rising possibility of a default if alternatives are not explored as a matter of urgency, he added.

Mr. Oware said this during the the Injaro Ghana Venture Capital Fund (IGVCF) launch, where he offered reasons for his outfit being one of the anchor investors for the private equity-focused fund.

“We have been deeply concerned by the asset allocation of pension funds; if we look at the typical pension fund in terms of asset allocation, the exposure to governments sector security is approximately 75 percent. The question then is, what risk does this pose? We can all see the growth of debt stock over the past few years – and in the same way we are concerned about private sector default. It can also happen in the public sector, as we have seen examples in other countries; and if we are being honest, we are approaching the tipping point,” he said.

He expressed displeasure with the failure of pension funds to allocate capital to long-term value drivers of investment, as investors.

“We decided to be an advocate to help direct capital to the private sector. We have been concerned about asset allocation in general to the private sector. Whereas government is doing approximately 80.1 percent of GDP in terms of debt, capital allocation to the private sector sits at less than 11 percent. If we continue at this pace, we will set ourselves up for failure in the long-term. And so, we have decided to embrace private equity as a means to get capital to the private sector,” he explained.

This comes despite what Mr. Oware described as “successful lobbying of the regulator”, which has seen an upward adjustment of the limits for investment in equities and alternate investment vehicles.

“The advocacy has helped. The new investment guideline that the National Pension Regulatory Authority (NPRA) has released is very supportive of capital allocation to the private sector,” said the Axis Pensions Trust CEO.

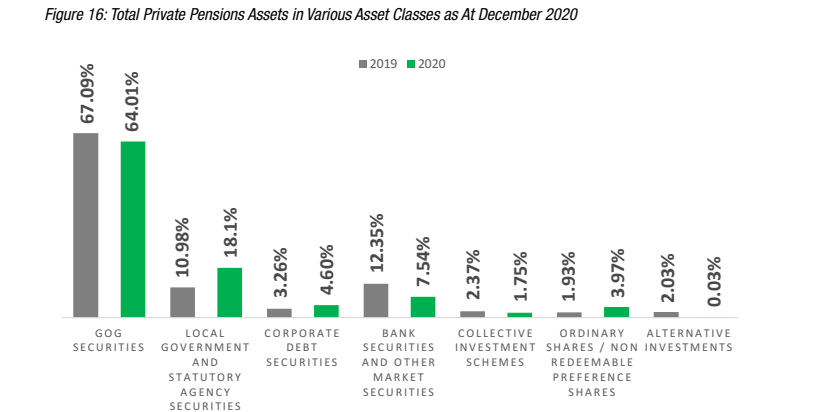

According to the NPRA in its last publicly available full-year report (2020), assets under management (AUM) for the industry more than doubled from GH¢15.2billion in 2016 to GH¢33.4billion as of year-end. Private pension schemes under the mandatory Occupational Pension Scheme (Tier- 2) and voluntary Provident Fund Scheme and Personal Pension Schemes (Tier-3) accounted for GH¢22billion of the figure.

Partners

On his part, the Securities and Exchange Commission (SEC) Director-General said a collective effort is required if businesses in the country are to partake in the approximately US$1trillion private equity market.

“For this to happen, we must have a thriving private equity ecosystem; and that is why we are excited about Injaro’s launch and the work going on at the Ghana Venture Capital Fund. The SEC is ready to have regular engagements with the association in ensuring a thriving local private equity industry,” he noted.

Reacting to the description of IGVCF by its CEO, Jerry Parkes, as an “investor conveyor belt” for the market, a consultant with the Ghana Stock Exchange (GSE), David Ganesha Tetteh, said the development is a welcome one and bodes well for the GSE and wider capital market.

“The stock exchange is very excited by this development… We are happy to hear that one of the routes they are considering for exits is the Ghana Stock Exchange. This is where we can get a good pipeline of well-governed, investor-ready companies to list on the stock exchange,” he remarked.