The latest Bank of Ghana business confidence survey has shown that businesses have expressed a negative outlook to their growth prospects on the back of existing economic conditions.

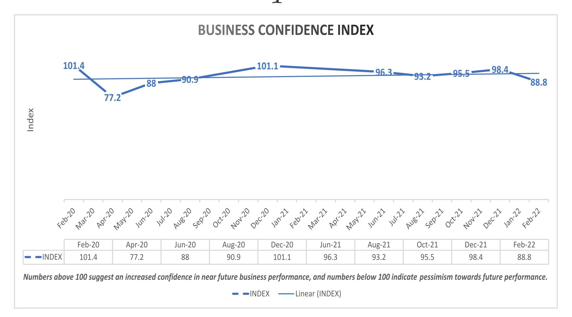

The central bank’s latest business confidence survey in February 2022, which gauges the level of optimism among business managers, revealed a slump in business confidence as it has declined by 9.6 points from 98.4 points recorded in the previous survey of December 2021.

At the moment, business confidence has returned to high-pandemic era levels – reaching its lowest since June 2020.

The Monetary Policy Committee Chairman (MPC) and Bank of Ghana Governor, Dr. Ernest Addison, noted that this is mainly on the back of businesses’ concern about the persistent increases in fuel prices, increases in transportation fares, and rising inflation.

“In addition to these factors, we are also concerned about the impact of these on macroeconomic conditions and businesses’ short-term targets and profitability for 2022,” he said.

These survey findings were largely in line with observed trends in the February 2022 Ghana Purchasing Managers Index (PMI). The Ghana PMI, which is a measure of the rate of inventory accumulation by managers of private sector companies, ebbed below the 50.0 benchmarks on the back of weak output and purchasing activity amid rising inflation.

The IHS Markit Purchasing Managers’ Index (PMI) for Ghana ebbed in February to clock 49.6, which is down from January’s 50.8. Consequently, the index was below the 50-threshold – suggesting a deterioration in business conditions relative to the previous month.

Again, the survey revealed that firms seemed less confident as sentiments regarding the coming year sank to their lowest level since June 2021 amid concerns regarding price pressures in the private sector.

The decline came amid weaker demand and higher price upsurges, as firms passed on spiking input costs to consumers by increasing output prices.

Consumer Confidence

Similar to business confidence, consumer confidence surveys conducted in February 2022 revealed a dampening of sentiments, as the index dipped by 0.7 points to record 87.4 points in February 2022.

Like the businesses, consumers were mainly concerned about the persistent increases in fuel prices, increases in transportation fares, and rising inflation.

Economic Activity

The bank’s updated Composite Index of Economic Activity (CIEA) has however shown a rebound in economic activity, albeit at a slower pace than last year.

The index recorded an annual growth of 4.2 percent in January 2022 compared to 13.9 and 3.4 percent in the corresponding periods of 2021 and 2020. Key drivers of the index during the period were industrial production, exports, credit to the private sector, and air-passenger arrivals.

Consumption of goods and services, and construction activities, however slowed down – acting as a drag on the index.