- Analysts fear impact on economy in case of mass exit

Offshore investors’ participation in the equities market as of February-ending remains at 80 percent of trading, a situation some analysts fear may have negative impacts on the local economy if there is a mass exit due to unfavourable market conditions.

Following announcement of the proposed 1.75 percent levy on electronic (E-levy) transactions during the budget reading in November, a rise in unfavourable macroeconomic metrics including inflation and depreciation of the local currency – as well as downgrading of the nation’s Eurobonds by key rating agencies – market observers predicted tough times for the market.

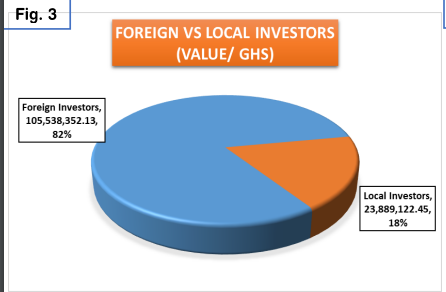

Data from the local bourse show that from beginning of the year to date, foreign investors have contributed 82 percent of trading on the market – which is 5 percentage points lower than at the end of January, indicating some movement out of the market by foreign investors.

Addressing the subject, an analyst who sought anonymity because he doesn’t have official permission to speak on the subject, said the combination of a long-term approach to the equities market and absence of ready takers for some stocks are key contributing factors.

“Many foreign investors have a long-term approach to equities investing. So it is not a market that would typically be dumped in haste. But, also, there is a high probability that there are not as many ready-takers. I am sure that brokers will be building sell orders in their books but there won’t be as many buy orders; so that way, trading will be reduced. So you won’t see the full impact of those who are looking to exit just yet… But this is largely a phenomenon in the equities market,” he explained.

A perusal of the data shows that foreign investors’ trading totalled GH¢105.5million, with domestic investors accounting for GH¢23.9million.

A further breakdown of the investor class participation revealed that most of the trades were executed on behalf of institutional foreign investors (82 percent), followed by domestic institutional investors (11 percent) and domestic individual investors (7 percent). Others are offshore individuals (0.04 percent), resident foreigners (0.03 percent) and joint accounts (0.02 percent).

Taking the above into consideration, coupled with a 54.14 and 38.33 drop in the volume and value of trades respectively when compared with the same period last year, Senior Analyst at UMB Brokers, Kofi Bussia Kyei, stated that the next couple of weeks will be crucial in determining the extent to which offshore investors are seeking to exit the market.

Pointing to the comparatively slow reaction time of the market to external pressures, he noted the impending review of the policy rate and further effects of the Russia-Ukraine crisis as additional factors which will impact offshore investor reaction.

“It is a bit too early to say, in my estimation, why the figures remain this high. We know our market can be slow to price-in some of these factors, but by beginning of the next quarter we will have a better idea of how desperate foreign investors are to exit. It would be wrong to say there will not be any impact, especially as institutional investors have benchmarks for what they can invest in; and these are some of the things they look at, so if the trends continue we will see it priced in.