- Sharpest rise of output prices in seven months

- New order growth slows and output declines amid price increases

- Business confidence at eight-month low

Inflationary pressures had a detrimental impact on Ghana’s private sector in February. Customer demand faltered amid price rises, while output and purchasing activity decreased and sentiment weakened. Input prices rose sharply amid higher costs for purchases and staff. In turn, output prices increased at the fastest pace in seven months.

On a more positive note, employment increased at a solid and accelerated pace.

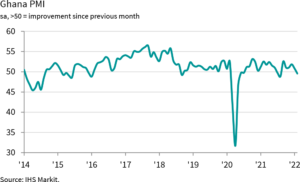

The headline seasonally-adjusted Ghana PMI dropped below the 50.0 no-change mark in February. At 49.6, down from 50.8 in January, the latest reading signalled the first deterioration of business conditions in the private sector for six months, albeit

one that was only marginal overall.

Business activity decreased for the second month running, and at a solid pace that was the sharpest since August last year. Firms often attributed the latest reduction to weaker customer demand amid price rises. This was also evident with regard to new orders, which increased at the slowest pace in the current six-month sequence of growth.

The price rises faced by customers were sharp, with companies in Ghana increasing their charges at the fastest pace in seven months. Higher selling prices primarily reflected the passing on of rising input costs to clients.

Overall input costs increased sharply, and at a slightly faster pace than in January. Data indicated that purchase prices were up at a particularly marked rate midway through the first quarter, largely reflecting rising fuel costs and currency weakness.

Staff costs also increased, and at the fastest pace since last July. Those panellists that raised wages mainly did so in line with higher living costs.

With the cost of purchased items rising sharply, companies lowered their input buying in February. Some respondents indicated that inventories were sufficient, given weaker new

order growth. The fall in purchasing was the first in seven months, while stocks of inputs were down for the third month running.

Meanwhile, suppliers’ delivery times shortened as vendors made efforts to get jobs finished, while prompt payments also helped to speed up deliveries.

Despite signs of weakness elsewhere, companies continued to increase their staffing levels in February. Moreover, the rate of job creation quickened to the fastest since May 2018. Rising employment was often linked to the filling of vacant positions.

A combination of higher staffing levels and softer new order growth meant that firms were able to work through outstanding business. Backlogs of work decreased sharply for the second month running.

Although hopes of continued new order growth supported optimism in the 12-month outlook for business activity, February saw a marked drop in sentiment linked to concerns

around the impact of inflationary pressures on the private sector. Confidence dropped to the lowest since June last year

Commenting on the latest survey results, Andrew Harker, Economics Director at IHS Markit, said: “The recent spell of elevated inflation is really starting to bite, with PMI survey panellists and their customers alike limiting purchases in the face of price rises. Growth

of new orders was only marginal in February, while output and purchasing activity saw outright declines. Price pressures were also key to a drop in sentiment, suggesting that Ghana’s growth profile over the months ahead is likely to be lower unless inflation begins to alleviate”.