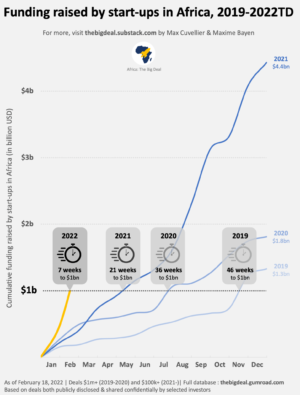

Early to mid-stage startups on the continent have attracted at least US$1billion in venture capital funding within the first seven weeks of the year, data from African-focused start-up deal database, The Big Deal Africa, have shown.

According to the numbers, this is a consistent improvement over the last three years as it took the continent’s startup ecosystem 46 weeks – until mid-November – to collectively raise US$1billion in 2019. This compares to the 36 and 21 weeks needed to attain the feat in 2020 and 2021 respectively.

Unsurprisingly, however, the Big Four – Nigeria, South Africa, Kenya, and Egypt – accounted for approximately 80 percent of these deals recorded in 2021, with Ghana coming in at a distant fifth.

Fuelled primarily by investors in regions with access to cheap capital, the pace of growth has led some analysts to suggest that there is an imminent slowdown in the level of venture capital coming into the continent, as rising global inflation causes investors to dial back on their risk appetite.

But speaking in an interview with the B&FT, Dean of the University of Cape Coast (UCC) Business School, Professor John Gatsi, disagreed with the assertion; arguing that the entire value of funding to African startups – which hit US$4.65billion in disclosed funding rounds in 2021, according to research and intelligence firm Briter Bridges – remains minute compared to the global figures.

“While we celebrate these figures, what we have had coming into Africa by way of direct foreign investment in startups through venture capital can best be seen as a drop of water in the global ocean of venture capital funding,” he stressed.

His view is consistent with figures which show that, globally, startups attracted a minimum of US$100billion in every quarter of 2021, with the third quarter setting a record at US$160billion in funding.

Virgin territories

Touching on Ghana’s comparatively low fraction of the funding pot, Prof. Gatsi called for startups to begin exploring areas beyond fintech and healthtech solutions.

He noted these areas are becoming saturated, with players from other countries having a head-start – adding that areas such as agritech, biotech and legal, which he described as ‘virgin territories’, must be developed as they will not only provide solutions to local problems and offer Ghanaian startups a competitive advantage, but also prove viable investment opportunities for risky capital.

“Investors are always looking for where to put their money; and make no mistake, there is enough money to go around. But we must have propositions they consider value for their money, especially when they are investing at the early stage of a business that is yet to establish a track record of profitability,” he added.

Exit strategy

The economist further stated that in addition to the state improving legal and regulatory frameworks in the country, which will in turn bolster investor confidence, business owners must be able to demonstrate viable exit strategies for investors.

This, he said, would best be done by a deepening the local capital market, especially the stock exchange.

“Investors must see a tangible exit strategy, if and when they want to. We cannot speak too much about how a well-developed capital market, especially through the Ghana Stock Exchange, would help in this regard.”