- “I contend that a country that tries to tax itself into prosperity is like a man standing in a bucket trying to lift himself up by the handle.” – Sir Winston Churchill, 1904

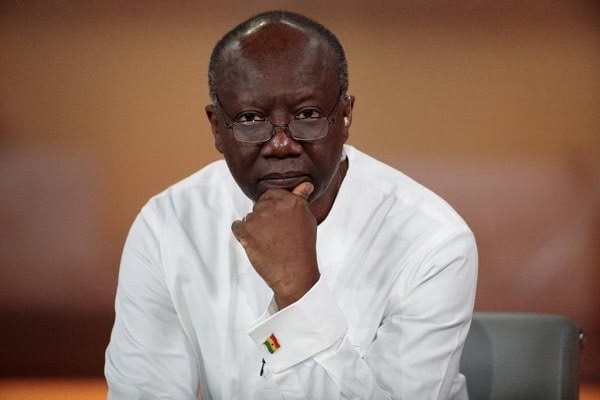

In line with Articles 108 and 174 of the 1992 Constitution, the Finance Minister has brought before Parliament the Electronic Transfer Levy bill, otherwise known as the E-levy bill, to be passed into legislation. According to section 1 of the bill, the E-levy seeks to impose a 1.75 percent tax on electronic transfers of money.

The proposed E-levy is not just an input tax, but a transactional tax. An input tax is collected by a seller at each stage of the supply chain. An example of input tax is VAT. It is collected by service providers on behalf of GRA. So the E-Levy will be collected by the telcos for the value added to the actual price of the services they provide. On the other hand, transactional tax is collected on a specific transaction. That is to say, a MoMo customer will pay a value of 1.75 percent tax added to the actual price each time he transacts beyond GH¢100.

What this simply means is that just because a person chooses to pay electronically, he can be taxed multiple times within the same chain of transaction. Thus, if a trader or retailer decides to purchase goods from a manufacturing company, the amount of money the trader pays for the goods will largely consist of taxes – i.e., from the manufacturer(s) to the distributor(s) several taxes will be paid multiple times.

These include multiple payments for Value Added Tax (VAT), National Health Insurance Levy (NHIL), Ghana Education Trust Fund Levy (GETFL), COVID-19 Health Recovery Levy (CHRL) and now the E-levy. All these will be paid at each stage of the supply chain, and most of these taxes do not give input tax deduction. The effect of this is that we should anticipate an astronomic increase in prices of goods and services if the bill is passed – which will be unbearable and lead to many Ghanaians being poverty-stricken.

What amounts to a nuisance tax is when businesses are charged on the number of transactions they make and not on the amount of income they accrue.

Decline of tax revenue in the informal sector

Per the 2022 budget statement read by the Finance Minister, the E-levy’s purpose is to target the informal sector. In view of the memorandum of the E-levy bill, about 2.4 million out of the 18 million eligible Ghanaian taxpayers pay tax. This makes Ghana have one of the lowest tax to Gross Domestic Product (GDP) ratios in Africa.

Ghana’s tax revenue to GDP was 13 percent in 2020, and is estimated to reach 20 percent in 2023. Ghana has a lot to do to meet the sub-Saharan average of 17 percent, which is above the nation’s 13 percent mark previous governments have over the years tried to upscale – with the country’s challenge of collecting less tax and relying mostly on external help: International Monetary Fund, World Bank, bonds and others. Besides, Ghana’s total revenue (both tax and non-tax) to GDP was also 14.3 percent from 2020 and is expected to rise to 16.9 percent in 2024.

But according to GRA, the major contributor to the country’s public purse from the informal sector, the Vehicle Income Tax (VIT), saw a drop from 8.3 percent in 2017 to 7.3 percent in 2020 – while the Tax Stamp which is the other contributor also witnessed a drop, from 1.4 percent to 1.3 percent in the same period under review.

The decline, according to some tax experts, is in sharp contrast to recent figures released by the Ghana Statistical Service in its Ghana Living Standard Survey (6), which peg the population of operators in the informal sector at 90 percent of the country’s workforce. According to the data, Ghana realised only GH¢35,811,805 from the Vehicle Income Tax and Tax Stamp out of a total revenue realised from self-employed people which was GH¢413,594,327 in 2020.

One may ask: how well do businesses in the informal sector utilise electronic payment in their transactions to be effectively captured under the E-levy? Because, most often than not, Small Scale Enterprises do not undertake electronic payment up to GH¢100 per day to fall within the scope of the levy. To this extent, one may say the effectiveness of the E-Levy in achieving its primary objective of widening the tax net is unfounded; it rather seeks to exploit.

Economic digitalisation for financial inclusion

In view of the need to expand the tax net in the informal sector to generate more revenue, last year the National Identification Authority (NIA) and Ghana Revenue Authority (GRA) announced the commencement of plans to replace the GRA Tax Identification Number (TIN) with the National Identification Authority (NIA) Personal Identification Number (PIN), known as Ghana card PIN.

The goal of digitalising of tax process is to collect the maximum amount of revenue with minimum cost to the state. The transitioning from TIN to Ghana card will provide data statistics and information about the economy; for example, determining which assessable persons are or are not taxable.

Thus, the transitioning could aid in reducing tax avoidance and evasion by providing unique identification of individual tax data. When combined with other mechanisms like withholding tax and withholding VAT in a proper way, it can loop in the informal sector (the biggest evaders of tax in Ghana). It may not necessarily make people pay the right amount of tax, but it will increase the taxpayer base.

Let me add that another possible measure is for government to implement the Taxation (Use of Fiscal Electronic Device) Act, 2018, after more than four years of being passed. This Act provides for the use of approved Fiscal Electronic Devices by specified taxable persons at each point of sale.

National Financial Inclusion and Development Strategy

From 2018 to 2023, the government of Ghana seeks to reduce economic vulnerability and income inequality through development of a broad financial inclusion policy. The Ministry of Finance, in collaboration with financial sector regulators and other key stakeholders, developed a National Financial Inclusion and Development Strategy (NFIDS) to address the fundamental barriers preventing the underserved population from accessing financial products and services that would enable them to generate income, build assets, manage financial risks, and become economically empowered.

The NFIDS is a strategy that provides a roadmap of reforms and innovation in the financial ecosystem to address financial exclusion and support broader development of the financial sector. Ultimately, the strategy seeks to increase financial inclusion from 58 percent of Ghana’s adult population to 85 percent by 2023.

During presentation of the 2021 budget to Parliament, government indicated that it is considering rolling out creative revenue mobilisation measures to fund its projects. For that matter, government also needs creative revenue mobilisation measures that will enable it to roll out its policies for the 2021 fiscal year. This has brought about government rolling out the ‘nuisance’ tax on mobile money to increase revenue mobilisation.

Government must ensure efficient means of revenue mobilisation rather than continuously rolling out new taxes which will end upconfronting the existing challenge of inefficiency in mobilising the revenue. Domestic revenue mobilisation (DRM) is the generation of government revenue from domestic resources, from tax or non-tax sources. Improving DRM of developing countries is a crucial factor in sustainable development.

Conclusion

The E-levy is not equitable as it taxes every time you transact using your electronic money transfer or your mobile money account.

- Principle of taxation

One of the basic principles of taxation is fairness and neutrality. This principle demands that taxes should not favour any one group over another, and should not be designed to influence individual decision-making.

This tax appears to be penalising Ghanaians who opt to use mobile money services or electronic money transfer as opposed to the traditional commercial banking services. It also appears to be designed to discourage Ghanaians from transacting electronically. This is because if you were to deposit, make a payment, withdraw or transfer money into your bank account using your bank account, this tax will not apply to you.

The tax also violates the basic principle of equality which requires people in equal circumstances to be treated equally. For example, two teachers earning the same salary will be taxed differently depending on whether one uses his electronic payment account or cash account. Indeed, we need to widen the tax base to include all people earning from certain economic activities, but there must be another way to achieve this.

As of 2018, there were 13.1 million active (out of 25 million registered) mobile money accounts. This figure was higher than the registered bank accounts – indicating that mobile technology is playing a key role in supporting financial inclusion across the country. The rapid increase in mobile money use has enabled the previously unbanked citizens to have access to basic financial services. Therefore, we should rather enhance and not inhibit it.

- Taxing to prosperity

The E-levy bill is the most critical issue that is currently being discussed and debated in Parliament. As Parliament is yet to resume from recess for the first time this year, now is a very good time for you to speak to your MP if you are one of the over 25 million Ghanaians who has a mobile money account.

To our MPs, you might find some inspiration in Sir Winston Churchill’s quote that he made in 1904:

“I contend that a country that tries to tax itself into prosperity is like a man standing in a bucket trying to lift himself up by the handle.”

Let us not kill the digitalisation of our economy. We ought to encourage its adoption to promote financial inclusion and national development.

>>>the writer is a Tax Policy Analyst. He can be reached on [email protected]/0548455071