…refining 10% earns US$55m per annum

Ghana is Africa’s largest gold producer and the world’s sixth but lacks a London Bullion Market Association (LBMA) licensed refinery to add value to the precious metal.

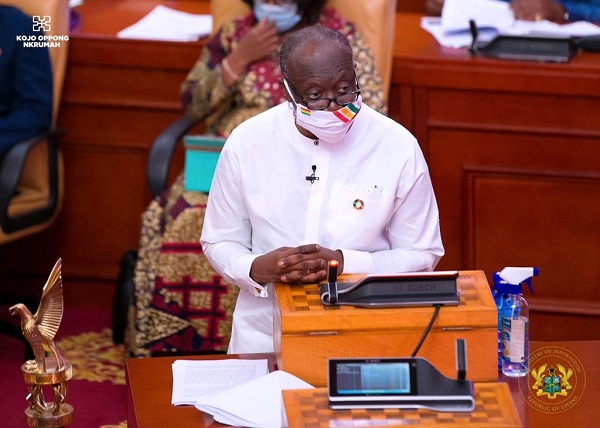

Exporting gold in its raw form, however, implies that the country is unable to reap the maximum benefits of being the continent’s largest producer, a situation Minister of Finance Ken Ofori-Atta believes needs to change in line with renew commitment to value addition and industrialisation by government.

He said the economy could earn an additional US$55 million yearly refining just 10 percent of gold with LBMA license. Globally, jewellery as an end-use of the gold mining market should grow from US$107.3 billion in 2021 to US$124.6 billion by 2026, at a CAGR of 3.0 percent for the period of 2021-2026, says Research and Markets.

Mr. Ofori-Atta spoke in Accra when Goldfields Ghana presented an interim dividend and guaranteed advance payment, totalling GH¢159million to the government for the 2021 financial year and underscored the need to add value its gold.

Africa produces about 870 tonnes of gold but it is only South Africa and Zimbabwe that boast refineries of capacity. Despite producing a reasonable percentage of the world’s gold, Ghana and the rest of the continent’s producers, are denied a good share of over the US$9.5 trillion worth global industry, because of lack of refining capacity.

In Ghana’s case, proceeds mainly come from gold royalties, dividends, corporate tax, PAYE and ground rent, among others, all of which represent just a fraction of the US$9.5 trillion industry wealth.

For instance, the mining industry’s total contribution to national revenue was GH¢4.172 billion last year, compared to Switzerland where gold trading accounts for nearly 4 percent of GDP, although it does not mine gold. The European country is one of the world’s leading processors of precious metals and one of the biggest beneficiaries of its wealth.

Dividend payment

The GH¢159 million concerns Goldfields’ Tarkwa Mine and the Damang Mine, out of which more than GH¢13 million is Guaranteed Advance Payment for the 2020 financial year, in respect of Abosso Goldfields Limited, Damang Mine

Alfred Baku, Executive Vice President and Head of GoldFields West Africa, presenting the cheque said the government held a 10 percent share in GoldFields Ghana through a free-carried interest. Under clause 6.2 of the ratified Development Agreement between Abosso Goldfields Limited, Damang Mine and the government, Goldfields is to pay the government an annual guaranteed advance payment of 5 percent of profit after tax in case it was not in a position to pay its normal dividend.

He said this was because GoldFields decided to reinvest approximately US$1 billion in the mine as part of the development agreement with the government. “The reinvestment project started in 2017, and after three years of hard work, we have achieved more progress than anticipated,” he said.

Meanwhile through the Goldfields Foundation, he said US$79 million has been invested in development programmes and shared-value projects in host communities in the Western Region, with the major one being the 33km Tarkwa Damang road, constructed at a cost of US$27million.

“Another key investment, which is ongoing, is the refurbishment of the T&A Park at Tarkwa into a 10,400-seat stadium, at a cost of over US$16million. This will be the new home of Medeama SC and, in time, will hopefully host the Black Stars in Tarkwa,” he said.

Aside dividend payments and the work it does through the foundation, he said GoldFields was a major contributor to national development and in 2020 the company contributed US$170 million in corporate income tax and royalties, US$23 million as employee pay-as-you-earn and US$20.9 million in dividends to the government.

Additionally, the miner has contributed over US$2.3 million in COVID-19 support to employees, host communities and the government.