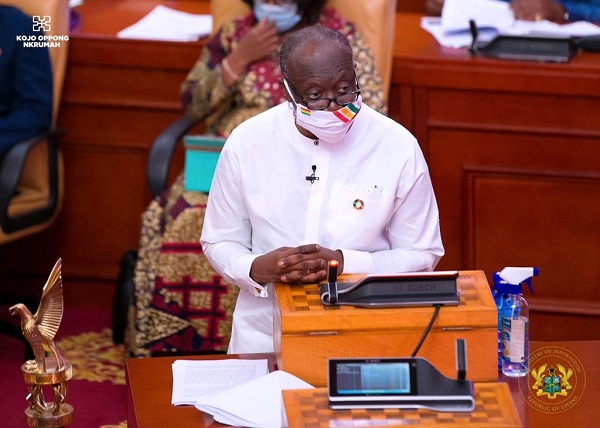

As the finance minister engages stakeholders in preparing the 2022 national budget, civil society organisation ‘Economic Governance Platform’ (EGP) has advised government to make debt sustainability a key factor in its economic policy going forward.

The group made the call after releasing a report that assessed the country’s growing debt stock – calling for stringent measures to avert conditions which may push Ghana into the category of a debt-distressed nation.

As at July this year, data from the Bank of Ghana (BoG) showed that Ghana’s total debt stock rose to GH¢322billion, equivalent to US$56.2billion and representing 76.6% of GDP.

This, the EGP maintains, could derail economic gains and cause fiscal slippages in government’s budget if the situation is not reversed. “As debt levels continue to soar, so do the risks of default or debt crisis. The IMF and World Bank debt indicators show that debt burdens may be major contributors to economic vulnerabilities, particularly in low- and middle-income countries,” the report said.

Giving some recommendations, the EGP said Ghana’s debt stock could hit more alarming levels if domestic revenue mobilisation is not improved to curtail the growing appetite for borrowing.

Improving domestic revenue collection

The group argued that Ghana has a high potential to raise additional tax revenues of about 5-6% annually.

“If Ghana’s revenues grow in line with a growing GDP and government is able to raise revenues around 19–21% of GDP each year, it is more likely Ghana will obtain a favourable financial rating from the financial world – and hence lower interest rates over time, while availing more and cheaper financing opportunities as well.”

According to the EGP, the key to debt sustainability will be collecting adequate revenues to support government’s economic agenda.

Avoiding wastage

Touching on judicious use of the country’s resources, the EGP said emphasis should be put on how loans are utilised through full implementation the Public Financial Management Act 2016.

It added that parliament must appropriately scrutinise and approve loans and projects with the national Interest in mind – ensuring that debt-funded projects are independently evaluated before, during and after their duration. “We also want government to consult and publish a debt strategy that fits the national view of debt and the national development plan.”

Concerns over increasing domestic debt

As part of its research, the EGP is worried about Ghana’s high and increasing domestic debt, questioning what may be influencing the trend. The group is of the view that it may be because Ghana allowed non-residents to participate in domestic debt issuance of more than three years maturity in 2006.

“This increasing type of lender comes with its own challenges for Ghana, because debt owned by non-residents could lead to significant outflows of these resources if the cedi deteriorates in value against foreign currencies.”

It appealed for government to ensure that the macroeconomic indices, especially the exchange rate, remain fairly stable over the long haul to stop the problem from recurring. It added that government must also include these factors in its debt management policy to curtail the risks.

The group observed that there has been a significant increase in applications for credit guarantees and re-lending financing request from many SOEs in Ghana recently. This, it stated, must be checked to ascertain the reason behind such actions.

The EPG proposed that in addition to government’s ‘credit risk assessment framework’ conducted for such guarantees and re-lending financing, the Ministry of Finance must also include the requirement for regular, preferably annually, public disclosure of their financial and corporate reporting, in line with good corporate practices.