The Institute of Economic Affairs (IEA) has proposed restructuring the nation’s external public debt, as well as introducing borrowing- or debt-ceilings in the annual Appropriations bill, among other measures, to arrest the nation’s ever-increasing debt stock – which has long breached the prudent 70 percent debt-to-GDP threshold for a lower-middle-income country.

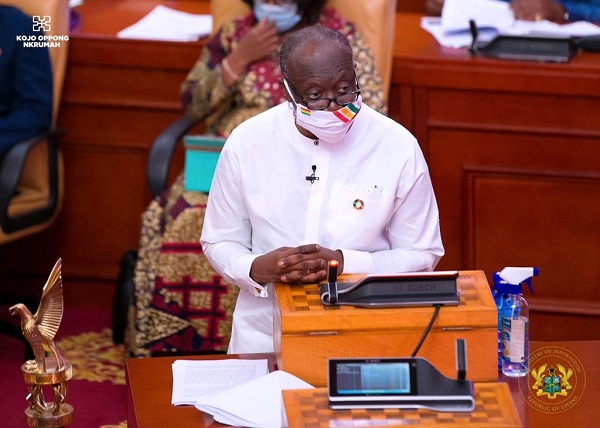

This was contained in a statement on the Institute’s expectations for the upcoming presentation of the next Budget and Economic Policy (BEP) by the Ministry of Finance to Parliament in November.

Per the 2021 mid-year budget review, nation’s public debt stock had risen from 76.1 percent at the end of December 2020 to 77.1 percent of GDP at the end of June 2021. The growth in debt stock was primarily as a result of the Eurobond issued in April 2021, lingering effects of the COVID-19 pandemic, and contingent liabilities as well as the front-loading of financing to meet cash flow requirements for first-half of the year.

The IEA wants the state, as a matter of urgency, to double down on efforts aimed at restructuring the debt stock.

“The current debt stock can be engineered to reduce the service burden. The debt can be restructured or refinanced, some of which is already being undertaken, to lengthen the maturity profile and replace more expensive debt,” a portion of the statement by the IEA reads. “Where possible, the opportunity should also be seized to negotiate discounted debt buybacks with creditors.”

Government, under its Medium-Term Debt Strategy (MTDS), has undertaken a number of measures to restructure its outstanding debts to ensure that “borrowing costs are as low as possible and consistent with a prudent degree of risk”, with one key strategy being to “elongate the tenor of bonds and loans”.

According to data contained in the 2021 to 2024 MTDS and published in March 2021, the Average Time to Maturity (ATM) for bonds has seen an overall increase from 8.2 years in 2017 to 8.7 years in 2018 – and subsequently 9.8 years in 2019 and a marginal reduction in 2020 to 9.4 years.

Borrowing cap

The IEA further argues that the introduction of a borrowing- or debt-ceiling in the annual Appropriations bill, which will require Parliamentary approval to exceed as is the case in other jurisdictions, will serve the public purse well.

“We are inclined to suggest that Parliament considers introducing a borrowing- or debt-ceiling in the annual Appropriations bill. This will be in addition to the existing expenditure ceiling that is imposed by Parliament for every budget, which more often than not is breached with impunity.

“If government wants to borrow beyond the initial borrowing – or debt- ceiling, it will have to come back to Parliament for approval, as prevails in the US. This suggestion is to rein-in the debt, which otherwise risks ballooning and overwhelming the budget in the form of escalating interest payments.”