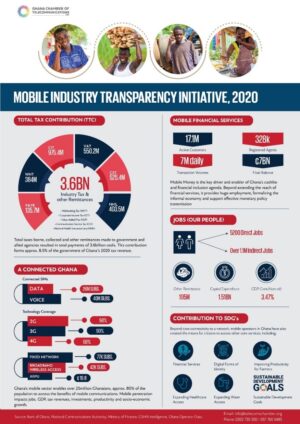

…as Telecos paid GH¢3.6bn tax in 2020

Total taxes borne, collected and other remittances made to government and allied agencies resulted in total payment of 3.6billion cedis. This contribution forms approximately 8.5% of Ghana’s 2020 tax revenue (Ministry of Finance, 2020 budget statement).

This was revealed at the 18th Knowledge Forum organized by Ghana Chamber of Telecommunications (GCT) and its partners to discuss their findings of their research on Total Tax Contribution (TTC) in the year 2020 at the Labadi Beach Hotel, La on Tuesday, September 14, 2021. Dr. Ing. Kenneth Ashigbey, CEO of the Chamber led the presentation and GCT Head of Research Derek Barnabas Laryea provided detailed explanation of the findings, purpose, methodology, of their industry research on how much taxes the Telecom industry paid to government in 2020.

The report highlights the convenience that innovations such as the Mobile Financial Services (MFS) being referred to as Mobile Money, brings to revenue mobilization, especially the large informal sector.

The Purpose & Methodology of the Study

The study objective was to measure the size of the contribution that members of GCT have made to the government of Ghana during the 2020 fiscal year. All GCT members took part in the study by providing data relating to their tax and other statutory payments for the financial/tax year ending 31 December 2020.

The Total Tax Contribution (TTC) methodology was employed to carry out the study. This methodology measures the total cash tax payments made by each of its members through its business operations. The TTC study considers not only corporate income tax but also all taxes borne and collected by the members of the Chamber and other statutory payments made to government agencies and regulators. Taxes borne are those taxes, which are a cost to the company when paid, and they in effect affect the results of the company, such as corporate income tax and employers’ social security contributions. Taxes collected are those taxes that are collected and administered on behalf of the government, such as withholding taxes and employees’ social security contributions. Although these tax contributions are not a cost to the company collecting them, the Telcos argue firmly that it is through their activities as collectors of government taxes that lead to the realization of these taxes, and this has cash flow implications for their operations in effect and impact either directly or indirectly on the prices they charged.

GHC31m collected as taxes from Mobile Money Agents

It is important to note that the over ¢31 million collected as withholding taxes from the about 328,000 registered merchants and agents would have been almost impossible to have been collected.

The chamber pointed out in their findings that collection of the taxes has an indirect cost to its members as it makes the product and service relatively more expensive. Details of the cost of collecting these taxes were not factored in this study. Additionally, there is a cost to collecting the tax as an agent of the government that has also not been accounted for in this study.

The methodology of the research covers largely taxes paid to the central government and other remittances relating to fees, charges, levies, and permits paid to key government agencies such as assemblies and other key ministries and regulators within the country.

To influence government policy and regulatory interventions on the sector, the Chamber believes there is the need for adequate information on industry costs, tax contribution and compliance, and its overall enabling impact on the economy. This should improve investor relations and appetite for investments in the Ghanaian market (industry) so that ultimately, the promise of digital inclusion, connected society and Government’s digital agenda can be attained within the short to medium term.

Key Findings

Based on the results, the eight participating companies in 2020 made a total tax contribution of over ¢3.6 billion in the 2020 calendar year. This represents total taxes borne, collected, and other payments and remittances made to the central government and other allied agencies.

Corporate Income Tax (CIT) constituted the largest tax type paid from the study. This tax relates to taxes borne by the members of the Chamber. The general corporate income tax rate is 25% and the industry contributed in monetary terms, ¢976 million, which represents approximately 26.8% of the TTC.

Value Added Tax (VAT) stood as second of the top tax lines of the industry, representing approx. 15.1% of the TTC in money terms of over ¢550 million. This tax line, although is a pass-through cost, which can be passed on to final consumers, puts an administrative obligation on the Chamber members to correctly administer, collect, and pay them over to the government. In addition to this, members of the GCT were also sometimes the final consumer from input VAT incurred on expenses made within the business.

Communications Service Tax (CST) also stood as another of the top tax lines in the study, representing also 14.5% of the TTC, in monetary terms of over ¢525 million. This is an industry-specific tax and was introduced in 2008 to raise additional revenue from communications services rendered by telecom operators to their customers. In 2013, the law was amended to further expand the scope of services subject to CST to include interconnect services and in 2020 the talk tax rate was reduced to 5%.

Other product taxes, regulatory fees, and the Universal Service Fund (USF), which mainly consist of the 1% annual net revenue, required to be paid to the National Communications Authority (NCA) on a quarterly basis and an additional 1% of total revenue required to be paid into an electronic fund set up by the government (GIFEC) was approx. 3.8% of the TTC representing ¢138 million. These statutory payments are based on the top line of the businesses and are payable, whether a business makes a profit or not.

Mobile financial services (MFS) for the first time contributed a whopping 5.91% tax contribution to the TTC which in monetary terms is about ¢215 million and largely attributed to Corporation Taxes and withholding taxes (WHT) paid from commissions to merchants and other engagements with suppliers, management services, etc.

Employment is generated through a wide range of direct and indirect activities in the sector. The members of the Chamber are known to be age-old large employers and in 2020 they employed a direct and indirect workforce of 5,700 and 1.1million personnel respectively. This accounted for the collection of Pay as You Earn (PAYE) on their behalf, resulting in the government receiving approx. ¢136 million, which is 3.7% tax contribution to the entire study and 1.81% of National total personal income taxes realized within the year 2020.

Analysis and conclusion

Trends of TTC study over the last three years have shown continuous average annual growth of over 28%. From GHS1.74bn in 2017, GHS2.2bn in 2018, and GHC3.2bn in 2019. There has, however, been a continuous decrease observed on certain lines, such as import duties, SIIT which creates a need for further analysis.

From the analysis, it can be concluded that for every ¢100 that is paid to the operators within the industry, they pay back ¢48 in the form of direct and indirect taxes, as well as other remittances to the government as explained above.

The remaining ¢52 goes into investment in the people, the business (capex), the supply chain (procurement), marketing, general operations, and its very unlikely that any of these funds are left to be paid back as dividends to shareholders which is the real objective of business everywhere in the world. What is important to also note is that the less availability of funds means future investments are likely to suffer and this hurts the quality of the network and service delivery.

The Covid-19 pandemic has affected FDI inflows and investible funds required by service providers to boost capacity with the growing demand for voice and data services. This is coupled with a huge acceleration in the growth in data demand faster than new capacity being installed in networks, resulting in a data capacity deficit.

The industry thrives on huge annual capital expenditure, to keep supporting the exponential growth in the network, product, and services. Over the two years, 2020 and 2021, the industry will invest over ¢3 billion on the network and IS infrastructure expansion. This will increase data capacity by 130% from 2.2million TB/day to 3.6million TB/day from March 2020 to March 2021. The traffic is expected to grow to 5 million TB/day in December.

The Ghana Chamber of Telecommunications (GCT), is an industry association, representing the interests of telecommunication operators and infrastructure companies, namely, AirtelTigo, MTN, Vodafone, American Tower Company, Helios Towers, Huawei, Comsys, and C-Squared. Members offer services ranging from fixed and mobile telecommunications to mobile data solutions, Internet services, and mobile financial services.

The Institute of ICT Professionals Ghana (IIPGH) is a professional association of those in the ICT industry. The organization focuses on capacity building for professionals, students, corporate organizations and other stakeholders in the ICT industry in Ghana. IIPGH collaborates with the Ghana Chamber of Telecommunications to educate the public on technology and how it can serve as an enabler for the socio-economic development of the country. IIPGH participated in the 18th Knowledge Forum as one of its partners.

David is the Executive Director, Institute of ICT Professionals, Ghana)

For comments, contact [email protected] or Mobile: +233242773762