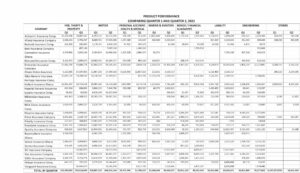

Motor Insurance continued its dominance in the general insurance category of insurance business in the second quarter of 2021. It earned GH¢648,214,114 in the second quarter as against GH¢310,097,324 in the first quarter, representing a 52.2% increase.

Motor insurance contributed GH¢648,214,114 out of the total gross premium income of GH¢1,260,935,087 generated in the second quarter of the period under review. Motor dominance in the general business segment results from its compulsory nature and the innovation brought by the Motor Insurance Database (MID) and introduced by the National Insurance Commission (NIC).

Fire, theft and property also experienced growth at 58%, from GH¢125,499,054 to GH¢296,516,648 in the second quarter. The portfolios of motor, fire, theft and property have a common feature, which is the element of compulsion by law in the purchase of these insurance contracts.

Hollard Insurance Company indeed topped the fire, theft and property portfolios in the second quarter by generating GH¢59,753,531 – while Glico General Insurance followed with an income of GH¢43,399,169 and Enterprise Insurance Company generated GH¢41,686,771; Activa International Insurance earned GH¢28,087,467 and Star Assurance raked in GH¢27,482,522.

The top five companies in the second quarter 2021 contributed GH¢200,409,460 – representing 32.4% of the total second quarter premium income earned.