Globally, the retailing industry has been quite challenging yet significant. The latter part of the 20th century, in both Europe and North America, has seen the emergence of the supermarket as the dominant grocery retail form. The reasons why supermarkets have come to dominate food retailing are not hard to find.

In fact, the retail industry has travelled a long way due to changes in the global economy, changes in technology and drastic shift in consumer demand. From 2010 to 2017, the composite annual growth rate in global retail revenue was 5.7%. The aggregate revenue of top 250 retail companies was valued at US $4.53 trillion in 2017 and such companies with foreign operations accounted for 65.6 % with a composite net profit margin of 2.3 % in the year 2017. (Deloitte Touché Tohmatsu, 2019).

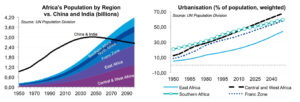

Africa has the fastest rate of urbanization in the world. More than 40 percent of its population is currently living in urban centers. By 2030, Africa’s 18 largest cities will have a combined spending power of $1.3 trillion. Additionally, Africa has as many cities with one million inhabitants as North America. Moreover, Africa is on track to become the continent with the world’s youngest population. Approximately 70 percent of Africans are presently under the age of 30. The youth account for around 20 percent of the population.

Urbanization rates are rising. In fact, UN figures indicate that in SSA, the urbanization rate increased from 11.2 percent in 1950 to 24.1 percent in 1980, and 36.4 percent in 2010. The UN forecasts that SSA’s urbanization rate will reach 45.9 percent by 2030 and 56.7 percent by 2050. In 2019, the population of Africa was estimated at 1.3 billion, with 350 million considered middle class.

A large proportion currently falls into the ages of 15 – 24. This age category spends more in consumer categories like entertainment, food, and technology. It is interesting to note that fifty three percent of African income earners are between 16 – 34 years old. This is an age group known for their awareness of and eagerness to consume new products.

In fact, the emerging middle-class consumer is increasingly brand conscious. Consumer spending is still mostly concentrated in the informal sector of roadside stalls and town markets. However, in East Africa there is already a discernible shift from informal to formal retail. As retail moves from informal to formal, companies like Walmart and The Carrefour Group are expanding their reach across the continent.

Walmart bought a 51 percent stake in South African retailer Massmart Holdings Ltd. in 2010. Despite some setbacks and leadership changes, Walmart intends to expand the brand with 47 new stores between 2019 and 2021. The world’s second largest retailer, The Carrefour Group, is also setting its sights on Africa. As recently as November 2018, Carrefour partnered with African e-commerce company Jumia to offer Carrefour-branded products on their e-commerce website.

Prospects of the Retail Industry in Ghana

Ghana has been ranked first in Africa and fourth in the world in the 2019 Global Retail Development Index which studies the global retailing landscape. The country has also been described as Africa’s new “bright spot” driven by increased foreign and public investment as well as urbanization of the population.

According to Population and Housing Census conducted by the Ghana Statistical shows that, between the year 2000 and 2010, the country’s population increased by 30.4 per cent with an intercensal growth rate of 2.5 per cent. The country increased foreign and public investment by 14.2 per cent (of GDP) in 2018, a number expected to rise to 30.8 per cent by 2028.

In fact, it has also been identified that urbanization will be a major driver for modern retailing, which is expected to reach $33.16 billion by 2024. It is refreshing to note that the performance of the Ghana’s economy coupled with an emerging oil and gas sector as well as stable political environment makes it the fastest growing economy in the world and as a result, a very competitive destination for retail international brands. Ghana’s retail sector is valued currently at $24.4 billion and is expected to reach $33.16 billion by 2024.

Ghana’s formal retail sector comprises both domestic and international players. Local chain Melcom was established in 1989 and is the largest retailer with 32 outlets across the country. It sells a range of goods, including electronics; housewares and food. There are a few smaller retail chains such as Palace and Max Mart.

One of the most prominent foreign supermarket groups is Shoprite Holdings from South Africa, which has six outlets. Other South African retail brands that have taken up space in Accra shopping malls include Game, Edgars, Woolworths, Truworths, Mr Price and Jet. It is worth noting that brands such as Mango, Payless ShoeSource and Sunglass Hut franchises are being operated by Lebanese-based Azadea Group. However, Vlisco Ghana, a producer of wax print fabrics and finished garments, also has a retail presence in Accra and the rest of the country through its Vlisco and Woodin brands.

It’s worth noting that, the informal trade still accounts for about 90 percent of the market, modern retail is gradually emerging, mostly in the capital Accra. The 20 000m2 Accra Mall, completed in 2007, was the first A-grade shopping Centre and is anchored by Shoprite and Game; followed by the 27 000m2 West Hills Mall opened in November 2014 and is anchored by Shoprite, Palace and clothing chain Edgar, Achimota Mall (13,000 m2), A&C Square Mall (10,000 m2) and the Kumasi City Mall (27,000 m2) and recently smaller shopping malls including the Marina Mall, The Junction and Oxford Street Malls (6,230 m2) were opened for business.

With respect to fast moving consumable goods, Ghana has a number of multinational FMCG manufacturers, including Unilever, Nestlé and PZ Cussons. Another prominent company is Fan Milk, a producer of affordable frozen dairy and juice products. It started in Ghana in 1960 and has since expanded to other West African countries. In 2013, Fan Milk was jointly acquired by private equity firm The Abraaj Group and international food company Danone.

Guinness Ghana Breweries (Diageo) and Accra Brewery (SABMiller) are the dominant players in the alcoholic beverages market. Both have recently invested in bolstering their operations. Guinness Ghana Breweries committed £28.6m ($41m) to a new brewing and packaging line at its plant in Kumasi, while Accra Brewery is in the process of a $100m expansion involving the installation of new packaging lines, ten beer storage vessels, warehouse and storage facilities, an effluent treatment plant, new brewing equipment and the upgrading of the municipal water.

In 2014, UK-based private equity firm Duet Group invested in GNFoods, a fast growing food-manufacturing company. South African alcoholic beverages company Distell has also established a new plant in Ghana from where it will bottle drinks that were previously imported.

Conclusion

Despite the entry of large international retailers and fashion brands as well as the development of new shopping malls such as West Hills Mall, Accra Mall, Junction Mall and Marina Mall in Accra, the market share of the formal sector remains small.

The writer is a Development Economist and Chartered Business Consultant. Daniel is the Chief Economist at the Policy Initiative for Economic Development. He also the Director of Research and Analysis, B&FT. He can be reached on email: [email protected]

Tel; 0244 476376/ 0201939350