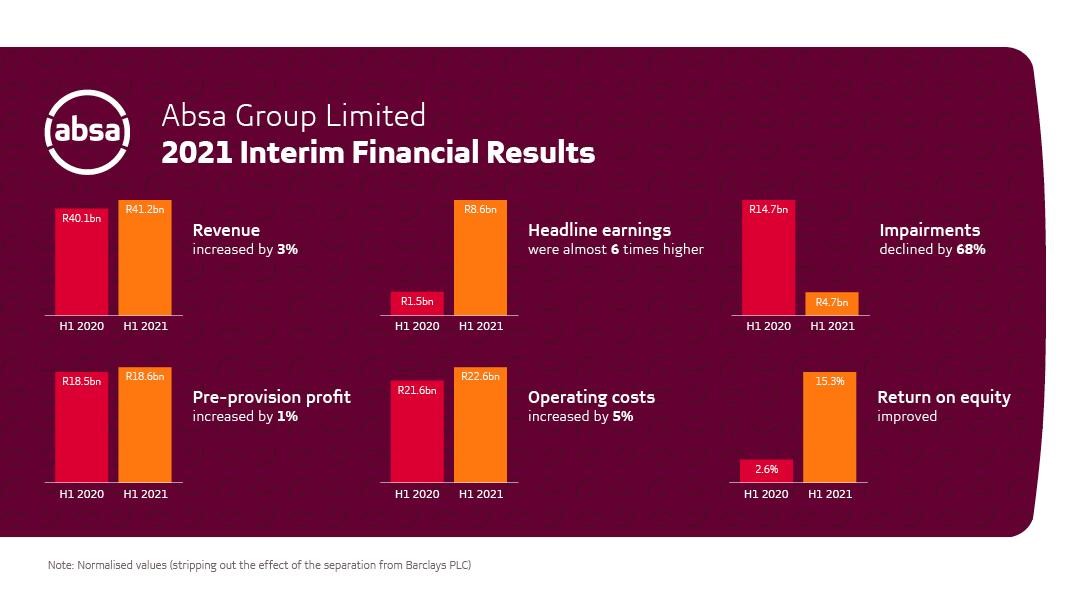

Financial services provider, the Absa Group, has recorded appreciable growth over the second quarter to see its headline earnings top pre-pandemic levels. Following an economic slowdown in the first quarter of the year, owing to a second wave of the prevailing COVID-19 pandemic, the Group saw its earnings up 474% year-on-year (YoY), from R1.5 billion ($102 million).

This was contained in its interim report for the year which also showed that headline earnings per share (HEPS) for the half-year reached an all-time record high; 4% above the previous record set in the comparable period of 2019.

Whilst growth was described as broad-based, as all business units reported strong growth from a low base last year, Retail and Business Banking (RBB) – which is in the second phase of a growth strategy introduced in 2018 – was the most crucial, growing headline earnings eight-fold to R4.2 billion ($285 million), according to Absa. This was, in large part, driven by a 68% decline in impairments from YoY.

“Our results were somewhat noisy, given the significant one-offs in our revenue, costs, and credits impairments. Excluding these, the underlying trends in our performance were better than they appear on the surface and we take great confidence from our strong balance sheet… it is evident in our numbers that most of our key strategic calls made back in 2018 were good ones; which we keep delivering against,” interim Chief Executive Officer, Jason Quinn said during a call discussing the results.

Similarly, Corporate and Investment Banking (CIB)’s headline earnings of R4 billion ($271 million), up 19% from the second half of last year. This was attributed to impressive growth, particularly in the global markets business and the investment bank.

Favoring normalised results to account for the separation from Barclays, interim Chief Financial Officer, Punki Modise added that these developments, in addition to a 12.7 percentage point appreciation in return on equity (ROE), have allowed Absa to resume dividend payments at a rate of 30% after they were deferred following the bank’s performance in 2020 when it reported a 51% decline in normalised headline earnings.

Ghana

With its regional businesses posting mixed results, Ghana remains one of the brightest spots for the Group outside South Africa, Mr. Quinn said. Without preempting the release of its domestic results, he expressed optimism that Ghana, in addition to some East African markets would fare better than their tourism-dependent counterparts such as Seychelles, Mauritius and Botswana.

The interim CEO also welcomed steps being taken to comprehensively regulate digital currencies, saying it would give market players the confidence to trade in and give financial advice under a more robust regulatory regime.

Guidance

The bank foresees mixed economic fortunes in the short-term as it expects favorable factors such as strong global growth, higher commodity prices, as well as support for domestic monetary and fiscal policies to be offset by the health, economic and social impacts of further waves of the COVID-19 pandemic, fragile business and consumer confidence, South Africa’s erratic power supply and the impact of recent civil unrests.

“Based on these assumptions… We expect mid-single-digit growth in net interest income giving an improved net interest margin. We will continue to manage operating expenses very carefully while maintaining investments in systems and digitalization despite increased variable and performance costs… we currently expect the dividend payout ratio of 30 percent for 2021, increasing to 50% over the medium term,” Mr. Quinn added.