For the first time this year, the cedi has ended a month with depreciation against its major trading currency, the US dollar, a development an economist says should be expected given uptick in economic activities, especially, imports.

Data from the Bank of Ghana shows the cedi, as of August 5, 2021 traded averagely with the dollar at GH¢5.80 compared with GH¢5.76 at the beginning of the year, representing 0.72 percent depreciation. Ordinarily, this would not be anything to worry about, given the cedi’s depreciated against the US dollar is normal. In fact, in August last year, it recorded a 2.7 percent depreciation against the US dollar.

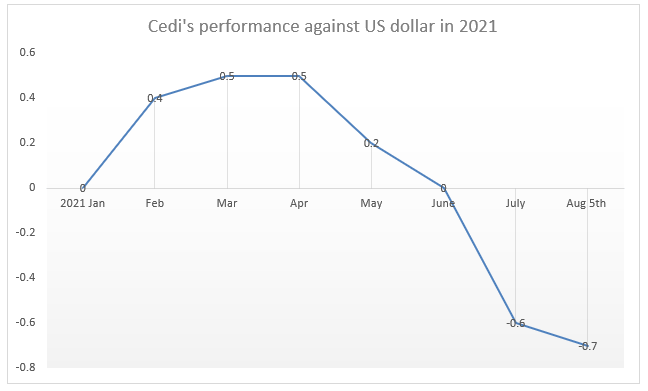

However, ever since the year began, the local currency has either dominated the US dollar or has recorded no depreciation at all. For four consecutive months since February to May, it recorded appreciation against the dollar of between 0.2 to 0.5 percent, a feat that has never occurred in the recent past. But that performance has been cut short, as in June, the cedi started losing its energy, depreciating by 0.6 percent at the end of the month.

The possible cause of this, according to Senior Economist at the University of Ghana, Dr. Patrick Asuming, can rightly be attributed to pick up in import activities relative to last year, as shown in the Summary of Economic and Financial data (July 2021). The data reveals import as of June 2021 recorded GH¢6.75 billion compared with GH¢6.39 billion recorded same period last year. This means more pressure has come on the local currency now than compared with same period last year, hence, the depreciation.

“In relative terms the depreciation is still very small. It is still less than 1 percent. Even in previous years where we think we had done well, by now, we would have done worse than that. If you look at the medium- term determinant, it appears that our exports have done relatively well. In the first six months, we have done slightly better than last year, but our imports have jumped a little bit.

So, our exports are doing better but our imports have risen more than the exports, so you realise that our trade balance is slightly lower than it was than same period last year. My suspicion is that the cedi is depreciating because imports have started picking up. Last year, because the global supply chain shut down, it was very difficult to import as much as we do but now it appears that the COVID conditions elsewhere have eased, so our imports have started to pick up again,” he said in an interview with the B&FT.

Despite the cedi’s sudden loss of strength, Dr. Asuming expressed optimism about the local currency, saying, it will still show relative stability at the end of the year.

“Given our recent history, even if we end the year with 2 or 3 percent, it is still considered stable. But I do not think we will see any of those wild depreciation as it used to be in the past. The main problem is when the currency becomes wildly unstable that you cannot predict and plan with it. We are still not in a range where we have to be concerned yet,” he said.

However, market watcher AZA Finance predicts more pressure on the cedi in the coming days, saying: “Ghana’s Cedi traded at a low of GH¢6 to the dollar this week compared to GH¢5.98 at the close of last week amid a lack of liquidity in the market. Protestors were out in the streets of Accra demanding for the government address economic challenges facing the country and become more accountable. In line with this, we project sustained pressure on the local currency in the coming days.”

The IMF has also cautioned the Bank of Ghana (BoG) to remain alert to the erosion of the gross internal reserves, given the country’s dependence on external borrowing.

“The BoG should also remain alert to the erosion of external buffers. While gross international reserves are at an all-time high, they are still dependent on external borrowing. A gradual reduction in FX borrowing needs, supported by greater exchange rate flexibility and a smaller financing need, can help mitigate FX rollover risks. A potential SDR allocation could be used to shore up international reserves, and, if concessional financing sources are not available, finance the critical vaccination rollout,” IMF Article IV report states.