“The most effective barrier for the success of mobile money around the world is the banking lobby”

———–Bob Collymore, ex-CEO at Safaricom – Kenya

Mobile money has revolutionized the way financial services are delivered around the world. Mobile platforms change lives by reducing costs, increasing transparency, and creating the opportunity for economic empowerment for people and businesses alike. This was first popularized by Safaricom and Vodafone’s M-Pesa (“M” for “mobile”, “pesa” for “money” in Swahili) in Kenya, which started in 2007.

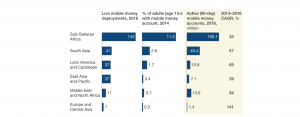

Half of the mobile money services worldwide are in Africa. To be more precise, the sub-Saharan African region has been at the forefront of mobile money for years. Thus, the continent remains the global leader in mobile money services (cf. Dr. PK Senyo, 2021).

When the Covid 19 pandemic began its “devastation” across the world in the early 2020s, it quickly became clear that mobile technology, and mostly mobile money, would have an outsized role to play in keeping people connected, delivering vital financial support, and providing safe, no-contact ways to pay for food, electricity, and other life essentials. Mobile money even became a part of a new daily routine for millions around the world – more than $2 billion have been transacted every day (cf. Andersson-Manjang/Naghavi, 2021). But how does mobile payment work? What are the benefits? Which African countries are the pioneers in using mobile money services?

Mobile Money – a cashless payment system

According to World Remit, Mobile money is a technology that allows people to receive, store and spend money using a mobile phone. It is sometimes referred to as a ‘mobile wallet’ or by the name of a specific service such as M-Pesa, EcoCash, Tigo Pesa and many more. This includes payments (such as peer-to-peer transfers), finance (such as insurance products), and banking (such as account balance inquiries). Even though, mobile phones are central to plenty of different uses, mobile money is more than just technology – a cash-in, cash-out infrastructure is needed, usually accomplished through a network of “cash merchants” (or “agents”), who receive a small provision for turning cash into electronic value (and the other way around). (cf. Donovan).

Mobile money is stored in a secure electronic account linked to a mobile phone number. Sometimes the mobile number is the same as the phone number, but not always. Mobile money is often offered by the same companies that operate the country’s mobile phone services and is available to both prepaid and contract customers.

With the help of this system, mobile money users can store, send, and receive money with their mobile phone. Items in shops or online can be bought, school fees and bills can be paid, and a top up mobile airtime can be made easily. In case a user wants to pay a bill or send money to another person, they simply select the relevant service from their phone’s mobile money menu. It is as simple as sending a text message (cf. World Remit).

Benefits of using Mobile Money

There are numerous reasons, why mobile money is an attractive alternative to the traditional cash payment for users (cf. RF Wireless World):

- Financial inclusion for everyone: Mobile Money can be transferred almost anywhere. It is an effective way to provide access to finance to millions of people around the globe, who were previously excluded from formal financial system – especially those in rural areas of developing countries.

- Cashless payment: The “contactless” or “cashless payment” decreases the dependency on cash and allows the tracking of transaction records, which increases financial security and reduces inherent risks of cash handling for instance loss, theft or fraud.

- Lower transaction costs: Compared to credit cards, mobile money has lower transaction costs.

- Increased transparency: With this solution no middlemen for transferring money are required, which increases transparency to the customer.

- Fast transaction: Long travels to send and receive money or to pay bills by standing in long queues are avoided, in other words, a fast and comfortable alternative way for the traditional financial transaction has been established.

Interoperability between Banks and Mobile Money platforms

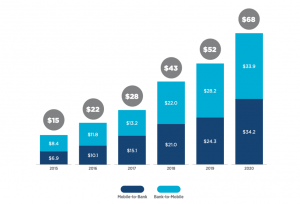

According to GSMA’s “State of the Industry Report on Mobile Money 2021”, between 2015 and 2020 the value of transactions flowing between mobile money platforms and banks has grown fourfold, from $15 billion in 2015 to $68 billion in 2020. The money flow maintained in close balance between the two systems (see Figure 1). The bar chart below shows the complementary relationship between banks and mobile money of the past five years, in which the proportions of money flows have only deviated slightly from a 1:1 ratio (cf. Andersson-Manjang/Naghavi 2021).

Source: State of the Industry Report on Mobile Money GSMA 2021

Mobile Money adoption – Pioneer Countries in Africa and best practices

Mobile money services have spread rapidly in many developing countries. However, only a handful of these initiatives have reached a sustainable scale. The Philippines in southeast Asia is one of the early adopters of mobile money services as of 2001 when SMART Communications launched SMART Money.

There has also been GCASH for that matter. However, Africa has made giant strides since that time with countries like Kenya, South Africa, Tanzania, Uganda, Zambia, Cote d` Ivoire, Ghana and a couple of others.

- Kenya: M-Pesa. With M-Pesa, Kenya is at the forefront of the mobile money revolution with the number of agents across the country increased by 40 percent even as of 2013. According to the Communication Commission of Kenya (2013), 24.8 million subscribers hooked up to mobile money services like M-Pesa. A survey by Pew Research Centre (2013) further stressed that the number of Kenyans using mobile wallets to make or receive payments was higher than any of 24 countries surveyed. The M-Pesa application is installed on the SIM cards of customers and works on all handset brands. Registration is free and users do not need a to have a bank account. Safaricom charges a withdrawal and transfer fee but keeps a free mobile wallet deposit. The transfer service was quickly picked up for use as an informal savings account system and electronic payment mechanism for bills, goods and services.

- South Africa: MTN Mobile Money. This was launched in 2005 as a joint venture between the country’s second largest network operator MTN and a large commercial bank, Standard Bank.

- Tanzania: Airtel. This operator was the first mobile network to introduce a phone-to-phone airtime credit transfer service “Me2U” in 2005 (Intermedia, 2013). The operator partners with Citigroup and Standard Chartered Bank to provide m-money services including bill payments, payments for goods & services, phone-to-phone and phone-to-bank money transfers and mobile wallets. Vodacom Tanzania launched the second East African implementation of the Vodafone m-money platform, M-Pesa.

- Uganda: MTN. The first operator to launch mobile money services in 2009 and it remains by far, the market leader (Intermedia, 2012). By law, each mobile money provider has to partner with a bank. However, users do not need a bank account to use mobile money services.

- Ghana: MTN Momo/Vodafone Cash/Airtel tiGO Cash. Ghana initially lagged behind other African countries when it came to mobile money adoption, after the introduction of mobile money services by MTN in 2009, but fast forward to 2020, and Ghana is now the fastest growing mobile money market in Africa (Mobile Money Africa, June 2021).

- Cote d` Ivoire: Orange/MTN. These have competed head-to-head in the mobile money market (CGAP, 2012). Orange Money was launched in 2008 by Orange in partnership with BICICI (BNP Paribas), and MTN Mobile Money was launched in 2009 by MTN in partnership with SGBCI (Société Générale) (GSMA, 2014).

Ending

Mobile transfers technologies are changing the way-in-way populations relate to financial services in many developing countries. The giant strides made by Africa hold sway to greater opportunities into the nearest future and therefore much more investment for research and innovation are required from various stakeholders to ensure the continent becomes a golden basket.

The African Continental Free Trade Area (AfCFTA) can leverage this low hanging fruit to harness opportunities in job creation and fair trade for Africa`s unstoppable youthful population and to create a conducive atmosphere for them to thrive.

References

Dr. PK Senyo, 2021 (Apr.18, 202), Ghana’s new mobile money rule could derail financial inclusion. But there are answers, https://theconversation.com/ghanas-new-mobile-money-rule-could-derail-financial-inclusion-but-there-are-answers-158770, accessed 6th August 2021

Andersson-Manjang, S. /Naghavi, N. (2021), State of the Industry Report on Mobile Money 2021, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2021/03/GSMA_State-of-the-Industry-Report-on-Mobile-Money-2021_Full-report.pdf, accessed 6th August 2021

Donovan, K., Chapter 4: Mobile Money for financial inclusion, https://web.worldbank.org/archive/website01523/WEB/IMAGES/IC4D_2-4.PDF, accessed 6th August 2021

WorldRmit, All about Mobile Money, https://www.worldremit.com/de/mobile-money, accessed 6th August 2021

RF Wireless World, Advantages of Mobile Money | disadvantages of Mobile Money, https://www.rfwireless-world.com/Terminology/Advantages-and-Disadvantages-of-Mobile-Money.html, accessed 6th August 2021

https://www.mobilemoneyafrica.com/blog/ghana-is-the-fastest-growing-mobile-money-market-in-africa-stanbic-bank [Accessed 8th August 2021]

(ACP, 2014), Mobile Money Services: “A Bank in your pocket”, Overview and opportunities

About the Writers

Sarah has a background in International Management and is a Project Manager at PIRON Global Development in Germany. She is passionate about tackling socioeconomic issues in emerging markets. Contact her via ([email protected])

Ebeneze is a Development Communication Specialist, an SDG Mkt Building & SME Researcher and Finance & Investment Nomad. He`s Ag. Country Director with PIRON Global Development GmbH, Ghana (www.piron.global). Contact him via ([email protected])