The government has signaled a limited need for new financing from the domestic debt market, following the announcement of a new issuance calendar for July to September 2021.

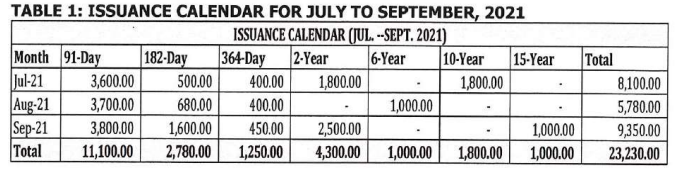

The new issuance calendar announced by the Treasury Department of the Ministry of Finance last week indicates that, government intends to issue a gross amount of GH¢23.23 billion, of which about GH¢22.62 billion is to rollover maturities and the remaining GH¢611.94 million is meant for fresh issuance to meet its financing requirement during the period.

In the previous calendar, from June to August 2021, the government intended to raise GH¢ 8.13 billion and GH¢7.13 billion in July and August 2021, respectively. However, in this new issuance calender, after a critical look at market activities in the first half of the year, government now plans to raise GH¢ 8.10 billion and GH¢ 5.78 billion in July and August, respectively.

According to Courage Kingsley Martey, a senior analyst with Databank, the asset management company, the main signal from the Treasury’s refreshed calendar for July to September is that government has limited need for new money. “The main focus for the next three-months would be to achieve rollover of existing debts that are due to mature over the period,” Martey said in an interview with B&FT.

“This is a reassuring signal in the midst of market concerns about the pace of increase in Ghana’s debt stock. We view the low need for new money [2.6 percent of the target] as a reflection of the strong investor demand and excess uptake at issuances during the first half of 2021. So, it is encouraging to see the Treasury scaling back on new issuances as the domestic financing requirements are met,” the senior analyst explained.

“After falling to significantly low levels, domestic yields are starting to pick up again over the past couple of weeks. This is mainly due to selling pressures from non-resident investors, which has created excess supply of bonds on the secondary market without a corresponding bid to match, leading to a drop in bond prices.”

Effectively, this decision by the government to signal a limited need for new borrowing could help cap or restrain the upward pressure. Given that majority of the planned issuance is rolling over of existing debt; investors will still need to deploy the cash on their balance sheet. This need, to place their cash, could ease the investor demand for higher yields.

Chief Investment Officer of Axis Pensions Trust, Nana Boamah in an interview with B&FT projected a 1 percent upside or downwards revision in rates. “My expectation is that yields will perhaps remain where it is. There is that probability of 1 percent upside or downwards revision in rates,” Mr. Boamah said. “I have been surprised by the fall in yields for 2021 given our fiscal situation but going into the Eurobond market earlier in the year brought some reprieved in terms of our fiscal position.”

In this light, the signal from the government on its financing needs should further push yields down, he added.

Some market analysts are predicting that the central bank will further reduce its policy rate from the current 13.5 percent. “If that happens, rates will definitely drop again but while we work on reducing yields, we should also be mindful of inflation,” Boamah said.