Many years ago, I visited a friend. On entering his house, I couldn’t help but wish I had chosen another time to visit.

There seemed to be a problem with his plumbing because the pungent odour that met my nostrils was so strong that it could not be ignored in ‘diplomacy’. He noticed my reaction and discomfort (I had held my breath but it would not help because it was not a fleeting odour). When the initial pleasantries were over, he quickly announced to me his wife was cooking.

Seeing that it did not explain the cause of my distress, he went on to explain she was using ‘dawadawa’ and ‘momone’ as seasoning! Like men usually would, we went on to discuss the merits and demerits of using particularly pungent ingredients like these two for seasoning. I really couldn’t understand why anyone would resort to ‘extreme measures’ such as this, just to season food and impart flavour.

A few minutes into meal time, however, I was a totally won-over convert! The aroma that had arisen from the prepared dish had ‘possessed’ me and when I tasted it, I knew this was different. The dish derived its appeal from the ‘culprits’ I had earlier dismissed. Smiling, my mind went back to my lessons on derivatives. The tastiness of the dish was the contract and the seasoning was the underlying asset. The distinct value of the dish emanated from the value of those two ingredients. My only issue, after enjoying the meal, was how I would get rid of the smell on my hands. The ‘underlying’ was very powerful.

Essentially, a derivative is a contract between two or more parties. The value of the contract is heavily dependent on the value of another asset which the contract rests upon, referred to as the underlying asset. Common underlying instruments include bonds, commodities, currencies, interest rates, market indexes, and stocks. Although it is common in many markets, derivatives trading does not occur in our local market. However, it is only a matter of time, as the legislative framework gets formed.

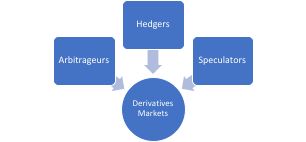

Derivatives have many beneficial uses in finance. They are used in risk management and are very commonly used by speculators too. They help in the determination and discovery of price. Investors and financial institutions also employ derivatives for market efficiency. We can think of derivatives as clay in the hands of a potter- they can be fashioned in various ways to suit a specific purpose, especially for those traded over-the-counter (OTC). The primary purpose of derivatives markets is the transfer of risk among market participants as they so desire.

Main market players in a derivatives market

A very important use of derivatives is in risk management. Derivative contracts are formed to hedge against an adverse condition or event in the financial markets. It does so by reducing uncertainty. For instance, a buyer can contract with a seller to purchase some specified goods at a certain price in the future. Both parties therefore have certainty of price and can plan future cash flow outcomes with much more certainty. The contracts do not necessarily eliminate losses but uncertainty. Hedging by risk managers is purely to mitigate risk. Hedgers may not seek to make a profit. Gold producers, for instance, in anticipation of a drop in prices of the commodity, may contract to sell their output at a certain price in the future, thereby locking in their proceeds and safeguarding a certain level of cash flows. Likewise, a company that buys dollars to finance imports, may contract to buy dollars at a specific exchange rate, GHS 5.9500/dollar in the future if it believes an event has occurred which will lead to a depreciation of the cedi against the dollar to a rate of GHS 6.200/dollar.

Courtesy: Idea Rocket Animation |

Courtesy: Market Business News |

Two or more parties enter into derivatives contracts based on what they believe will very likely be outcomes in the future. One party who believes interest rates are bound to drop can contract with another party who holds the view that rates would most likely rise or be flat. Speculators, therefore, find derivative contracts to be particularly useful because they have a view to making a profit from subsequent price movements of the underlying. They put their money at risk, analyze and forecast price movements, and trade derivatives contracts with the hope of making a profit if their forecasts turn out to be accurate. Invariably, speculators are usually the counterparties to hedgers. They play a vital role in markets by absorbing surplus risk and injecting much-needed liquidity into the market by trading where other investors dare not.

A third type of market participant in the derivatives market is the arbitrageur. Arbitrageurs attempt to profit from market inefficiencies relating to any aspect of the markets- price (including rates), dividends, or regulation. Arbitrage is where two equivalent assets or derivatives (or a combination of both) sell at different prices. The arbitrageur therefore has the opportunity to buy at a lower price and quickly sell at a higher price to realise a profit, usually at little or no risk and without committing any capital. This action eventually leads to the situation where the price difference decreases to zero and a single price is discovered.

Derivative contracts can be categorized into two groups, according to how they trade:

Over-the-counter (OTC) contracts and exchange-traded contracts. The former has a lot of customization to suit contracting parties and is a much larger, mostly unregulated market. The latter is standardized and the exchanges it trades on requires margins from traders to minimize default of settlement.

There are four main types of derivative contracts:

- Forwards

- Futures

- Swaps

- Options

Forwards are non-standardized contracts between two parties to buy or sell an asset at a specified future time, at a price agreed upon today. Futures contract differs from a forward contract in that they are standardized contracts written by a clearing house that operates an exchange where the contracts can be bought and sold.

Swaps are derivatives in which one party exchanges cash flows of its financial instrument for those of the other party’s financial instrument. Options are contracts which convey to the owner or the holder, the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price prior to or on a specified date, depending on the form of the option.

Application for investors in Ghana

The legal framework for a derivatives market is yet to be developed. To this day, derivatives trading has been against the law but the amendment of the securities industry law should make it a permissible market activity. Derivatives contracts can find application in our local market and facilitate trading activity. Underlying assets such as the Ghana Stock Exchange Composite and Financial Stocks indices, Government treasury rates and cedi exchange rates.

Derivatives find extensive use in hedging. Companies that often execute foreign exchange transactions could hedge against currency fluctuations that would cost them otherwise. They could enter into forward contracts or option contracts to manage the risk of an adverse currency rate change.

With the advent of the Ghana Commodities Exchange (GCX), the use of derivatives contracts for trading on the exchange will enhance activity and promote the interest of the investing public. Companies that buy large volumes of agricultural produce for processing, say, could mitigate the risk of high costs during lean seasons by using forwards or futures of the GCX, or options.

Swaps can be used to give an efficient means of adjusting the interest rate exposure of a company’s assets and liabilities. Treasury departments of companies and financial institutions would be more able to manage their interest rate exposures to reduce losses.

Investors who may wish to benefit from price differential opportunities in a volatile market could do so through arbitrage mutual funds. These funds take advantage of price differences of assets that, theoretically, should have the same value to make money for their owners.

There is not doubt that derivatives trading and markets can result is huge losses, as was the case in Ashanti Gold and this fact makes it uncharted territory. With the right legislation, however, a responsive and well-regulated derivatives market can be instituted. Market participants will build capacity to enable them participate and further develop a local derivatives market. The whole financial services sector could be the richer.

About the Writer

Kwadwo is a Senior Investment Analyst at OctaneDC Limited and heads OctaneDC Research. Prior to joining OctaneDC team, Kwadwo was a Fund Manager at Dalex Capital and has over a decade experience in fund management and administration, portfolio management, management consulting, operations management and process improvement. You may contact him at [email protected] or +233244563530