There is a strong proclivity to consume but a low proclivity to save. Consumption would imply minimal savings, investment, and capital development. Savings reflect the percentage of net income not spent on current use. Saving is, thus, a sacrifice from present consumption, which allows wealth to be accumulated. It is the preservation of income for future use.

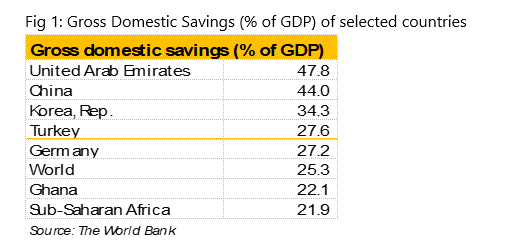

High levels of gross domestic savings increase the amount of domestic resources available for investment, support businesses and decrease the need to resort to foreign borrowing in order to cover domestic investment and consumption demand by a country. Gross Domestic Saving consists of savings of household, private corporate and public sectors. Research has proven that there is a positive correlation between domestic savings and economic growth. It is therefore not surprising that most of the popular business destinations of Ghanaians have a gross domestic savings (GDS) as a percentage of GDP being higher than that of the world. The GDS as a percentage of GDP for Ghana is marginally above that of Sub-Saharan Africa (SSA), and well below the average for the world.

A peep under the hood into the savings pattern of Ghanaians from 2017 to 2020 shows a worrying trend. Our analysis shows that broad money supply (M2+) during the period of 2017 to 2020 grew by a CAGR of 22.1% while that of savings and time deposits grew by 14.9% over the same period. Moreover, savings and time deposits as a percentage of broad money supply depicted a declining trend, having weakened from 34% in 2017 to 28% in 2020. The average rate over the period has been 31%. We are of the view that the crisis that bedevilled the financial industry might have upended the saving pattern of Ghanaians. Comparatively, the data from Kenya shows that savings and time deposits as a percentage of broad money supply (M3) has averaged 40% from 2017 to 2020.

We therefore conducted a survey to gauge the perception and behavioural approach of Ghanaians towards savings. A total of 107 people answered the survey, out of that, 75 of them were males, which corresponds to 70% of total respondents, whiles 32 were females which represented 30%.

Nonetheless, according to S&P’s Global Financial Literacy Survey, adults who are financially literate in Ghana are only 32% of the adult population. The most financial literate country in Africa was Botswana at 51%. African countries scored the worst in terms of financial literacy in the world. Individuals who are financially literate can budget, manage debt, and develop a savings and retirement plan. Financial illiteracy comes at a high price. Consumers who don’t grasp the idea of interest compounding wind up paying more in transaction fees, accruing more debt, and paying higher interest rates on loans. They also borrow more and save less money as a result.

Conclusion

From the observations made through the survey and available data on the savings culture of Ghanaians, we are of the view that there needs to be strong sensitization of the importance of savings and financial literacy to translate the financial aspirations of Ghanaians into reality. Moreover, the banking regulator and the financial industry players need to embark on a drive to reassure Ghanaians to have absolute confidence in the industry, especially as the financial clean-up of 2017-19 is currently bearing positive fruits. Furthermore, the banking industry players must develop attractive saving products with competitive interest rates to augment the interest of Ghanaians across the spectrum to imbibe an aggressive savings culture just like their counterparts in popular business destinations like China and the United Arab Emirates.