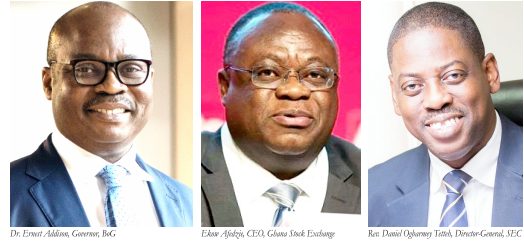

The Governor of Bank of Ghana BoG, Dr. Ernest Addison will today Tuesday, May 25 lead discussions at the maiden B&FT Money Summit, a foremost platform to dialogue on issues pertaining to the financial sector.

Organised by the B&FT in collaboration with the (BoG), Ghana Association of Bankers (GAB), Ghana Stock Exchange (GSE) and Ghana Insurers Association (GIA) under the theme: The Role of the Financial Sector in Post-Pandemic Recovery, the event will see Dr. Addison, together with seasoned industry players and policymakers deliberate on how to position the sector to lead in the post pandemic recovery efforts.

The one-day event, coming off at the Kempinski Hotel in Accra, is sponsored by FBN Bank, Fidelity Bank and MainOne and will cover every aspect of the financial sector – banking, insurance, pensions, capital market and asset management.

It will bring together experts including: John Awuah- Chief Executive Officer, GAB; Vish Ashiagbor- Country Senior Partner-PwC; Victor Yaw Asante-Managing Director-FBN Bank Ghana; Atta Yeboah Gyan ,CFO -Fidelity Bank Ghana; and Prof. Godfred Bokpin, Economist and Professor of Finance, University of Ghana Business School to deliberate on how the financial sector can play a catalytic role in speeding Ghana’s recovery from the pandemic shock.

Other speakers are Kojo Addae-Mensah- Group CEO, Databank Group; Daniel Ogbarmey Tetteh-Director General, Security & Exchange Commission; Ekow Afedzie-Managing Director-Ghana Stock Exchange; Solomon Lartey- CEO at Africa Sureties & Insurance Advisory Company (ASIAC) Limited; and Edward Forkuo Kyei-Chief Executive Officer-Glico Group.

The Summit is expected to mobilize expert opinions on key developments within financial sector of Ghana, illuminate public understanding of key policy measures in the financial sector to brainstorm and proffer solutions to identified challenges in the financial sector and to elicit opinions and input of key stakeholders into government policies.

Designed to be both engaging and impactful, affecting both government policy and decision-making by private players, it will feature two plenary sessions – – banking session in Ghana’s economic development: challenges, prospects and outlook; and investment culture: the role of pensions, capital/stock market, fund managers, and the insurance sector.

These sessions are expected to provide a platform to enable private sector players to share their opinions and make significant inputs into government policy making, with the ultimate goal of positioning the financial sector to lead in the country’s recovery efforts.