- Pressure mounts on gov’t to further reduce fuel price

- Calls for restructuring of tax build-up intensifies

With the increasing cost of living and consistent dwindling of consumers’ purchasing power, incomes of many citizens can only buy less of their usual consumption basket – a situation of the poor getting poorer in real terms, and the middle-class getting thinned out.

With the implementation of new and amended taxes kicking in a few days ago – on May 1 which coincidentally was Workers’ Day – and immediately reflecting in telcos’ charges and fuel prices, the atmosphere across the country is charged.

The Ministry of Energy announced an eight pesewas per litre reduction in petroleum products; reducing the originally announced increase of 17 pesewas to 9 pesewas taking effect from yesterday; but that still is not calming down nerves.

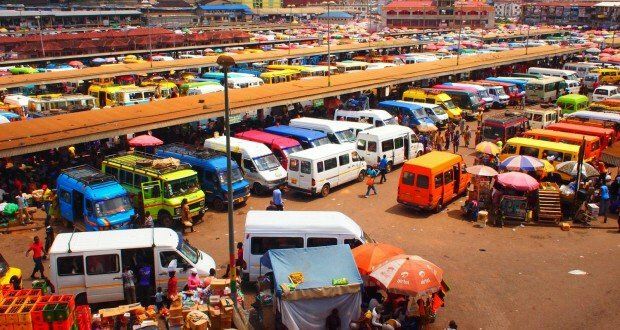

Players in the transport sector have already stated that an increase in fares by at least 20 percent is imminent, with stress on the fact that the reduction by the ministry is insignificant. The Ghana Private Road and Transport Union (GPRTU), Progressive Transport Owners’ Association (PROTOA) and Concerned Drivers Association have said that they are preparing to finalise talks with the Ministry of Transport and announce the new fares.

This, coupled with the already high cost of living due to the effects of COVID-19 on the global supply chain, has pushed many Ghanaians to brace themselves for tougher economic times.

Speaking to the B&FT, Stephen Asare, a banker working at the central business district in Accra said: “We are really not in normal times. The economy for me as a middle-class Ghanaian is becoming more difficult by the day. School just vacated for two weeks and already I have to sort out school fees. With that not settled, I have to increase my budget for fuel and the transportation of my kid to and from school. I simply need to do magic with my salary to survive”.

Afia Oyerebia, a petty trader at the central business district, also told the paper: “I am planning to do some bulk-buying soon; because in the next five days, prices of goods will go up astronomically with the impending increase of transport fares. At least the goods are close to me, so I need to take advantage”.

Sampson Dwumor, a teacher who was shopping at the central business district of Accra said: “I have realised that since the advent of COVID-19 prices went up, and any time you complain the traders attribute it to COVID-19. They say the shipping of goods and prices of the goods overseas have escalated, so they have to increase the price. I can only imagine what they will say from next week if transport fares go up. We are living in some hard times”.

Comfort Nai, a civil servant also said: “Government is yet to determine the wage increment for public sector workers. Even before that, they tested the water by telling us there would be no increment and came back to say it was not so. Just this May Day, the executive has frozen its salary – an indication that public sector workers might not even get an increment they will be happy about”.

Further reduce fuel price

The National Petroleum Authority, in a communique dated May 4, revealed that the price of fuel per litre will be reduced by 9 pesewas starting from Wednesday, May 5. Despite the NPA’s move, some players in the sector – including citizens – have begun a campaign to push the price further down: claiming the best way to achieve this is for government to restructure the cost build-up of petroleum prices, and also reassessing the existing deregulation programme in the country.

Included in every litre of fuel purchased are several taxes, levies and margins. They include the Energy Debt Recovery, 49 pesewas; Road Fund, 48 pesewas; Energy Fund Levy, 1 pesewa; Price Stabilisation and Recovery Levy, 14 pesewas; Special Petroleum Tax, 46 pesewas; Primary Distribution Margin, 11 pesewas; BOST Margin, 6 pesewas; Fuel Margin Marking, 3 pesewas; Marketers Margin, 46 pesewas; and Dealers Margin, 30 pesewas.

With the new and amended taxes which began on May 1, the latest additions are Sanitation and Pollution Levy, 10 pesewas; and the Energy Sector Recovery Levy, 20 pesewas. This means the levies have seen a 30 pesewas increase while two margins, Fuel Marketing and BOST Margins, also saw increases. But the NPA subsequently reduced some of the margins.

Duncan Amoah, Executive Secretary of the Chamber of Petroleum Consumers (COPEC), one of the campaigners against the increment said: “At a meeting over the new petroleum prices, we made a case for a restructuring the price build-up, to which the sector minister, Matthew Opoku Prempeh, asked that we hasten slowly.

“We also raised an issue with the current state of the downstream deregulation programme, but the minister promised a dialogue. We want the BOST, Fuel Marking and Price Stabilisation and Recovery Levies to be relooked at, or possibly scrapped; we think they have outlived their usefulness.”

At a time when government revenue has significantly dwindled and expenditure is over the roof due to the effects of COVID-19, one will have to wait and see if their campaign will yield any results.