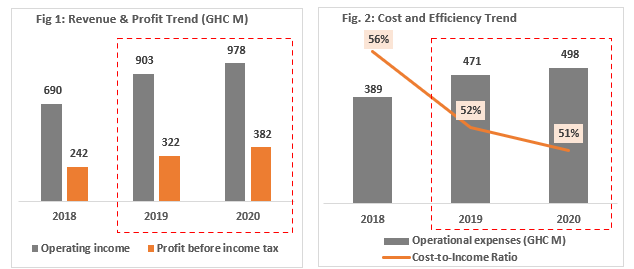

Despite the challenges posed by the COVID-19 pandemic, Fidelity Bank Ghana recorded a remarkable profit before tax of GH¢382 million in 2020, representing a 19% increase from the GH¢322 million recorded in 2019. The bank also grew its operating income by 8% over the prior year to GH¢978 million. (see Fig 1 below).

Operating expenses were well managed, growing at a relatively lower rate of 6% to GH¢498 million in line with the bank’s efficiency drive, anchored on digitization, expenditure reprioritization and the adoption during the year of cost containment measures aimed at mitigating the impact of COVID-19 on the Bank’s business.

The overall growth in revenues outpaced the increase in operating expenses, resulting in the Bank’s cost-to-income ratio declining further to 51% (see Fig. 2 above). The cost to income ratio measures a bank’s operating expenses as a percentage of its operating income. The low cost of operations as compared to the impressive increase in revenue shows the Bank’s efficiency and profitability in spite of the negative effects of COVID-19.

Several key balance sheet items posted strong performance with deposits increasing by 25% to GH¢6.51 billion and investment securities growing by 15% to GH¢4.93 billion, exceeding the industry average in both cases. The bank’s gross loans and advances declined by 2% year-on-year to GH¢2.4 billion, reflecting the impact of settlements during the year.

The bank remains well capitalized closing the year with total equity of GH¢1billion and a capital adequacy ratio of 21.43% which is well above the regulatory minimum of 13% (reduced to 11.5% during the year by the Bank of Ghana as a policy response to the COVID-19 pandemic). The capital adequacy ratio is a measurement of a bank’s available capital expressed as a percentage of its risk-weighted credit exposures. Fidelity Bank’s capital remains adequate for its current risk profile and planned growth of its business.

Fidelity Bank’s market leading platforms and channels continue to attract customers, resulting in significant growth in digital and electronic transaction volumes during the year. In 2020 Fidelity Bank’s credit rating was affirmed by the Global Credit Rating Agency at A and A1 in the long- and short-term categories respectively, with a stable outlook. This reflects the bank’s strong capital base, liquidity position and financial performance over the review period.

Speaking on the Bank’s 2020 financial performance, Julian Opuni, Managing Director of Fidelity Bank Ghana, stated: “2020 was a challenging year for everyone. We are fortunate that our financial performance in 2020 revealed that we continue to make strong progress across all areas of our business. Moreover, we understand that our success is a function of the unwavering support that we receive from our loyal customers and we are grateful to them for their continued business.”

With respect to Q1 2021 financial performance, Fidelity Bank recently published its unaudited financial results for the quarter ended March 31, 2021, declaring a profit before tax of GH¢104.5 million, 16% in excess of the equivalent figure for the same period last year. Profit after tax recorded a growth of 30% over Q1 2020 to GH¢89.5 million.

Driven by this strong profitability, the bank’s capital adequacy ratio rose to 21.73% in Q1 2021 (Q1 2020: 20.07%). Fidelity’s capital adequacy ratio is significantly above the regulatory minimum threshold of 13%. The Bank’s capital position remains robust and adequate for planned expansion and growth.

The bank closed the quarter with a total deposit base of GH¢6.9 billion, growing by 13% over the position recorded in Q1 2020. Although the bank’s balance sheet declined by 8% against the position recorded in Q1 2020, it maintained its average loans and advances book at GH¢2.3 billion while increasing its investment in government securities by 38%. Consequently, despite a much lower interest rate environment, net interest income rose to GH¢197.4 million, a 7% growth over Q1 2020 while non-interest income increased by 29% to GH¢68.4 million.

By all accounts, Fidelity Bank has performed well and demonstrated its resilience in the face of the ongoing challenges of the COVID-19 pandemic. It is expected that the bank will continue to cement its leadership position in the Ghanaian banking sector if it continues along this trajectory.

In a little over a decade, Fidelity Bank Ghana has grown from a discount house to a Tier One Bank and is now the largest privately-owned Ghanaian Bank. The bank currently serves its customers in 75 branches across Ghana and is a leader in the digital banking revolution. Fidelity Bank also revolutionized the agency banking space in Ghana with over 4,000 Agents across the country and is the undisputed champion of inclusive banking in the country.

The bank has two subsidiaries, Fidelity Asia Bank Limited, which is a wholly owned subsidiary in Malaysia and Fidelity Securities Limited. In a short period of time, Fidelity Bank has become a household name in Ghana by adopting a customer-centric culture and delivering consistently on the promise of making a difference in the lives of all stakeholders.

The Fidelity Bank brand has an infinitely positive outlook on life and the brand’s tagline of “Believe with Us” speaks to this. The bank believes that if all stakeholders come together, nothing can stand in the way of progress because ‘Together, We’re More’.