Mutual funds and unit trusts have been popular investment vehicles in Ghana from the nineties.

The lure of starting with little and being able to watch our investments grow as we add periodically to them has added to the growth of collective investment schemes in Ghana. Currently, there are about 46 mutual funds and 21 unit trusts in Ghana.

Additionally, there are quite a number of schemes that are awaiting licensing by the regulator, Securities and Exchange Commission (SEC). Some of these were formed in response to the Regulator’s order for all retail investments under GHS 100,000 to be pooled.

Mutual funds have been the more popular of the two types of CISs, constituting more than double the number of unit trusts.

Investors find CISs useful and important. It is relatively easy for any retail investor with only a small amount of money to subscribe to shares or units of a scheme and access the same kind of professional fund management services a large managed account would have. This is one of the biggest attractions.

We shall look at a few uses of a scheme for an investor. The presentation may not necessarily be exhaustive. We may not have thought collective investment funds could be used like that but these are probable uses which could further enhance our everyday lifestyles. Invariably, all investments are borne out of needs and must have a purpose.

Encourage savings and investments culture

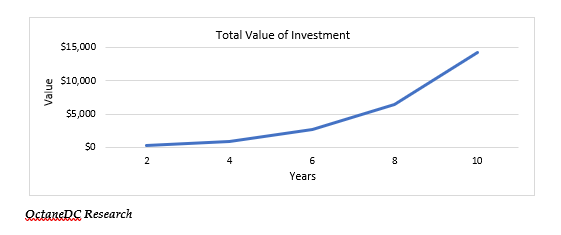

The very fact of easy of entry makes it ideal and inspiring for investors with little. They can begin and add on continually to their investments in small increments and watch them grow. For instance, let’s take a look at a young investor who can initially afford to set aside and invest GHS 10 monthly. After two years at 15% p.a. compounded monthly, she would have contributed GHS 240 and earned GHS 41 to make GHS 281.

Supposing she can increase her monthly additions every 2 years as her career progresses. For the next two years, she can increase her monthly contribution to GHS 20. Her investment would be worth GHS 941. In another couple of years, at GHS 50 monthly, she would make GHS 2,676. If she increases her monthly additions to GHS 100 for two years and eventually GHS 200 for another two years, she would realise GHS 6,419 and finally GHS 14,275 in ten years of investing.

| Years | Monthly Addition | Total Addition | Interest/Capital Gain | Total Value | ||

| 0 – 2 | GHS 10 | GHS 120 | GHS 41 | GHS 281 | ||

| 2 – 4 | GHS 20 | GHS 240 | GHS 180 | GHS 942 | ||

| 4 – 6 | GHS 50 | GHS 600 | GHS 534 | GHS 2,676 | ||

| 6 – 8 | GHS 100 | GHS 1,200 | GHS 1,343 | GHS 6,419 | ||

8 – 10 |

GHS 200 | GHS 2,400 | GHS 3,057 | GHS 14,275 |

OctaneDC Research

With a small amount initially, an investor can, therefore, aspire to have a significant amount after a while. This may not have been possible with other types of investments.

The fact that CISs can be invested in quite easily and the fact that piecemeal additions can be made are critical. For most types of investment securities, it may not be affordable or practicable to do so. The investor can even increase the additions or decrease them to suit their situation at any point in time. Increasingly, fund managers and administrators are also leveraging new technologies to facilitate investments in these schemes, especially for the small retail investor.

Wealth Generation

Given adequate time, collective investment schemes can serve as viable vehicles for building wealth. As highlighted above, with just a little at the beginning coupled with consistency, we can build wealth over time. It may seem that CISs, because they offer diversification, are less risky and would not yield aggressive returns. Actually, it depends on the type of fund. Funds that have a significant portion of the holdings in high yield equities and bonds can provide growth to build wealth over time. This is especially true for funds that actively and aggressively trade. The funds constantly search for investment securities that offer high capital gains and constantly try to have an edge over the market with superior data and analysis coupled with quick trading. Obviously, this requires a very active fund manager with a lot of experience, the capacity to collect and analyse lots of relevant data and an instinct for great opportunities on the market.

Collateral for lending

CIS funds can be used to leverage capital from lending institutions. Holdings of units or shares in a fund, especially for one that is fairly liquid, can be used as collateral for a loan to start or expand a business venture. The investment is not impaired and the venture can pay back the debt while the investment in the scheme continues. If, for instance, Mensah has a holding worth GHS 10,000 in a unit trust and wishes to invest GHS 8,000 in his electricals shop, he can approach a lender (a bank) and submit particulars of his investment to the lender for a loan of GHS 8,000 for 3 years. Supposing his shop is worth GHS 20,000.

This would make his net worth GHS 30,000 (shop and unit trust holding). At an interest rate of 25% p.a., he pays back a monthly amount of GHS 994 to the bank. This he does with proceeds from the shop while his unit trust investments still grow at say 15%. At the end of the loan period, he would have paid off GHS 11,450 to the bank and seen his investment grow to GHS 12,480. His net worth would then be GHS 43,930 (GHS 20,000 + GHS 12,480 + GHS 11,450). Without the investment as collateral, he would have had to take the GHS 8,000 from his investment, leaving it at GHS 2,000. This would grow to GHS 2,496 at the end of the 3 years. His net worth after loan repayment would therefore be GHS 33,946 (GHS 20,000 + GHS 2,496 + GHS 11,450).

This is the same idea that is employed in mortgage financing. It is usually much better to borrow to finance large capital-intensive ventures like buying a house or expanding one’s business. Every lender looks for credibility in the borrower. Collateral in the form of investments in funds could provide this line of security for the lender. It would ensure that, not only is the lender assured of repayment and be willing to lend; the lender would potentially be more amenable to a favourable interest rate for the borrower.

Portfolio Management

While CIS funds can be diversified, they can provide further diversification and an investor can use different funds in a portfolio construct to achieve a desired portfolio structure. For instance, an investor may initially invest in highly liquid funds to provide cover for emergency needs. Later, the investor may choose to add holdings in an aggressive growth fund to benefit from high yield and grow wealth. This could be balanced with investments in a more stable fund with time, to reduce risk. In a reasonable time, the serious investor would have built a portfolio of fund investments which would be geared towards meeting the investor’s objectives. In effect, the investor would be positioned to benefit from the good from any fund he or she is invested in. Additionally, a savvy investor could, with the help of an investment adviser, construct a portfolio that suits his or her needs at a particular time.

Targeted investing

Since these collective investment funds have different characteristics and objectives, the investor can use them to derive specific benefits with less money and risk. For instance, an investor desiring to invest for a short period and preserve capital, can invest in a money market fund. When the investor seeks to disinvest, she can be almost certain that, in the very least, inflation would not have eroded her investment. A parent with her child’s school fees (GHS 3,000) to pay in six months’ time can invest (assuming a net return of 15%) about GHS 2,797 now for six months. Likewise, an importer of spare parts who would expect to pay GHS 50,000 to clear goods at the port in 9 months’ time can invest just about GHS 45,024 for 9 months and easily disinvest to have the GHS 50,000 he needs. Better still, the parent or importer could invest less initially and add to the investment monthly to realise the objective at the end of the period. This flexibility becomes important because we usually may not have enough money to meet a particular need at an instance. However, with time, we could come up with additional money that could total what is needed.

Conclusion

A good plan to achieve a goal should serve us well. It is time to speak with our investment adviser to help you map out a careful plan to get us where we wish to or have to be. Many daunting tasks can be accomplished when little steps are taken and that is what collective investment schemes can do. It is a good time to go to your investment adviser to sit and have a chat on how collective investment scheme investing can help meet our financial needs.

About the Writer

Kwadwo is a Senior Investment Analyst at OctaneDC Limited and heads OctaneDC Research. OctaneDC is a Fund Management Company (FMC) licensed by the Securities and Exchange Commission (SEC) of Ghana. OctaneDC evolved out of two licensed FMCs (OctanedSD and Dalex Capital) in 2019, with a cumulative business presence of 15 years. The company offers products and services that supports wealth creation and financial independence determinations of our existing and potential clients. They are located at No. 12, Asmara Street, East Legon. You may contact Kwadwo at [email protected] or +233244563530