…allows for processing EMV GH-Link prepaid cards

eTranzact Ghana Limited, a leading electronic payment services provider, has secured an enhanced Payment Service Provider (PSP) licence from the Bank of Ghana (BoG) in accordance with the Payment Systems and Services Act, 2019 (Act 987).

Established in the year 2006, eTranzact Ghana Limited has been at the forefront delivering cutting-edge innovation in the electronic payment space. As a market leader providing bespoke electronic payment solutions, eTranzact continues to support banks and other financial services providers to deliver digital financial solutions for their clients.

The licence, the highest within the PSP category, allows eTranzact to among other services process EMV GH-Link prepaid cards for banks, institutions and the general public.

The licence also allows eTranzact to undertake payment processing services such as mobile money transfer, mobile banking for financial institutions using applications, and USSD and EMV prepaid card routing and aggregation services. It also offers eTranzact the opportunity to undertake the termination of inbound international remittances to beneficiaries’ wallets through partnerships with foreign remittance companies, payment aggregation, merchant acquiring and aggregation, and payment gateway services.

The Executive Director of eTranzact Ghana, George Babafemi, stated that this licence offers the company, as a processor of Gh-link EMV cards, the opportunity to partner banks who may want to issue Gh-link prepaid cards in either the physical or virtual variants.

Hitherto, this service has been a preserve of foreign card processors, but issuance of the licence means that banks can issue the Gh-link EMV cards at a cheaper cost for various use-cases – such as loyalty card, momo card, remittance card, ID card, etc. – to deepen the Bank of Ghana’s agenda in making Ghanaian banks issue local cards for local transactions.

“This licence means eTranzact is a brand to be associated with within the payment industry, without fear or doubt. It means that the investments made in infrastructure and contributions made so far in the payment industry are not in vain,” he said while expressing his appreciation to the regulator for its diligent and forward-thinking approach to new technologies.

Mr. Babafemi added that the licence also allows eTranzact room for upward scalability, a deepening of its existing business portfolio and customer base.

He added that his outfit is also ready to innovate within the payment ecosystem to accommodate those who may have been excluded. “The enhanced PSP licence means our business has a good foundation to leverage expansion, business and regulatory-wise,” he said.

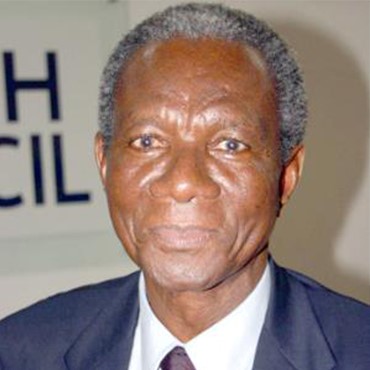

Kwame Pianim, Board Chairman of eTranzact, used the opportunity to laud the central bank for bringing sanity to the payment ecosystem; as it has not only introduced relevant and timely policies, but has also made the issuance of licences more transparent – and, more importantly, established a dedicated office for the sub-sector.

“An unregulated environment brings chaos, cheating, and galamsey-like businesses which can be a cancer in the entire system. It is therefore reassuring to see that the regulator has set up a dedicated office for the budding FinTech space,” he added.

On security that the enhanced licence offers, the eTranzact MD expressed the belief that customers will have a greater sense of security in his firm’s operations; especially at a time when there has been a rise in the activities of cybercriminals.

“Anyone can claim to be secure, but the proof that a platform is secure is largely in its licence and who licences it. BoG’s licencing process is thorough, as it scrutinises the security of the platform, the environment as well as the background of the key employees. With these, companies – both local and in the diaspora – can feel comfortable to work with eTranzact,” he noted. This, he added, will be crucial in his firm’s expansionary drive into other markets.

eTranzact has been operating in Ghana for more than 15 years. Having gathered industry experience over those years, in addition to being licenced, the banking fraternity can now relax in doing what they know how to do best – that is, banking – while we offer them a truly first-class and secured electronic payment platform to carry out their innovative digitisation agenda at an unbelievably low cost.