A new digital system initiated by the Ghana Revenue Authority (GRA) has added more than GH¢1 billion to government’s revenue in just ten months of its implementation, as it has virtually halted diversion of fuels and under-declaration of products.

The platform is an end-to-end Electronic Metering Management System (EMMS) solution which gives real-time visibility and transparency to major stakeholders such as GRA, and Customs. The system monitors every litre of fuel that is imported into the country and further monitors fuel that leaves the 16 currently operational storage sites.

Ever since the implementation of the system by Strategic Mobilisation Ghana Ltd (SML) in June 2020, the volume of petroleum products it has recorded has increased by 752.4 million litres which generated a tax component of more than GH¢1 billion to the Ghana Revenue Authority (GRA) at the end of March 2021.

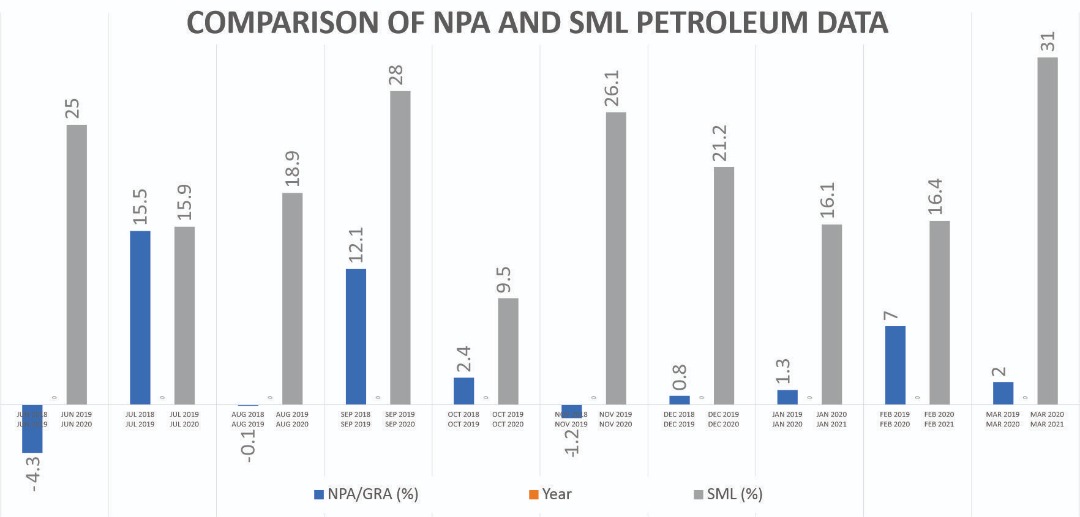

The figures are even more appreciated when compared to same data gathered by the National Petroleum Authority (NPA) as the new system shows astronomic increment in volumes of fuel discharged at the various storage centres. For example, while the NPA data shows an increase in volumes of just 2 percent in March 2019 and March 2020, the SML system shows an increase of 31 percent in March 2020 and March 2021.

Similarly, between December 2018 and December 2019, the NPA recorded 0.8 percent increment in volumes while the SML system also recorded 21.2 percent increment in volumes in December 2019 and December 2020.

This pattern, Managing Director of SML, Christian Tetteh Sottie, attributes to the new robust metering system implemented by the company.

“For a long time, there has been the issue of whether the country gets full returns from its petroleum products. So this concept was conceived that we should have an independent party that could monitor the petroleum liftings that could be compared with whatever data that each party will give.

In the petroleum sector we have the depot owners as one party; we have the Oil Marketing Companies (OMCs) as another party; we have NPA; then we have GRA Customs Division that will take the revenue. It is presumed that because they are doing the same thing, whatever data we have should be the same, but is has never been the same and sometimes the difference is very huge.

So installation was started in 2020 and in May, we had a test run and in June we went live with operations. And since we started the monitoring, we have noticed that the volumes growth has gone up as compared to previous years. And at the time we launched it, there was reduced economic activity so we presumed that the petroleum sector will show less volumes. But rather it was the opposite. So that tells you that the monitoring has had a positive effect,” he said in an interview with the B&FT.

Revenue shortage has been a consistent feature of the country’s economy, especially under the current administration due to the abolishment of some taxes it tagged as nuisance when it was ushered into power in 2017.

Mr. Sottie added that the company has the capacity to expand and improve the system to other sectors of the economy where revenue leakage has been a major challenge. He further stated that, given the robustness of the system, government can exceed its revenue target for the year if it is replicated across other sectors.

Government has targeted to raise some GH¢72.4 billion in revenue for this year after achieving the revised target for last year despite reduced economic activity stemming from the impact of the coronavirus pandemic on the economy.

The GH¢72.4 billion target also signals government’s confidence of a rebound of economic activity, especially when it exceeded the revised target of GH¢53.7 billion in 2020 from the original target of GH¢67 billion following the pandemic’s impact on the economy.