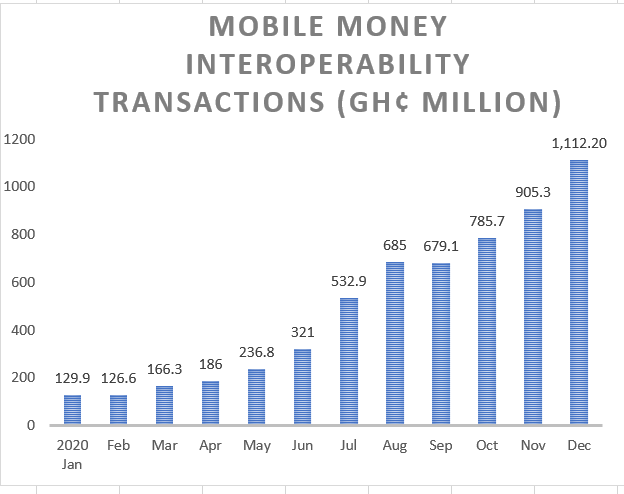

- Hits more than GH¢1bn in value

- Regular mobile money platform also records GH¢67bn in value

The country’s largest cross-network payment platform – mobile money interoperability – has seen a record significant jump in transactional value in the very year the first case of the deadly coronavirus pandemic was recorded in Ghana, suggesting that the platform has been widely accepted by even those who were initially sceptical about its use.

The statistical bulletin data published by the Bank of Ghana shows that the mobile money interoperability platform recorded in excess of GH¢1.2billion in transactions as of December 2020, a tremendous jump from the GH¢166.3 million recorded in March 2020 – the very month the country recorded its first case of the virus.

This indicates more than 568 percent growth within a period of just nine months, compared with the 215 percent growth recorded between December 2018 and December 2019; suggesting that the pandemic’s onslaught forced many, including those who were formerly apprehensive, to embrace doing business on the mobile money platform.

The interoperability platform is not the only one to see such growth, as the mobile money platform which records data for transactions carried out within the same network (for example MTN to MTN) also saw figures double within the nine-month period.

The mobile money platform transactions value jumped to GH¢67.9billion in December 2020 from GH¢33.8billion recorded in March the same year. This is more than double the 45 percent increase in transactional value recorded between December 2018 and December 2019, a further testament to the fact the pandemic has awakened consumers’ desire to go digital.

A self-employed man in Gbawe – a suburb of Accra, Andrew Mingle, confirmed this in an interview with the B&FT when asked if the pandemic has impacted his business transactions.

“Ever since the pandemic started last year I have preferred digital transactions over cash. I now encourage all my clients to pay their debts through the mobile money platform rather than bring me cash. Besides that, I now pay my workers via mobile money platforms instead of cash. I also tell them to send the sales of the day to my mobile money account rather than cash. It has even made doing business simple and quicker now,” he said.

A medical laboratory scientist in Dzodze, Volta Region – Aurelia Tuffour, also told the B&FT she has seen change in acceptance of the platform, as people who previously insisted on cash payments are now ready to accept mobile money.

“For me, I was a regular user of the money platform even before the pandemic. But what I have realised is that people who previously rejected payment through mobile money have now come to accept it. So, transactions that I would have ordinarily done with cash are now done through mobile money. Quite recently, I went to buy furniture from a carpenter and wanted to pay in cash but he told me to pay through mobile money. So, I can say my transactions on the platform has increased since the pandemic,” she said.

Reasons for the increase in use of the mobile money platform, besides the pandemic, can also be attributed partly to network providers’ efforts made in educating the public about fraud and assuring customers that the platform is very safe for transactions; thereby restoring some lost trust in the system.