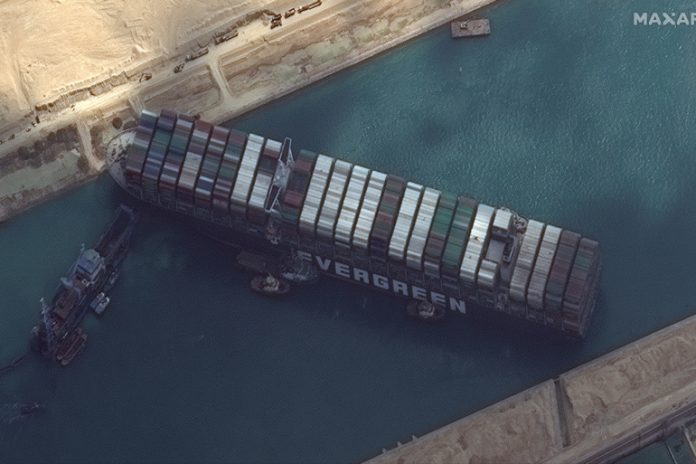

The grounding of an ultra large container ship in the Suez Canal brought traffic on the central shipping route between Europe and Asia to a standstill. In this Q&A, Allianz Global Corporate & Specialty (AGCS) Global Head of Marine Risk Consulting, Captain Rahul Khanna looks at some of the potential implications of this incident and highlights some of the risk challenges posed by ever-increasing ship sizes.

How do operators approach the salvage of such a huge ship? What are the challenges?

Container-carrying capacity on ships has increased by 1,500% over the past 50 years and has doubled over the past decade and a 224,000-tonne, 400-metre-long vessel which can carry up to 20,000 containers like the MS Ever Given is in the top 1% in terms of size of vessels on the ocean. Obviously, the size of these vessels make a salvage operation a significant undertaking. For some time now many in the salvage industry have warned that container ships are getting too big for situations like this to be resolved efficiently and economically.

Dislodging a “mega ship” in a confined space like the Suez Canal will be challenging, requiring the expertise of a specialist salvage company – not all have the experience of dealing with such vessels. Their first job is to assess the degree to which the vessel is aground, and what could be the safest and quickest way to refloat the ship. A best case scenarios would be that a combination of high tide and adequate tugs may free the vessel. However if the vessel is hard aground then lightening the vessel may be the only option and containers may have to be removed from the ship. This will delay the salvage/refloating process and is going to make the operation a lot more expensive.

Assuming that the grounding of the Ever Given will continue, what are the potential claims scenarios in scope from an insurance perspective?

It’s still too early to comment on the causation of this incident as a number of different factors have been cited as contributing to the incident in reports. However, potential claims scenarios could include damage to the vessel’s hull and engine (if there was a machinery breakdown issue – a frequent cause of marine insurance claims); damage to the propeller and its shaft if the stern is aground as well; salvage and vessel removal costs – which can quickly escalate particularly in the event of wreck removal; third party liability claims especially with regards to damage to the canal; loss of any perishable goods in cargo; and business interruption and loss of revenue claims as a result of this blockage.

If ships are unable to go through the Suez Canal, is there any chance they can take the longer route around the African coast?

The option of going around the Cape of Good Hope (COGH) is always available although it adds around 5,000 nautical miles or 9,000 kilometers to a typical journey from the Middle East to Europe. From Singapore to Europe it probably is less, around 3,000 to 3,500 nautical miles

This means a lot more fuel consumption and a much longer journey time (around 10 to 15 days more depending upon the speed of the vessel). Therefore, such a consideration is considerably more expensive but the ship can save on Suez Canal fees. The weather is another consideration as this can deteriorate while going round the Cape. Therefore, it’s not the first route choice for smaller vessels who may not even have the fuel capacity. Much also depends on the price of fuel and prevailing ship charter rates. Sometimes higher fuel prices and charter rates combined could make the longer journey cost-effective. For a few days blockage it probably doesn’t makes sense for ships to reroute, only if a longer term delays are envisaged.

What is the likely impact on global supply chains? Which goods may be affected?

Such incidents show the immediate impact that the blockage of one of the world’s major shipping routes can have and highlights how dependent global trade has become on mega ships. Between 10-12% of global trade passes through the Suez Canal with more than 50 vessels transiting it a day. Lloyd’s List has estimated that around $10bn of daily marine traffic could be halted by this blockage and it comes at a particularly bad time for global supply lines. Car and computer makers are straining from a global chip shortage, exacerbated by a fire in a big chip making factory in Japan. Car makers have closed plants after a Texas cold snap earlier last month hit plastics production, and California ports have been hit by backlogs and delays. The canal is an important route to transport oil and liquefied natural gas from the Middle East to Europe and there is also the potential for delayed shipments to technology and automotive companies as well.

What are the challenges of mega ships in general? From a risk management point of view, what lessons can be drawn from this incident?

Insurers have been warning for years that the increasing size of vessels is leading to a higher accumulation of risk. These fears are now being realized, potentially offsetting long-term improvements in safety and risk management.

Such ships generate economies of scale for ship owners but also a disproportionately greater cost when things go wrong. Dealing with incidents involving large ships, such as fires, groundings and collisions, are becoming more complex and expensive.

Fires on board large container vessels are now a regular occurrence and such incidents can easily result in large claims in the hundreds of millions of dollars, if not more. A hypothetical worse-case loss scenario involving the collision and grounding of two large container vessels, or a container vessel and a cruise ship, could result in a $4bn loss if the costs of a complicated salvage and wreck removal and any environmental claims are included.

The size of a vessel can significantly increase salvage and general average costs. Mega ships require specialist tugs and finding a port of refuge with capacity to handle such a large ship can be difficult, which increases the salvage operation costs.

It is clear that in some shipping segments, loss prevention measures have not kept pace with the upscaling of vessels. This is something that needs to be addressed from the design stage onwards. And with 24,000 TEU vessels on the horizon we are now seeing the implications of what might happen more regularly in the future.

In this case of this particular incident there will no doubt be some valuable lessons to be learned with respect to the pilotage and handling of the ultra large vessels in the Suez Canal, especially during sand storms and other scenarios where visibility is hampered