A new report by the Institute of Customer Service Professionals (ICSP), titled ‘The State of Customer Service in Ghana’, has disclosed that measures outlined by the Bank of Ghana (BoG) in 2020 to curb cyber fraud in the financial sector has boosted the confidence of customers.

The report, which was published in January 2021, pointed out that introducing the central bank’s Cybersecurity Directive for Financial Institutions has helped to provide guidelines for cyber and information security, benefitting customers in the financial sector.

“This has strengthened customer confidence in the security of banking technology in Ghana,” the report said – urging other sectors of the economy to sensitise their employees around information security outside of the office environment.

It added that even though uncertainties of the COVID 19 situation creates an atmosphere that encourage some activities of cyber fraud, the situation is however largely controlled by measures put in by the Bank of Ghana, boosting the public’s confidence.

The report however advised the central bank to periodically evaluate its system to ensure that new techniques used in cyber fraud are detected on time and halted, or else it could erode the confidence customers have in the financial system.

“Modern attacks have been automated and are quite difficult to detect. There is no single method that can successfully protect against every single type of attack. Internal threat activity has also gained prominence in the COVID-19 era. In the banking sector, the growing online banking services is an area of concern,” the report stressed.

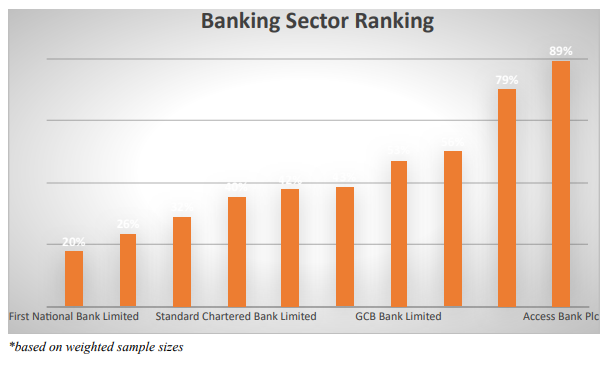

Performance of individual banks

On performance of individual banks in customer satisfaction, Access Bank once again had the highest percentile score under the banking sector, with a score of 89.15%. It was followed by Absa with a satisfactory score of 78.78%, and Fidelity Bank Ghana Limited with a score of 56.29%.

The report urged interested parties to contact the Institute of Customer Service Professionals (ICSP) for a detailed report on specific banks in the banking sector. The report further showed that analysis of respondents’ verbatim responses on their overall impressions of the sector showed there were almost as many positive impressions as there were neutral responses or suggestions of room for improvement.

Negative impressions made up 13% of the verbatim, while neutral/more room for improvement and positive impressions made up 44% and 43% respectively.

Purpose of the report

Among others, the reason for the report is to uncover a deep understanding of customers’ motivations and their evolving needs, and the relative importance of customer experience measures to them.

Also, it is aimed at identifying the drivers of customer satisfaction in the various sectors and their impact on customer loyalty, as well as to establish the case that customer satisfaction has an impact on customer advocacy.

The study also provides a creative and intuitive grasp of how each customer experience in the various sectors can be shaped to make it easier for companies to understand and improve their customer experience. In addition, it is targetted at identifying the various channels within which customer experience occurs and suggest better ways of improving customer experience in the sectors.