In an environment of increased volatility and uncertainty, maintaining a sufficient buffer of liquid assets may at times detract from the ability to allocate assets with the highest potential returns but potentially lower liquidity. This trade-off can sometimes be minimized by employing derivative instruments. Even though obtaining funding via the traditional methods such as the loan syndications market and others remains important, being funded on the back of derivative instruments provides some key benefits. Whiles in the University years ago, I saw a lot of students struggling to understand the topic ‘Derivatives’. Indeed, in the ‘corporate world’ understanding how ‘Derivatives’ works and its application on the financial market remains a mirage to most finance professionals.

In simple terms, a derivative is a contract between two parties which derives its value/price from an underlying asset. The most common types of derivatives are futures, options, forwards and swaps and for the purpose of this article, I will seek to explore some Swaps funding solutions that are available on the financial markets where prospective clients (Commercial Banks and Corporates) can tap into grow exponentially. The main issue with Swap is the type of risk or exposure. For example, a wrong-way risk defined by the International Swaps and Derivatives Association (ISDA) occurs when “exposure to a counterparty is adversely correlated with the credit quality of that counterparty”. Meaning, it arises when default risk and credit exposure increase together.

Total Return Swap (TRS)

Simply defined, TRS is a funding option where a Bank provides liquidity to a client which is exchanged/backed by collaterals such is Treasury Bills or Bonds. I.e. funding against Securities. For illustrations purposes, let me use Commercial Banks to represent ‘’Bank A’’ and clients/Customers to be ‘’Client B’’. Now Let’s assume a Client B needs a 1yr United States Dollar (USD) funding for general corporate purposes from Bank A and client B needs the USD20m USDGHS funding via a TRS format. The trade details will be such that Bank A will transfer USD20m to client A and Bank A buys Ghs50m bond portfolio from client B at coupon of 19%pa and provide Investment certificate. Assuming a USD interest rate of 6%pa which bank A receives on the funding of the notional, Bank A will pay the 19%pa as yields on the Bond portfolio.

At maturity, Bank A will deliver the Ghs50m worth of bonds in receipt of the USD20m funding provided to client A. It is important to emphasize that these types of transactions are executed via The International Swaps and Derivatives Association (ISDA) documentation. ISDA is a trade organization of participants in the market for over-the-counter derivatives and the association helps to improve the private negotiated derivatives market by identifying and reducing risks in the market. Key considerations in this type of transaction is FX and rating trigger events. Again, in as much as Securities are involved, there is the need for collateral management for 1-way USD Margining depending on price movements of Bond Portfolio.

Cross Currency Swap (CCS)

CCS is one of the derivatives transactions which a lot of students and even finance professionals struggle to come to terms with, particularly its practicability and applications in the business world. In its simplest form, with a cross-currency swap, interest payments and principal in one currency are exchanged for principal and interest payments in a different currency. Interest payments are exchanged at fixed intervals during the life of the agreement. So client B can raise USD term funding against GHS cash by converting its GHS Liabilities into a USD liability via a CCS. There are benefits and downsides of funding via this channel. Usually there are no upfront fees charged. There is also the ability to sweat the assets on the balance sheet to obtain lower cost USD funds leading to improved profitability and higher return to shareholders. It provides longer term funding and potentially reduces asset-liability duration gap. You the client can retain the economic risks and benefits of the collateral, subject to no default.

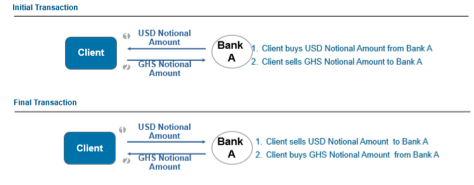

Exhibit 1: Funding via USDGHS Cross Currency Swap

FX Swap

A swap is basically a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. Most swaps involve cash flows based on a notional principal amount such as a loan or bond, although the instrument can be almost anything. Usually, the principal does not change hands. Each cash flow comprises one leg of the swap. One cash flow is generally fixed, while the other is variable and based on a benchmark interest rate, floating currency exchange rate, or index price.

Invariably, an FX Swap allows clients to use funds at disposal to procure funds in an alternate currency for use. It is an effective cash management tool. On the near date the required currency is obtained for the currency available and at the far date these amounts are swapped. The rational is that since the rates for the swap at the far date are known beforehand, an FX Swap entails no FX Risk and enables effective cost management and risk budgeting.

A typical example of this type of funding will be an FX Swap transaction on USDGHS with a USD and GHS notional amount of USD10m with a maturity of 6months and quarterly frequency. Now at the initial Transactions Client sells GHS notional amount and Bank A buys USD notional amount. On final maturity, Client buys the GHS notional amount and sells the USD notional amount.

Fx Swap Transaction Flows

Exhibit 2: Funding via FX Swaps

Structured Funding – USD loan against Marketable Securities

Since the mid-1980s, structured finance has become popular in the finance industry. Structured finance has been used to manage risk and develop financial markets for complex emerging markets. Structured Funding is where Bank A provides funding to client B on the back of marketable Securities which are acceptable or meets the criteria by Bank A. Let`s assume a client needs a notional USD50m term loan with a 2-year tenor with the option to extend for a further 1 year on maturity date with a bullet repayment on maturity date. With such funding arrangement, client B will provide say USD100m equivalent of GHS Treasury securities. Depending on the Bank, a coverage ratio of about 30% of notional is to be maintained as per collateral maintenance provisions. Key deal covenants that are taken into consideration are such that for as long as the Facility remains outstanding, the Borrower (Client B) shall maintain standard covenants for a facility of this nature. Financial Covenants as documented in the Facility agreement may include Capital Adequacy Ratio levels, Gross Non-Performing Loans Ratio, Loan to Deposit Ratio, Loan Loss Reserve Ratio if the borrowing entity is a Financial Institution.

Some of the benefits of this funding option are that, it is relatively cheaper and/or longer-term funding than could be achieved via syndicated/bilateral loans or bond issuance in current markets and the ability to sweat the assets on the balance sheet to obtain lower cost USD funds. Again, securing longer term funding reduces client’s asset-liability duration gap. Bank A will also retain the economic risks and benefits of the collateral, subject to no default and will have the right to sell the bonds on default of the facility. The major key benefit to a client is that, you receive low cost funding and continue to receive the proceeds of the coupon from the securities provided as collateral. Important to highlight that this type of loan is executed via Master Loan Agreement (MLA) Documentation

To sum up, there are several ways to obtain Cedi or USD funding, but I believe the derivative market is less explored. There is a huge opportunity for corporate treasurers to tap into this area to support funding requirements for expansion, infrastructure or working capital needs. Bank Treasurers can also take advantage to increase liquidity by raising the needed funding to support their underlying clients.

Credit: Joojo Kakra Bannerman CFA, Miriam Amoako

Disclaimer: The views expressed are personal views and doesn’t represent that of the media house or institution the writer works.

About the Writer

The writer is a Finance and investment professional, managing Banks and Non-Bank Financial Institutions, local and global Custodians, Trustees, Pension and Asset Managers, Insurance and Fintech relationships with an international Bank in Ghana. Contact: [email protected], Cell: +233-200301110