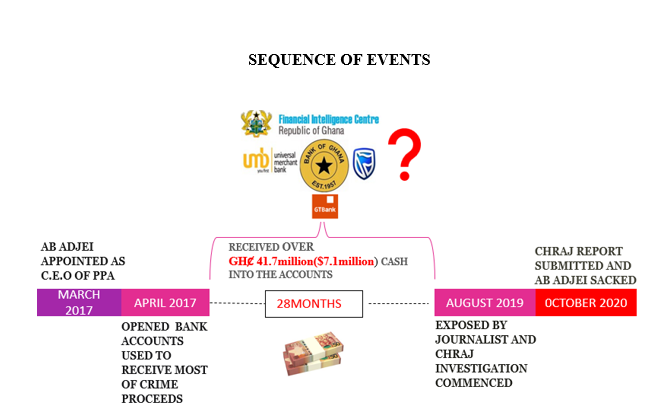

The Chief Executive Officer (C.E.O.) of the Public Procurement Authority (PPA), Adjenim Boateng Adjei, was on October 30, 2020 sacked by the president as recommended by the Commission on Human Rights and Administrative Justice(CHRAJ) report after a 14-month investigation into an allegation of conflict of interest.

The CHRAJ investigation followed an exposé dubbed ‘Contracts for Sale’ – a Manasseh Azure Awuni investigation aired on Joy News TV on August 21, 2019 that revealed how Mr. Adjei used his position as C.E.O. to influence the award of government contracts to Talent Discovery Ltd. (TDL), a company he had co-founded with his brother-in-law subsequent to his appointment. TDL then retailed those contracts to third parties at a fee up to 18% of the total contract sum.

The National Risk Assessments (NRA,2016 & 2018) cited corruption through the abuse/misuse of public office for personal gains as one of the Money Laundering threats, and all the examples given were related to contracts by Politically Exposed Persons (PEPs); as such, it is very disturbing for our Anti -Money Laundering , Counter Terrorism Financing and Proliferation of Weapons of Mass Destruction (AML/CFT& P) regime if it has to take the work of an investigative journalist to prompt such an investigation into abuse of office by a PEP through contract after his accounts with three different banks had received over GH¢41.7million (US$7.1million) in cash and in multiple currencies within 28-months (from his appointment) prior to the exposé in a clearly suspicious manner as revealed by the report.

Basically, the collective obligation of The Financial Intelligence Centre (FIC), the Bank of Ghana (BoG) and the Accountable Institutions (Banks) is to ensure that any use of the banking system for Money Laundering is detected and reported to investigative authorities for further investigations and prosecution; therefore, Mr. Adjei’s case indicates a system deficiency – but who do we blame for this? Although from the outside one cannot tell who is at fault, a juxtaposition of each institution’s roles with the facts in the report gives an idea of how each institution could have contributed to the failure.

Banks

The role of a bank is to detect and report to the FIC any suspicious/usual transactions by its customers.

Bank of Ghana and Financial Intelligence Centre Anti-Money Laundering/ Combatting The Financing of Terrorism & The Proliferation of Weapons of Mass Destruction (hereafter called BOG & FIC AML/CFT& P) guidelines defines a suspicious transaction as:

“One which is unusual because of its size, volume, type or pattern or otherwise suggestive of known money laundering methods. It includes such a transaction that is inconsistent with a customer’s known legitimate business or personal activities or normal business for that type of account or that the transaction lacks an obvious economic rationale.”

To be able to perform this role effectively, 1.3 of BoG & FIC AML/CFT& P guidelines oblige banks to implement Customer Due Diligence (CDD) as part of the overall AML/CTF&P compliance programme.

CDD involves the scrutiny and monitoring of customers to ensure that a customer is truly who he/she purports to be, operates the account for the stated purpose, and transactions undertaken are consistent with the bank’s knowledge of the customer, the customer’s income or business and risk profile.

In a situation where the customer poses high risk of Money Laundering, the scrutiny and monitoring must be increased, which is normally called Enhanced Due Diligence (EDD). EDD includes source of funds, source of wealth and increased transaction monitoring, in addition to the simple verification and monitoring required for low risk customers.

Mr. Adjei as a high-risk customer

- Politically Exposed Person (PEP) – senior public offical

His position as C.E.O. of PPA makes him a senior public official and thus a PEP in line with the BoG& FIC AML/CFT& P guidelines. PEPs are classified as high risk because of the high possiblity of using their position and influence to engage in Bribery and Corruption.

- Past events

An adverse media search reveals that the Adade Committee recccommeded dismissal and prosecution of Mr. Adjei for his involment in a procurement scandal in 2002 at the Ghana Water Company Ltd. (GWCL), where he was Chief Manager (material). Although he avoided prosecution and was susequently reinstated, this information in my opinion calls for Mr. Adjei to be classified as a high risk cutomer.

Enhanced Due Deligence (EDD) requirements

Having established that Mr. Adjei is a PEP and for that matter a high risk customer, the banks are obliged to perform Source of Wealth (SoW), Souce of Funds (SoF) and a increased transaction and activitiy monitoring.

- Soure of Funds (SoF)

Source of funds is about identifying and understanding the origin of funds that Mr. Adjei would deposit into his account either from his employment income or business etc. If it is from his employement, his letter of appointment or payslip could be used to verify the amount. If it is from his business, the management accounts, bank statmements and the amount of revenue or income that could be ideally generated from such business activity could be used. This is to create a profile of how much is likely to be deposited into the account. If the funds were to be paid in by third parties, attempts must be made to identify the relationship between said third parties and Mr. Adjei.

- Source of Wealth (SoW)

The purpose of a SoW investigation is to build a logical and holistic picture of the source of an individual’s net wealth.

SoW is about understanding the activities that had contributed to the accumulated wealth of Mr. Adjei over time. This involves estimating the net worth of the customer, demanding to know the activities that generated the wealth and corroborating the information provided. For instance, which buildings and cars does he own; which business does he have interest in and enquiring how they were financed – e.g., from trading profits, gift, inheritance etc. Unexplained gaps between funding activities and the net worth could signify an illegality, and the customer must be monitored closely. Corroborating Mr. Adjei’s business interest would reveal, among others, the companies that he co-founded subsequent to his appointment, which includes TDL (the company used for selling government contracts).

- Increased transaction and activity monitoring

The banks would have to intensify the scrutiny of Mr. Adjei’s account activities, increasing the number of his trasactions that are to be examined further in the bid to increase the chance of identifying suspicious transactions. Its just like the extra caution we take when a known thief comes to visit.

The National Risk Assessment (NRA) in 2018 mentioned that over 85% of universal banks in Ghana have AML automated tools. As such, given the status of these banks in Ghana, it is fair to conclude that they have automated AML tools which allow real-time monitoring and reporting of large and unusual transactions and picked up most of the GH¢41.7million worth of transactions (excerpt below) for further investigations.

Stanbic Bank

“In respect of his USD account number 9040002473180, the Respondent opened it on 03-04-2017, within a month after his appointment with an opening balance of US$5,000. Four months after opening the account, significant cash amounts had been deposited into that account, including the following:

“Cash Deposits: From 01-08 -2017 to 08-09-2017, cash amounts totalling over US$125,000 were deposited by Faustina Mildred and Christabel into the Respondent’s Account. The Respondent withdrew US$30,000 and US$10,000 cash from his account in a day. On that same day (08-09-2017), Christabel deposited a cash amount of US$15,000 into the account.

“The respondent again made a cash withdrawal of US$40,000 on 27-09-2017; and about a week later, he made a cash deposit of US$50,000. Earlier, Christabel made a cash deposit of US$40,000. On 15-02-18, Faustina Mildred made a cash deposit of US$50,000 and another US$100,000 on 21-03-18. Five days after that, one Kofi Appiah Dwomoh made a cheque payment of US$100,000 into the account.’’

In respect of his Cedi Account No. 9040002313337 at the same bank, opened on 21 January 2017 before his appointment, a total of GH¢3.83million was credited and GH¢3.81million debited to the account between the date of his appointment as CEO and 29 August 2019.

UMB

‘Number 428872’. The Transaction summary indicates the following:

20-12-2018 Cheque payment by OAB Adjei RKP US$60,000

21-12-18 Cheque payment by OAB Adjei RKP US$60,000

02-01-19 Cheque payment by OAB Adjei RKP US$50,000

It is important to state that the AML tools-alert is not conclusive, so the banks would have to investigate further and decide whether it’s a false positive or indeed a suspicious transaction that warrants filing with the FIC.

Currency Transaction Report (CTR)

It is known that cash transactions facilitate money laundering, and as such 1.22 of BOG & FIC AML/CFT&P guidelines obliges financial institutions to report to the FIC all cash transactions within Ghana in any currency with a threshold of GH¢50,000.

Looking at the transaction history in the report, a majority of Mr. Adjei’s transactions exceed this threshold; as such, the banks must have filed numerous CTRs with the FIC.

Why suspicious transaction reports must be filed on Mr. Adjei

STR is a report to be submitted by banks to the FIC within 24 hours for any identified suspicious transaction. In the case of Mr. Adjei, one would expect the banks must have filed several STRs with FIC if proper EDD had been effected in the light of facts revealed by the report.

When quizzed about the funds, he mentioned sales proceeds from a Frosty Ice Natural Mineral Water Ltd. – a company he had formed with his wife in 2019 subsequent to his appointment. Assuming the said business was even operating in 2017 and formally registered in 2019, an effective SoF and SoW would have revealed it’s not really possible for the business to generate such amounts in size and frequency.

Moreover, his post-appointment monthly cash deposit of GH¢1,490,091 and US$255,405 is a huge jump from his pre-appointment average monthly deposit of GH¢18,000 and US$1,000 – and this is worth examining.

Finally, the fact that approximately all the cash deposits during the period were withdrawn or transferred to other companies – including real estate companies – in an approach that may indicate layering and integration, and the volume of CTRs that must have filed on the customer, it is expected that any investigation carried out by the bank should result in a filing with the FIC. It would therefore be surprising but not impossible if none of the three banks filed an STR with the FIC .

An argument could be raised as to why the bank should continue the relationship if it had indeed filed the STR; although it is a valid argument, banks sometimes receive orders from the FIC to keep an account going – and in some instances ending the relationship would signify a tip-off, which is an offence.

Why the banks might have not filed STRs on Mr Adjei

The banks might have genuinely not detected and reported the suspicious transactions as a result of weakness in the AML/CTF& P system. This could come from not classifying Mr. Adjei as a high-risk customer, and not performing SoF and SoW – leading to poor monitoring and STR decisions.

It is also possible that the banks might have deliberately ignored any red flags to obtain the huge deposits, thereby choosing profit over compliance and treating any potential fine as cost of doing business.

If it turns out to be any of the above, it will bear resemblances with the Lombard bank case of October 2020 involving a €340,058 fine by the Malta Financial Intelligence Analysis Unit for Anti-Money Laundering breaches mostly related to PEPs, and we should expect sanctions from the regulator for breaches.

FinCEN files

Two of the banks involved were named in the recent FinCEN files released by the ICIJ that accused banks of facilitating Money Laundering; it is therefore very important that we are clear on what actions the banks took in this case, as any STR filed or remedial action taken could assist in mending any reputational damage suffered by these banks due to release of the FinCEN files.

Credit:ICIJ

The Bank of Ghana (BoG)

The Bank of Ghana, as the supervisory authority, is mandated to effectively enforce the AML/CFT& P requirements and ensure compliance by the banks. This mandate is usually discharged through the issuance of guidelines, on and off-site examinations, training and sanctions.

The examination is to confirm whether the compliance programmes of banks are adequate and operating effectively to curb AML/CTF&P risk and to give appropriate sanctions, or to see that remedial action is effected for any identified weakness or breach.

PEP reviews form a key part of central banks’ AML/CTF examinations, and as such it could be assumed that BoG examined the PEP procedures of these banks within the 28 months.

BoG performs procedures to determine whether the banks’ system for monitoring PEPs for suspicious activities and for reporting suspicious activities is adequate. These procedures could include reviewing the accounts of selected PEPs for unusual/suspicious transactions; following through to determine whether the transaction monitoring system detected such transactions; and when detected, a review of the reasonableness of any decision by the bank regarding not filing an STR.

The examination report is discussed with management to effect remedial action to correct any weakness or breaches, and fines are applied where necessary.

One could reasonably expect that, being the C.E.O. of government’s contract-awarding authority, and a co-signatory to the TDL bank accounts, Mr. Adjei should be part of any PEPs list for BoG’s examination – given that abuse of office for personal gain was identified as a Money Laundering threat in the 2018 NRA and all cases (GYEEDA, COCOBOD, NLA) cited relate to the PEP office’s abuse in contract-related issues.

Moreover, the volumes and values of cash transactions by Mr. Adjei and the number of CTRs to have been filed on his behalf should add him to any material list for any examination.

One could therefore conclude that any effective examination by BoG during the period included a review of Mr. Adjei’s accounts and identified the unusual transactions; and where the banks did not complete an STR, appropriate action was taken – and as part of remedial action subsequently, STRs were filed with the FIC.

The BoG could also pass the information to the FIC for investigations if it identified that STRs were deliberately not filed by the banks.

How BoG could have contributed to the failure

BoG may not have selected the accounts of Mr. Adjei for review or did select that account but did not detect the unusual transactions. In that case, the effectiveness of its risk-based examination could be questioned. There could also be the situation wherein officials may be compromised/or be under duress to overlook the transactions in case the banks did not file STR.

One cannot rule out the possibility of no on-site examination during the period as a result of inadequate resources, or the fact that those banks are rated to have strong AML/CTF and hence less frequent examinations.

Financial Intelligence Centre (FIC)

The FIC is mandated to receive, analyse, and transmit disclosures on suspicious transactions to appropriate authorities like CHRAJ, EOCO if the need be. If it turns out that the banks or BoG sent suspicion reports to the FIC, then the onus lies on the FIC to show if it did trigger investigations or not. The FIC analyses the data contained in the reports together with other Currency Transaction Reports and any other data it accessed to make a decision whether in its opinion the evidence substantiates the suspicion and warrants reporting to the investigative authorities for further actions.

Therefore, it is not every Suspicious Transaction Report (STR) received from the banks that passes to investigative authorities for prosecution or further investigations.

Page 81 of the CHRAJ report indicates some work on the part of the FIC, as it mentioned that CHRAJ obtained information from the FIC regarding the bank accounts and companies where Mr. Adjei is a beneficiary owner. However, one cannot tell if the work is an STR-triggered investigation or if the exposé triggered investigations.

If the FIC did not receive STR and CTR on Mr. Adjei from the banks or BoG, there is not much it could have done – and could not be faulted because the FIC has no powers to conduct on-site supervision of the banks, so there may be limited possibility of identifying the issue.

Thankfully, the 2019 National Policy on AML/CTF indicates that by December 2021 the Anti-Money Laundering Act, 2014 (Act 874) will be amended to grant the FIC powers to perform on-site supervision and apply sanctions.

Having established the above, the following scenarios could have happened with the FIC within the 28 months prior to the exposé:

- That the FIC did not receive any STR on Mr. Adjei from the banks or BoG

- That the FIC received STRs in time and concluded they did not warrant reporting to investigative authorities

- That STRs were received in time but the FIC had not commenced/concluded its investigation

- That STRs were received so late it was not possible to conclude investigations before the exposé

Any of the above possibilities do not give indication of an effective AML/CTF regime, given the time-frame and what was revealed in the report.

How the FIC could have contributed to the failure

If the FIC had received the STRs from the banks and concluded the suspicions do not warrant reporting, then the decision of the FIC could be faulted given the facts in the reports. Although it could be argued that poor STR could lead to a defective decision, the FIC has the power to request further information. More so if the right number of CTRs were filed that could add to the STRs and trigger an investigation.

The FIC may have received the report in time, but investigations where not done or concluded due to in adequate resource to handle large volumes of STRs. I do agree that the FIC may not be faulted in that instance, but one would not be wrong to expect that given the pervasive nature of the case and PEP involved, it should have been among the priority areas of the centre.

We cannot rule out the issue of potential compromise or duress which might force officials not to work on the STRs creating backlogs. It is because of some of these happenings that in July this year the German state prosecutors instigated a criminal action against some officials of the German Financial Intelligence Unit (FIU) and raided the office in Cologne.

Ghana being on the Financial Action Task Force (FATF) increased monitoring list and European Union blacklist is an indication of a deficient AML/CTF regime, and events like these tend to give credence to the assessment of these institutions.

The Mutual Evaluation Report (MER) by Inter-Governmental Action Group against Money Laundering in West Africa (GIABA) that was used by the FATF in listing Ghana noted that although there are sanctions available and applicable to natural or legal persons for non-compliance with the AML/CFT requirements, these sanctions are rarely applied in practice; leading to the moderate ratings in Immediate Outcome (IO) 7 in effectiveness assessment.

If we intend to be delisted by the EU and FATF, then we must apply the necessary punishments in this case to make our claim for high IO7 ratings in the next round of evaluation scheduled for May 2022. This year, countries are getting tougher in sanctions with US$5.6billion in fines levied by mid-year – and Ghana must follow suit. For instance, in Kenya five banks were in March fined US$3.75million; and just this September, Westpac in Australia received a US$1.3billion fine for breaches.

Therefore, if it turns out that the banks are in breach, we should be seeing the Bank of Ghana’s sanctions applied; and where it is the case that any of the officers in the three institutions were compromised, the appropriate action must be taken.

Also, if inadequate resources on the part of the regulators caused the deficiency, government must allocate enough resources to them; and regarding the FIC, the amendment of the Anti-Money Laundering Act, 2014 (Act 874) could be fast-tracked to allow it perform on-site examinations as an extra layer in the fight.

It is my hope this matter gets a very thorough review, so the public can be assured the Banks, FIC and BoG are all doing the maximum that can be done in the fight against Money laundering – leading not only to the EU and FATF delisting Ghana, but also an overall reduction in predicate crime.

>>>The writer is a Financial Crime Enthusiast. [email protected]