A review of Q3`2020 financial performance

Any strong economy is reflective of its robust financial system so when macroeconomic indicators point to a positive direction, it is largely fueled by players in the financial sector. Financial Analysts and researchers were equally concerned about how the COVID-19 pandemic could derail the gains made in sustaining the banking sector during the crises. Globally, to reduce the spread of the novel COVID-19, governments enacted mitigation strategies based on social distancing, national quarantines, and shutdown of non-essential businesses. The halt to the economy represented a large shock to the corporate sector, which had to scramble for cash to cover operating costs as a result of the revenue shortfall. The financial sector, and Commercial banks in particular, are expected to play a key role absorbing the shock, by supplying much needed funding (Acharya & Steffen, 2020; Borio, 2020).

In fact, under these unprecedented circumstances, central banks and governments enacted a wide range of policy interventions. While some measures have aimed to reduce the sharp tightening of financial conditions in the short term, others sought to support the flow of credit to firms, either by direct intervention of credit markets (e.g., government sponsored credit lines and liability guarantees), or by relaxing banks’ constraints on the use of capital buffers. While credit institutions were being called to play an important countercyclical role to support the real sector, these actions also have a series of implications for the future resilience of the banking sector. For instance, as lenders exhaust their existing buffers, they might also experience deterioration of asset quality which may threaten the systems’ stability. As the crisis is expected to continue, even after the lockdowns were lifted and economies start to reopen, the net effect of these policy measures on the banking sector is largely unknown. Commercials Banks in Ghana recently published their 3rd quarter 2020 management financials and a quick review is being done to understand how they have managed to sustain the shocks during this pandemic.

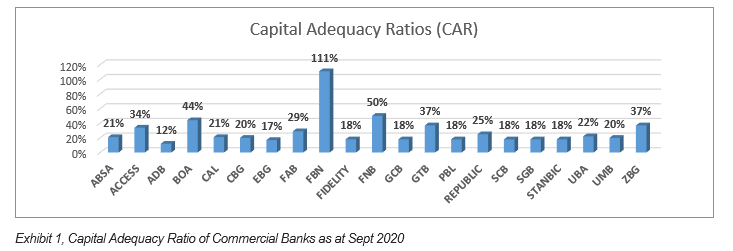

Capital Adequacy Levels

Capital Adequacy Ratio (CAR) is a measurement of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposures. This is basically used to protect depositors and promote the stability and efficiency of financial systems around the world. But it is important to look at what two types of capital measures: tier-1 capital, measures how any bank absorb losses without a bank being required to cease trading, and tier-2 capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. In my view, the Bank of Ghana saw into the future and requested banks to shore up capital from Ghs120m to Ghs400m to ensure that the banks are stronger to withstand some of these shocks. Due to COVID 19, Bank of Ghana reduced the CAR from 13% prudential limit to 11.5%. In spite of the crises, all the banks maintained a high level of capital well above the prudential limit to absorb shocks in the event of uncertainties. Solvency continues to remain strong with the industry CAR of 20.9% well above the regulatory minimum of 11.5% under Basel II/III. The higher capital adequacy more than the regulatory threshold indicates that banks have more scope for lending.

Asset Quality

During this COVID -19 period, the general expectation was that commercials banks may take a tight credit stance and reduce their lending book. Reasons being that the lockdowns and the general slowdown in the economy could result in cash flow challenges which could invariably see elevated levels of Non-Performing loans (NPLs).

However, according to data from Bank of Ghana, Asset growth was even stronger, and new advances have increased from the beginning of the year to date. Banks’ total assets increased by 23.8% year-on-year to Ghs142.6bn, compared to a growth of 10.1% a year earlier. The growth was broad-based and reflected in both domestic and foreign assets, which went up by 24.5% and 15.6% respectively. The relatively higher domestic asset growth pushed its share in total assets to 92.4%, up from 91.8% over the period. The major issue identified is that most commercial banks continue to hold significant deposits in Investments which should rather go to private sector to boost the economy. Recommendation to Bank of Ghana is to cap how much banks can hold in investment and rather deploy excess liquidity to improve the low level of Asset to Deposit ratios of some of the banks.

Profitability/Earnings

Profitability indicators remained strong during this pandemic. Banks remained profitable in spite of the COVID 19 and its attendant challenges. As at September 20, the industries revenue (excluding National Investment Bank) increased by 18% to Ghs10.8bn from of position of Ghs8.86bn in same period last year. However, when you compare Sept 19 industry growth with Sept 18 growth, industry revenue increased by 27%. GCB, Ecobank and Absa maintained 12.7%,11.8% and 9.5% market shares respectively. Absa Bank (Ghs494m) relinquished its top spot as the most Profitable bank to Ecobank (Ghs547m) due to a 2% decline year on year. It is noteworthy that Standard Chartered (Ghs491m) moved from the 6thposition to 3rd position on Profit Before Tax (PBT) seeing over 70% growth year on year. I believe this is due to the bank’s strategic commitment to enhance its technological drive to serve its clients. Overall industry PBT increased by 20% to Ghs4.5bn.

Liquidity Levels

The banking sector continues to be liquid and well-positioned to absorb liquidity shocks. The development reflects the gains from the recent banking sector reforms and the COVID-19 policy responses. Thus, the sector on its own can correct for such liquidity imbalances resulting from mild to moderate shocks through interbank activities. During the lockdown, many transactions were done online, a lot of banks revised their transactional charges including mobile money charges aimed at alleviating the suffering on clients.

Management Team

The test of leadership has really been shown during this COVID 19 period. In fact, during Lockdown period crises management team by various banks truly demonstrated that they were on top game seeking the welfare of their staff. Till date, some banks are still running a shift system, and some have over 70% of their staff still working from home. According to an article published by Bloomberg on 5th November 2020, ‘’Stanchart Unveils Permanent Move to Flexible Working from home 2021’’ and the report further indicated that about 90% of its 85,000 staff will have the option to pick location, hours. This is a sign of how management is dealing with pandemic crises. Leadership of some banks provided laptops, Internet services, travelling packages, protective equipment and other safety measures and equipment etc. Management also to some drastic decisions to improve technology and ensure stable systems. The list can go on and on, but the important thing is that, all competitor banks did extremely well to curb the spread of the virus to its staff.

To conclude, the spread of COVID-19 represents an unprecedented global shock, with the disease itself and mitigation efforts –such as social distancing measures and lockdowns both having a significant impact on economies globally. The commercial banks have lived up to expectation by playing an important role in absorbing the shock in the economy. There were expectations that commercials banks would have suffered the most during the COVID 19 period, however, the last quarter results have shown that the banks remain resilient, well capitalized with high liquidity buffers. It is my believed that full year 2020 results will even show a more positive result.

Thank you for reading.

Credit: Daily Graphic, Business and Financial Times, Bank of Ghana, Banking Sector Report 20, World Bank, Miriam Amoako, Sophia Kafui Teye (Fidelity Bank Securities)

Disclaimer: The views expressed are personal views and doesn’t represent that of the media house or institution the writer works. The analysis excludes National Investment Bank Financial Statement.

About the Writer

Dr. Carl Odame-Gyenti, is Finance and Telecom enthusiast, managing Banks and Non-Bank Financial Institutions, local and global Custodians, Trustees, Pension and Asset Managers, Insurance and Fintech relationships with an international Bank in Ghana. Contact: [email protected], Cell: +233-200301110