Claims payment is usually regarded as the end product of all insurance contracts. Therefore, timely payment of all genuine claims by life insurance companies gives more credibility to insurance, especially as insurance products are intangible products. The reputation of an Insurance company, and the industry in general, hinges on Insurers’ responsiveness to claims.

The National Insurance Commission (NIC) has a broad guideline for claims processing.

Generally, Maturity and Death claims go through the following processes:

For maturity claims

A maturity claim is the one which is payable when the life assured survives the policy duration (i.e. the life assured does not die within the life assurance policy duration). Maturity claims take place in life assurance policies such as endowment assurance and other investment-linked life assurance policies. Maturity claims are sometimes referred to as maturity benefits.

The claims procedures to be followed by the life insurance company for maturity claims are:

- i) Ensure that there is no outstanding premium.

- ii) Ensure that the policy document is submitted by the life assured or assured (or the

policyholder as the case may be).

iii) Ensure that there is adequate proof of title by the claimant. The life insurance

company just needs to verify its records to ensure that the claimant is the true owner

or beneficiary of the policy.

For death claims

A death claim is one which is payable when the life assured does not survive the policy duration (i.e. the life assured dies within the life assurance policy duration). Death claims are expected under Death Protection-only life assurance polices, as well as life assurance policies used for both death protection and investment purposes.

The claims procedures to be followed by the life insurance company for death claims are:

- i) Ensure that there is no outstanding premium.

- ii) Ensure that the policy document is submitted by the named beneficiary or assured

(provided that the assured was not the life assured under the policy involved).

iii) Ensure that there is adequate proof of title by the claimant. The life insurance

company needs to verify its records to ensure that the claimant is truly the

named beneficiary of the policy. This shall be done in line with the valid means of

identification provided by the deceased named beneficiary.

- iv) Proof of death. Proof of death is a fundamental requirement by the life insurance

company when settling death claims. The documents required to prove the death of the

life assured are –

– Submission of the original copy of death certificate (for sighting)

– Submission of the original copy of medical certificate cause of death

– Submission of burial certificate.

– Submission of the Police report if death was by an accident.

- v) Proof of age. Proof of age is expected to be proven at the inception of the life assurance

policy.

The following documents may generally be acceptable as valid document for the proof of

age in life assurance:

- a) Birth certificate

- b) Statutory declaration of age

- c) International passport

- d) National identity card

- e) Certificate of church baptism

- f) Marriage certificate

- f) Drivers’ licence

- g) Adoption or Naturalisation certificate.

For maturity claims, per the NIC guidelines, the Life Insurer shall inform the policyholder life assured or the assignee nominee or beneficiary and issue a Discharge Form at least two (2) months before the maturity date, giving details about the claim – including the maturity date, amount payable, and requirements for payment.

From then on, there is a series of back and forth.

For surrenders, the Insurance Company is to ensure that endowment policyholders who seek information on surrender values are made aware of the other options available, including the fact that they may be able to sell the policy on the traded market as an alternative to surrendering.

General Impact of COVID-19

The world is experiencing a unique situation. Over the past months, hundreds of millions of people from all over the globe have been forced to stay home overnight. Economic activities came to a virtual halt, though they are picking up little by little. The current pandemic determines what we talk about, what we can do and what our future looks like. Besides all the necessary short-term measures, insurers also need to think beyond the current crisis to a future that may be very different.

The most obvious effect of COVID-19 on the insurance industry in Ghana is the upsurge in health, travel and business claims. Though insurance policies do not directly cover pandemics, the impact of COVID-19 on the global economy has had a toll on the insurance industry. There are reports of insurers already paying millions of cedis through e-payment channels even during the lockdown period. There is obvious pressure on sales from reduced business activity and less use of face-to-face channels in transactions. Though the lockdown in Ghana was brief, it further exacerbated the impact of the pandemic resulting in lowering interest rates and increasing credit risk.

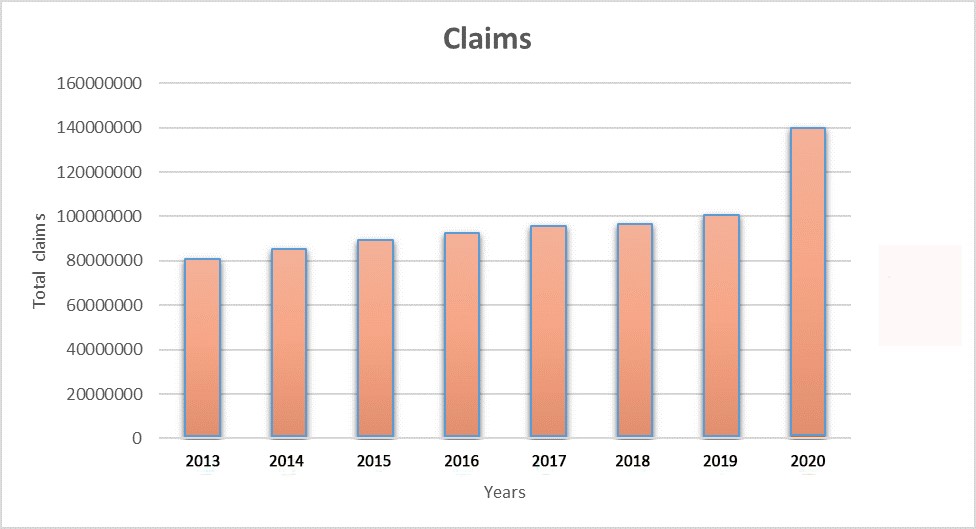

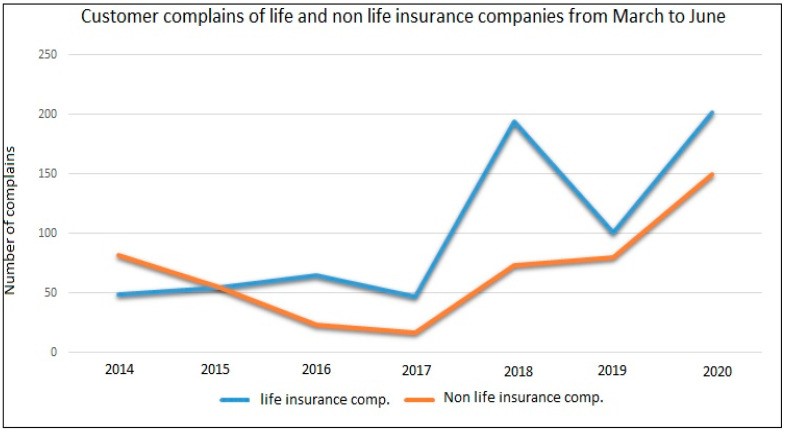

According to the NIC, a lot more clients now call in to complain about their insurers, and the number of people calling in to enquire about claims has quadrupled within the pandemic period as compared to the same period last year; as evidenced by the following graphs:

Fig. 1. Comparative graph of claims for March to June (the peak of the COVID 19 pandemic for 2020) for Life Insurers

Claims rose from GH¢100,000,000 in 2019 to GH¢140,000,000 in 2020 for the same period (March to June).

Fig. 2.

Daily Claims for March to June

| Year | Daily Claim |

| 2013 | 1001236 |

| 2014 | 1103265 |

| 2015 | 1222311 |

| 2016 | 1203265 |

| 2017 | 1100326 |

| 2018 | 1100000 |

| 2019 | 1100232 |

| 2020 | 1700003 |

Fig. 3.

Fig. 4. Claims to the individual life insurance companies for March to June

2020 increased across the board from the 2019 levels.

Data Source: Study into The Impact of COVID-19 on the Insurance Industry published in International Journal of Environmental Research and Public Health

The true purpose of an insurer in times of crisis and stress is to provide peace of mind. Being there when it matters most for the insured requires insurers to devise strategies for handling this crisis from a customer and wider stakeholder perspective. From waivers of deductibles to pre-approval of claims or setting up funds for frontline employers, insurers are demonstrating their empathy.

The Need for Innovation/Digitisation

In a crisis, companies and industries must adapt to survive, and we are seeing such adaptation across the life insurance sector. COVID-19 put the shift to digital on fast-forward. Agents are conducting virtual appointments or making special arrangements to meet with applicants while following social distancing guidelines. Insurers are making more applications available electronically and generating a greater percentage of business through digital channels. To help facilitate and encourage truthful disclosures, they are increasingly employing call centres to assist consumers in filling out applications. The use of new digital technologies to perform important tasks such as identity verification and risk assessment is also growing. The evolution toward e-applications had begun before COVID-19, but the pandemic has resulted in agents overcoming their trepidation and embracing digital initiatives.

This crisis may prove to be a catalyst for product simplification and accelerating the development of direct digital channels. These digital channels will also be invaluable when the number of enquiries and claims increase and insurers need a cost-effective yet customer-friendly way to handle these requests. Directing customers to self-service channels and the automated processing of straightforward claims are proving effective.

Remote claims processing is here to stay, and anyone proficient enough to use a smart phone, should be able to use the self-service channels and the automated processing of straightforward claims.

Faster transition to digital claims

In recent years, many insurers have been making a gradual shift to digital claims processes, leveraging technologies like predictive analytics, Artificial Intelligence (AI), and automation. But the COVID-19 pandemic is likely to accelerate the move to digital. It’s almost too soon to predict the longer-term impacts that the pandemic will have across the insurance industry—but one thing is sure, change has come, and it is likely to stay.

Before the pandemic, trends in remote claims processing were already gaining momentum. Still, virtual claim processing wasn’t generally perceived as prevalent throughout the industry yet, and some insurers had the transition further down their roadmap. But with most claims staff now working remotely during the pandemic, many insurers have made a swift transition to remote processing. With potential benefits such as lower costs related to in-person loss inspections, improved customer experience, and expedited claims processing, we fully expect this trend to remain.

Remote claims processing also opens the door to fraud.

Security Concerns (Opportunities for Fraud)

Even seemingly simple updates such as entering new contact information or changing policy ownership can be part of a scheme to defraud or commit identity theft.

Perhaps the most important consideration is to make sure people are who they say they are. This is easier said than done: Identity thieves have become much more sophisticated in recent years, and the COVID-19 pandemic has opened up holes in defences that insurers had come to rely on. For any policyholder request, be it Maturity Claims or Death Benefits, bailoutapp.rgd.gov.gh the following established due diligence protocols is essential.

- This means asking for multiple forms of identification – national IDs, utility bills, etc. These provide many avenues of identity validation.

- When necessary, insurers should pursue alternate ways to confirm a person’s identity that employ all available data.

- As an added security measure, for digital claims processing, Insurers can consider use of electronic signature programmes such as DocuSign where the IP address can be traced to a location, to minimise the threat of bogus claims and identity thefts.

Difficult economic times may cause more insurance customers to access the cash value of their policies, by taking out a loan, cashing out an annuity, or through other means. While insurers should, of course, endeavour to serve these legitimate policyholders as quickly and efficiently as possible, care must be taken to guard against fraudsters. If more people are surrendering policies, try to discover why and look for patterns.

From a workers’ compensation standpoint, there may be risks. A significant percentage of the workforce moved from offices to working from home in less than two weeks. This could potentially have an impact on workers’ compensation claims. While many commercial offices have surveillance systems that can potentially be used to validate claims, most homes do not.

US Case Study

Consider the case of Sandberg v. JC Penney, where an employee successfully received worker’s compensation for her injuries after tripping over her dog while walking to the garage. As a designer, the plaintiff worked from home and kept work materials in the garage. Since her home premises and work premises were the same, the court decided that her injury did indeed arise in the course of her employment.

So how do carriers best protect against fraud, waste and abuse? It will take a combination of people, processes and technology.

Fraud Detection

Insurers can use already-established software programmes to upload customer or claimant submitted images to a cloud-based repository when they report claims (something similar to the Motor Insurance Database (MID) the NIC introduced for the Motor Insurance sector earlier this year). The platform will then automatically indicate whether the image data corresponds with prior claim information or if a duplicate photo already exists in the database.

This enhancement also includes cutting-edge image forensics technology that searches the Internet for any photos that match files submitted with a claim and analyses metadata to determine if the image data (date, time, and location) corresponds with the claim information.

These tools can help insurers improve efficiency and reduce leakage: Claim handlers can quickly and easily check for pre-existing damage within their workflow and get insights needed to either expedite legitimate losses or investigate suspicious claims.

In the US, a company – Verisk – is helping the industry meet virtual claims-handling challenges with a new, digital media database.

In summary, the call for Innovation and digitisation requires the use of:

- Artificial Intelligence

- predictive analytics

- Digital Image Forensics

- Automation

Industrywide Collaboration

Having access to broad industry data (for analysis and other purposes) gives a wider perspective, helps in reviewing loss histories, prior special investigations, prior salvage, mail drop addresses, and other attributes indicative of fraud from claims across the industry. It’s an essential first line of defence against claims fraud. Additionally, industrywide data allows an understanding and view of how seemingly disparate claims, people, and entities are connected through linked events.

Utilise Third Party Public Records

A very useful free, public source of records is the various social media platforms where people voluntarily and frequently share details of their personal lives including what has been happening to them, places they have been, etc. Utilise these third party public records. This can be automated and blended into analytics.

Strategic Moves

Accelerate digital and automation transformations. Digitizing and automating processes can make end-to-end claims journeys more efficient, protect against future outsourcing interruption, and better manage responses during claim volume spikes. Insurers can start by enabling customer self-service for routine inquiries, which as stated earlier, any client smart enough to use a smart phone should be able to process.

Prepare the workforce for a digital future. The pandemic-triggered shift to virtual working and subsequent increased need for customer self-service and digitization will accelerate a change in the role of the claim handler. As artificial intelligence and automation become more significant in the claims process, the function of the claim handler will shift from technical adjudication to value creation. And as carriers shift work to remote environments, they should identify the skills needed for their future-state organizations, help valuable employees acquire those skills, and when necessary, look outside the organization for people who can fill gaps.

The Fraud Threat

It is said that threat is prevalent when motivation, rationalisation and opportunity converge; and the COVID 19 pandemic, and its attendant hardship, disruption and digitisation of processes and transactions, has created the perfect platform for fraudsters.

Incentive drives behaviour. Widespread unemployment, economic uncertainty, and increased mortality concerns brought on by the coronavirus outbreak have made the need for life insurance more tangible for millions of people. While malicious fraudsters will seek to take advantage of the current distraction and disarray to advance their schemes, many – normally honest – people facing financial pain will be more susceptible to seemingly mild deception. It is much easier to hold back the truth when doing so could help loved ones facing an uncertain future.

Then there is opportunity. As with so many aspects of business and everyday life, social distancing and stay-at-home measures have disrupted the life insurance application process. Life insurers, who have long depended on in-person interactions and verifiable evidence to ensure the accuracy of applications – advisor meetings, paramedical exams, blood tests – now need to evaluate other methods and data sources, ones that can be completed remotely without the need for personal contact. Unfortunately, the opportunity for applicants to withhold important information on applications completed in this manner – even unintentionally – is significantly increased, as is their willingness to do so. Who is more likely to leave out something important: the applicant filling out a form in front of an insurance professional at an office during business hours, or the applicant completing an online form at home in the middle of the night?

Underlying all of this is a fundamental challenge for the industry: Insurers make an attractive target for fraud. The death benefit, the potential financial benefit, in comparison to the annual premium paid is huge. The insured and the carrier enter into this arrangement based on a high degree of trust, offering opportunities for deception starting at the time of application. In addition, the frequent perception of insurers as impersonal corporate entities makes us unsympathetic victims, especially for smaller, seemingly harmless transgressions. So, with increased incentive, greater opportunity, and relatively guilt-free execution, what’s to stop consumers from withholding information on insurance applications?

There is also the opportunity for identity thefts or impersonation for Maturity Claims.

Steps to Insurance Claims Fraud Detection During the COVID-19 Pandemic

- Validate the Death Certificate

With the exception of fast-track or express claims, which fall under a designed threshold face amount, all death claims should require a certified death certificate or, at a minimum, a copy of a certified death certificate. However, a death certificate does not guarantee the legitimacy of a claim. In fact, most fraudulent claims will contain what appears to be a valid death certificate. Even amid mass disruption, it is vital to remain vigilant in following established protocols for identifying potential red flags.

Is it acceptable to waive the death certificate at the beneficiary’s request due to an inability to obtain one during the pandemic? Beneficiaries may experience a slight delay before the certified documents become available, but if immediate funds are needed for burial services, in some cases alternative death certification can be obtained, such as hospital or physician records that confirm the illness and the cause and date of death.

- Confirm Cause of Death

As a response to COVID-19, a new ICD-10 code (International Classification of Diseases, Tenth Revision) has been developed for reporting of COVID-19 cases. According to the U.S. Centres for Disease Control and Prevention (CDC), “These can include laboratory confirmed cases, as well as cases without laboratory confirmation. If the certifier suspects COVID-19 or determines it was likely (i.e., the circumstances were compelling within a reasonable degree of certainty), they can report COVID-19 as ‘probable’ or ‘presumed’ on the death certificate”.

The concern is that many certifiers are provided no prior health history of the deceased by the family and must complete death certificates based on limited events related to COVID-19. Numerous anecdotal sources report that many deaths linked to the pandemic are incorrectly coded: While the deceased may have had medical conditions contributing to a COVID-19 death, the cause of death is recorded as COVID-19 with no underlying conditions noted on the death certificate. This is extremely challenging if the death occurs within the contestable period of the policy. Simply attributing the cause of death to COVID-19 without valid background certifications can be misleading, and policy beneficiaries may intentionally leave out critical medical history when informing the certifier registering the death.

When reviewing the death certificate, examine and verify the place of death, the certifying individual, as well as the time of certification. For example, if the death occurred at home, who certified it and when? Was it a medical director with a valid license. Was the deceased transferred directly to a funeral home? Throughout the pandemic, funeral homes have become overwhelmed and may not follow proper protocol, and other practices have been adjusted to account for logistic challenges. This should not prevent insurers from seeking all necessary verifications.

- Investigate Contestable Claims

All contestable claims should be investigated thoroughly, regardless of the cause and manner of death, to eliminate fraud opportunities. Some beneficiaries may expect that if the cause of death is related to COVID-19, no investigation is warranted, even if death occurs within the contestable period of the policy. If a beneficiary pressures to waive or conduct a limited investigation, it should raise a red flag. As stated previously, the cause of death on a death certificate may be coded as COVID-19 with very little or no prior known medical history about the deceased. The contestable investigation may identify other significant medical conditions that were originally not provided on the death certificate, yet appear in pre-COVID-19 medical records.

This is an example from the US: Someone under hospice care for cancer dies at home within the contestable period, and the death is attributed to COVID-19. The funeral director completes the death certificate without knowing the medical history of the insured, leaving out cancer as an underlying condition. A COVID-19 test may or may not have been performed, making identification of any material misrepresentation extremely difficult. In this case and many others like it, a thorough investigation is warranted.

- Verify Foreign Deaths

Fraud is particularly prevalent in certain developing countries, and proper investigation and confirmation of death occurring in these nations is recommended. Unfortunately, the current climate makes this process very difficult: The closure of public offices can prevent any type of in-person verification. But persistence is key, and claims professionals should avoid the temptation to cave in and waive a proper investigation. A reputable foreign death investigator should be able to utilize a local network of contacts to follow appropriate leads and provide verification.

- Collaborate with Underwriters

Many insurers have implemented modified underwriting requirements to account for current challenges in gathering traditional evidence such as in-person medical examinations and fluid testing. Claims teams should coordinate with underwriters to implement a system for flagging these policies for future claims processing as an extra precaution against fraud. Fraudsters are well aware of less stringent underwriting requirements at the time of issue, which in turn provides ample opportunity for them to use a stand-in applicant or employ other forms of deception. Claims examiners will need to take extra care when adjudicating policies issued during the pandemic for years to come.

In addition to new policies, coverage increases for existing policies provide an enticing target for fraud. If a coverage increase has been requested during the pandemic, the agent or insured may have become aware of temporarily relaxed underwriting guidelines, leaving an opening.

Summary

In these times of crisis, claims professionals must work under challenging conditions to pay all appropriate claims timely and accurately within NIC regulations and policy provisions, while keeping a wary eye out for increasing fraudulent claims. It is therefore essential that they remain vigilant, avail themselves of all available resources – fraud experts, reinsurers, and other partners, and follow their instincts: If something doesn’t look right, there is a good chance it isn’t.

Insurers need to become more connected and agile. Being digital is paramount. Simple digital products, online services and customer experiences, delivered at lower cost; becoming more connected and agile has become essential for continued growth.

The writer is the Chief Executive Officer of Quality Life Assurance Company Limited (QLAC)

FIN