The days of “I don’t have money on me” are long gone. With the advent of mobile money all you need to do is get your mobile device and transfer money from one wallet to another. Whether banked or unbanked, there is no excuse.

Today, there are more than a billion people in the world who own mobile phones but lack bank accounts. It might sound strange for the 21st century, but give careful thought to the situation and you will find that, because of digital technology, which promises a quicker, safer and smarter way of transacting, people are less likely to be interested in joining long queues and completing a booklet of forms to open bank accounts for transactions.

They are more likely to opt for an alternative that allows them to carry out banking and financial transactions without necessarily visiting a bank. Mobile Money has done just that.

In Ghana, Mobile Money has made life easier and this method of transferring money has seemingly become the most inclusive and accepted mode of cashless payment – right from the fancy restaurant at Silver Star Towers to the corner store on your way home.

Anyone and everyone can sign up for a mobile money wallet and with the advent of mobile money payment interoperability – a system that allows the transfer of funds from mobile money accounts to bank accounts and vice versa, the agenda to push financial inclusion is finally being realised as many Ghanaians now have a reason to set up bank accounts to be linked to their mobile money wallets.

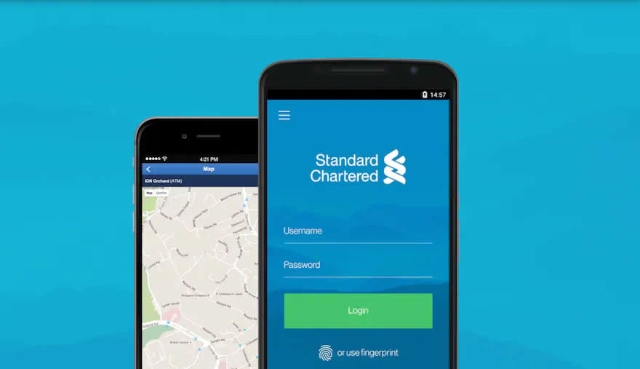

At the fore of Mobile Money Payment Interoperability coupled with innovative digital technology, is Standard Chartered’s SC Mobile app, which is making life for the already banked and new to bank population efficient, safer and smarter.

With the SC Mobile App, one can set up a bank account in minutes, without visiting the bank or branch, and immediately enjoy services that hitherto could only be done in the branch. Most notable of these services is the payment service that allows one to transfer money from their bank account to a money wallet.

The mobile money payment functionality permits a transfer to a registered MTN, Vodafone or AirtelTigo Wallet; all while in your comfort zone or on the go.

Especially in these times of COVID-19, it is advisable to find alternative means to remain cashless and carry out banking and financial transactions without visiting the bank. Staying true to its brand promise ‘Here for Good,’ Standard Chartered Bank has made cashless transactions possible through its SC Mobile app and continues to innovate and provide relevant solutions that meet the demands of its customers while ensuring that they remain safe.