…employee compensation, wages & salaries exceed revenues

Genuine concerns have been raised by stakeholders about the country’s debt situation, with some even fearing it will eventually lead to a situation where it will no longer be sustainable. As legitimate these worries are though, the truth be told, the data shows there is no way this economy can run without borrowing.

A closer look at the figures presented by Finance Minister Ken Ofori-Atta indicates just two items on the expenditure list combined, i.e., wages and salaries, and compensation of employees which include allowances – are more than projected revenues and grants for the period.

Data presented by the finance minister in the 2021 first quarter budget shows that total revenue and grants is projected at GH¢13.3 billion for the period. However, the expenditure list shows that government will spend GH¢7.7 billion on employee compensation, and GH¢6.4 billion on wages and salaries.

What this actually means is that, the two expenditure items combined (GH¢14.1 billion) are more than the revenues government expects to generate from productive activities of the economy, and even monies it will receive free (grants) from donor programmes. This literally means there is no option, other than borrowing, for government to be able to meet its obligations.

And yes, indeed, the finance minister said government will look to the international bond market to raise about US$5 billion to offset the fiscal gap. Of this amount, he said, US$1.5 billion will be used to support the 2021 budget and US$3.5 billion for liability management.

Besides the employee compensation and wages and salaries which exceed revenue in the budget, there is also concern of interest payment on debts (both domestic and foreign) which is projected at GH¢7 billion.

These three items in the budget account for 77 percent of the GH¢27.4 billion Ofori-Atta is asking Parliament to approve for the period under discussion. No wonder just 6 percent of funds the minister asked for is going into capital expenditure, as that is the only expense government can cut down to avoid excessive borrowing.

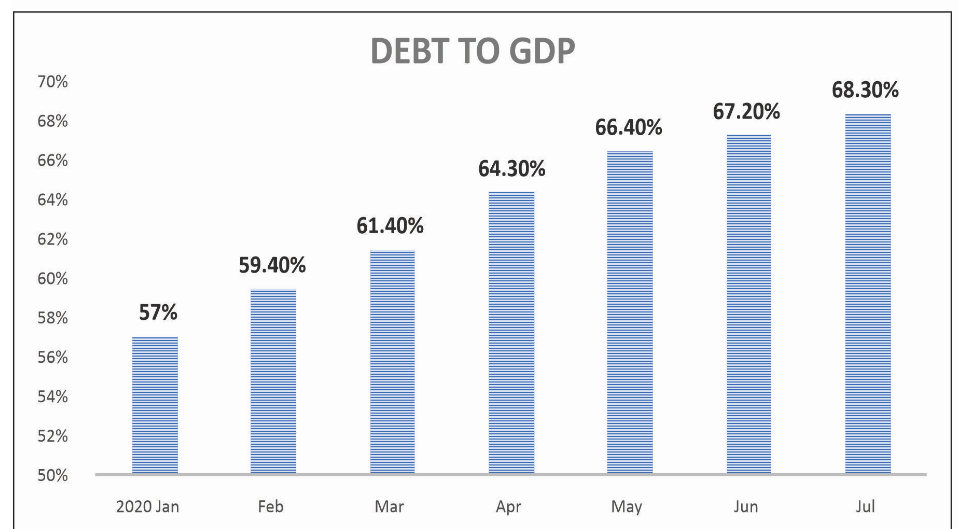

Already, total public debt as at July 2020 hit more than 68 percent of GDP, a figure the World Bank says, put the country at high risk of debt distress. The IMF, in its latest Regional Economic Outlook, has expressed concerns over the worsening fiscal situation and ballooning public debt of the country which has been further exacerbated by the pandemic.

It projects fiscal deficit to hit -16.4 percent of GDP at the end of the year, indicating the country will have to borrow more than the GH¢44 billion (which is 11.4 percent of GDP) it earlier stated will be needed to close the fiscal gap for the year.

Responding to a question on the debt situation during a virtual launch of the report, Director, African Department, IMF, Abebe Aemro Selassie, said it requires swift policy response from government to keep the debt level in check.

“This year, the policy response has been very supportive, as needs to be the case, but, you know, going forward, it’s will be very, very important to make sure that policies revert back to making sure that there is much more focus on keeping debt stable and bringing it down gradually. So, I think much will depend on how quickly this policy recalibration takes place, and, given how high debt levels are in Ghana, I think the quicker that is done, the better,” he said.

So yes, the debt situation of the country is very worrying, in fact, genuinely troubling, but the reality is that, government has no option than to borrow to undertake its projects, considering the dire revenue situation of the country.