The rush by local investors to invest in Ghana’s Life Insurance market has been justified by the performance of most of the company’s life companies by the close of the 2019 financial year.

Prior to the enactment of the Insurance Act 724 2006 life insurance companies in the country were treated like a department of a non-life company. Until that law was passed that life companies should be separated from their non-life counterparts, life funds were misused by the general business companies.

Life funds were either used by non-life companies to pay claims or salaries of staff when the urgency arises. The regulator’s vision to separate them have seen the light of the day by the close of 2019 accounting year.

Many doubting insurance experts have signaled that life insurance business is fast becoming the future of the risks management business in the country; they seem to be growing faster in income than their general business counterparts.

However, while life insurance has claimed most of the headlines as far as the industry goes it is still a poor second to the general business accounting on average far less than 20% of Ghana’s insurance industry both in life and general insurance.

Indeed, when the Act was introduced in 2006, insurance companies were given some time to separate their operations. Before then, there were only two specialized life insurance companies in the country. These companies were Gemini Life Insurance Company (now Glico Life) and Ghana Life Insurance Company.

These companies prior to 2006 were only underwriting life businesses until companies like Star Life Assurance Company and Enterprise Life Assurance Company joined in the early 2000’s.

However, following Governments effort to strengthen the country’s financial sector the leadership of the National Insurance Commission – The industry regulator – contributed to the optimism of the industry.

SIZES OF MARKET

By 2007 there were 18 life insurance companies licensed to do business in Ghana. The companies then were; Colina Life (now Saham Life); Capital Express Life; Donewell Life; Enterprise Life; Ghana Life; Ghana Union Life and Glico Life.

The rest are; IGI Life (currently out of business); Met Life; Phoenix Life; Provident Life; Quality Life Assurance Company; SIC Life; Unique Life; UT Life (Mi Life) and Vanguard Life.

FINANCIAL PERFORMANCE

Life Insurance Premiums has continued to increase- from Ghc187 million to Ghc270 million by 2010. However, there was a growth rate drop of 9% from 52.97% in 2010 to 44.2% in 2011.

There is still potential for growth. For the 2nd year the life sector has recorded a much higher growth than the non-life. These may continue for a while with a little more innovation with respect with product development and how distribution activities are organized.

| Year | Premium Income

(Gh¢) million |

Growth

(%) |

| 2007 | 67.53 | – |

| 2008 | 91.25 | 35 |

| 2009 | 122.3 | 34.9 |

| 2010 | 187.34 | 53.2 |

| 2011 | 270.2 | 44.2 |

Indeed, by close of 2019, there existed 25 life assurance companies doing business in the country. In 2019 the following companies are; Allianz Life; Donewell Life; Enterprise Life; Exceed Life; First Insurance; Ghana Life; GUA Life; Glico Life; GN Life. The rest are – Hollard Life; Metropolitan Life; Mi Life; Old Mutual; Phoenix Life; Prudential Life; Quality Life; Saham Life; SIC Life; Star Life and Vanguard Life.

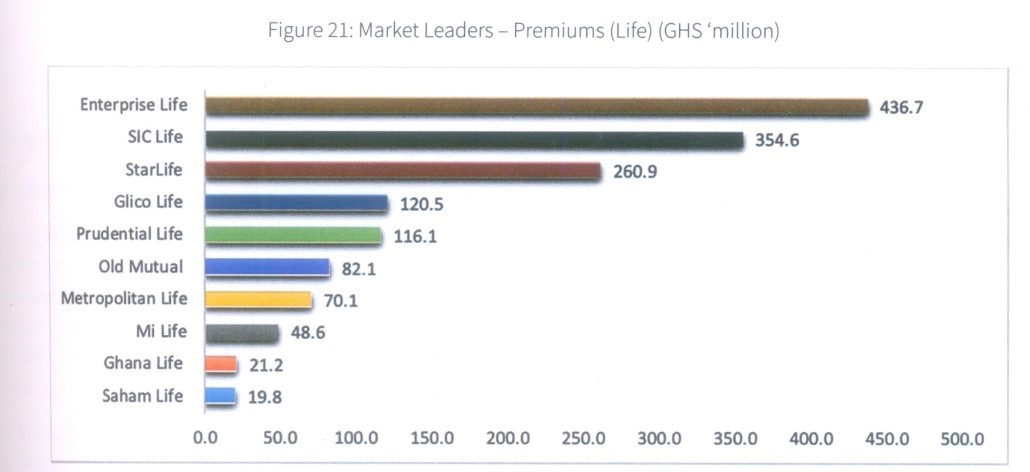

Enterprise Life maintained its lead in terms of premium volume with a total of Ghc437million in the year under review, SIC Life followed with Ghc355million and Star Life and Glico wrote the third and fourth higher growth of business with premium contributions of Ghc261million and Ghc121million respectively.

Prudential Life was the fifth higher with Ghc116million. However, contributions from the top ten life insurance market leaders in terms of premium amounted to Ghc1.15billion representing 39% of the sector’s total premium.

PREMIUM CONTRIBUTION BY DISTRIBUTION CHANNELS

Individual / Tied Agents contributed 61% of Life’s annual premium income and have continued to be the leading channel for the distribution of Life insurance products. Direct business also contributed 13% of the premium, whilst insurance brokers contributed 8%. This represents percentage point loss of 3% and 1% with respect to Individual / Tied Agents and Direct business respectively. Insurance intermediaries (Brokers) on the other hand, gained 2% points in 2019. Bancassurance ended the year back at 13% up from 11 % when it lost 2% from 2017. The other distribution channels used in the life sector are the Telecommunication Companies and Corporate Agents.

The impact of COVID-19 is likely to reinforce the importance of insurance companies having a diversified set of distribution channels. There is need for concerted efforts by all concerned to develop the non-traditional distribution channels.

INVESTMENT YIELD

The ratio measures the return on a company’s investment it seeks to measure the quality of a company’s investment portfolio. It is a ratio of investment income to total investment. The industry average reduces of 15% in 2018 to 9% in 2019. Nine companies recorded investment performance below the industry average, the companies are; Allianz Life and Vanguard Life recorded very low yields far below the industry average.

INVESTMENT YIELDS (%)

| Company | 2018 (%) | 2019 (%) |

| Allianz Life | 20 | 4 |

| Donewell Life | 13 | 11 |

| Enterprise Life | 10 | 8 |

| Exceed Life | 19 | 19 |

| First Insurance | 10 | 10 |

| Ghana Life | 12 | 15 |

| GUA Life | 9 | 6 |

| Glico Life | 8 | 11 |

| Hollard Life | 5 | 6 |

| Metropolitan Life | 15 | 13 |

| Mi Life | 6 | 8 |

| Old Mutual | 13 | 14 |

| Phoenix Life | 17 | 13 |

| Prudential Life | 11 | 12 |

| Quality Life | 18 | 8 |

| Saham Life | 8 | 6 |

| SIC Life | 14 | 9 |

| Star Life | 11 | 6 |

| Vanguard Life | 18 | 1 |

PRODUCTS

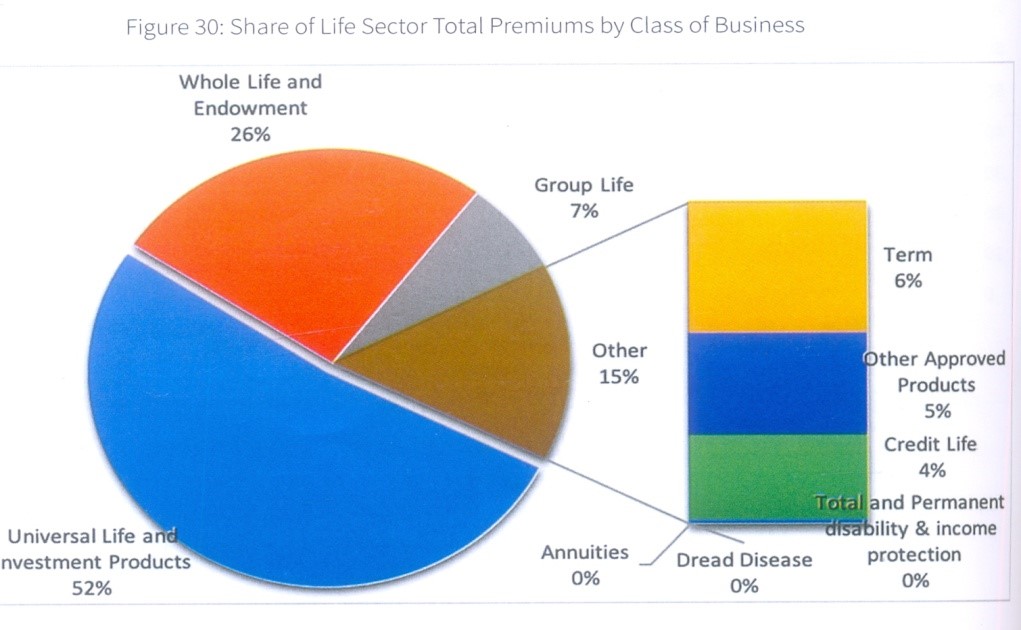

Universal Life products continue to be the main product line within the Life sector. In 2019, it generated about Ghc858million (52% of the sector’s total premiums). Whole Life and Endowment products contributed about 26% of the sector’s total premium (Ghc431million). Group Life premiums stood at Ghc117million which represents 7% of the Life insurance premiums. All other products together contributed Ghc245million representing 15%.

MICROINSURANCE

To expand the insurance market especially to the low income segment of the population, the insurance industries together with the regulator have worked assiduously to see to the growth of microinsurance in Ghana. A few years after its introduction, it has become one of the most viable insurance products for those segments of the Ghanaian population that have been traditionally under-served.

The target market of microinsurance is the informal sector which happens to constitute about 80% of the Ghana’s workforce. The growth of microinsurance has been greatly aided by technical service providers such as BIMA (Milvik Ghana Limited), MicroEnsure and AYO intermediaries Ghana Limited.

The diagram below summarizes some key information of the technical service providers.